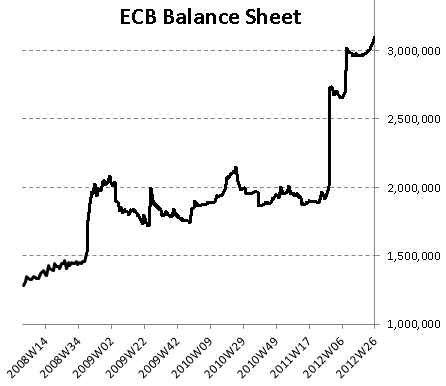

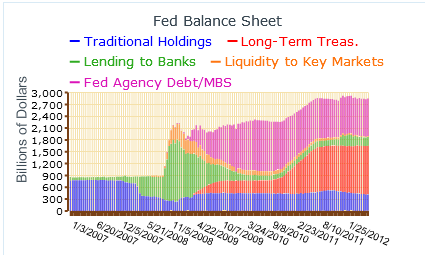

The dynamic central banking duo – ECB balance sheet up over €3.1 trillion mimicking Fed balance that is close to $3 trillion. Shuffling toxic assets into darkness.

- 2 Comment

You might have the vague memory that the European Central Bank reacted somewhat negatively to the Federal Reserve’s massive balance sheet expansion a few years ago. The ECB was not following in the same path as that of the Fed. Well fast forward to the current Euro crisis and the ECB now has a balance sheet that far surpasses that of the Fed. You have the two largest central banks in the world with over $6 trillion in unaudited funds and surely a good portion of that is toxic assets. This trajectory is unfortunately a natural consequence of our current banking system. These central banks focus on protecting their big banking allies and the crisis is still going on. Of course the working and middle class will be paying for this in a variety of ways for years to come. Ask the 25 percent unemployed in Spain and Greece how well the economy is doing. Ask young Americans how the economy is doing.

ECB does a Federal Reserve impression

The ECB has now gone into giant bailout territory with €3.1 trillion in assets on their balance sheets. Calling these bank loans “assets†is probably making the situation seem better than it really is:

European banks are flashing red. The Spanish banking system is virtually nationalized. Greece is buying a bit of sunshine with more loans but this is not helping the people. The Euro-zone unemployment rate is at all time highs. So of course the solution to all of this is to give banks more loans. The ECB is simply following in the same path that the Fed has undertaken:

Yet this is a long proposition. The Fed balance sheet has been over $2 trillion since 2008. Four years later it is close to $3 trillion. Even now, we still don’t have the full scope of what exactly is on the balance sheet of our central bank. Remember that the Fed is independent within the government and that is how they can expand their balance sheet with no questions asked. The ECB has embarked on a similar path.

Yet the core issue is too much debt being supported by too little production and growth. Simply adding more debt and buying more time is unlikely to produce quality results. Does anyone really believe that the US will ever payback the more than $15 trillion we owe? Europe is in poor shape and these bailouts are principally focused on helping the banking system and not the public. The good of banks has been far disconnected from the good of the public for years. The incredibly high unemployment across countries and the massive filtering of wealth to the banking class should give you a true picture of what is transpiring. If the economy were getting better, why in the world would the ECB take on such massive amounts of banking debt to their balance sheet when only a few years ago they criticized this same behavior?

“(SoberLook) Jean-Claude Trichet used to argue that unlike the Fed’s balance sheet during 2008-09 period, the Eurosystem assets were dominated by securities, gold, and foreign reserves, rather than loans to banks. That composition is changing quickly however. Here it the ECB’s balance sheet assets breakdown from a year ago – with circled items representing lending to Eurozone’s banking institutions under various programs.â€

So much for keeping quality assets on the balance sheet.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Jim Strong said:

Of course, mortgage backed securities without legal standing of the assets represented is the major crime in regard to derivatives and the banks central association with them since approximately 1998 in the US and Europe. The destruction of the legal standing of property via the hasty destruction of titles, notes and the paper trail of legal ownership during massive property securitizations with a demand outpacing the existence of enough mortgages for securitization, forces the banks to keep, in collusion with governments, the “non-property” assets (no legal paper trail of ownership present) within govt. agencies and banking systems, and thus hide the true market value (ZERO) of the so-called assets and the crime of property destruction underlying them.

Nothing is allowed to face mark-to-market tests for true price discovery.

The first item the US Constitution guarantees protection of is….property, and without property and its legal standing in force, there is little justification for forming or maintaining a

Constitutional government, much less a Republic, without property rights, and property value, and rule of law for the transfers of such as related to commerce and the building of wealth and stable society by a free population. A Constitutional Republic becomes valueless without rule of

law and transparent property value. If a diabolical group wanted to destroy any nation-state with property rights and rule of law, it only has to destroy the value of the property contained within the state…..and, derivatives based on a process that destroys the legal value of property does just that. Buffet’s comment in the early nineties that derivatives are weapons of mass destruction was an understatement as to the scope of destruction that has occurred at light-speed.and govt agency “asset” balance sheets at taxpayer expense. Taxpayers are liable for valueless former property that has no legal standing at all. The fraudulent process makes the

governments illegitimate in and of themselves, and every transfer, transaction within govts. and govt. agencies are fraudulent too as they are transferring liabilities with no value compared to what is claimed. When the Fed Res accepts mortgage securities from say, Fannie Mae, it is accepting toxic mortgages as if they were worth the stated value, and as if they have legal standing in a court of law…they do not, and therein lies the fraud, ongoing and expanding…..JS 7-6-12July 6th, 2012 at 8:13 am -

Paul said:

Central Bank = Central Planning. USSR = Central Planning. USSR failed as will the Central Banks pile on of debt on top of debt. At some point all of this will come crashing down. The Great Recession merely postponed another Great Depression which will clear out unsustainable bank debt.

July 7th, 2012 at 6:50 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!