The endgame of the credit card nation – 40 year bull market in revolving debt expansion comes to a sudden halt. U.S. consumers on average have 4 credit cards with 1 out of 7 having 10 or more.

- 1 Comment

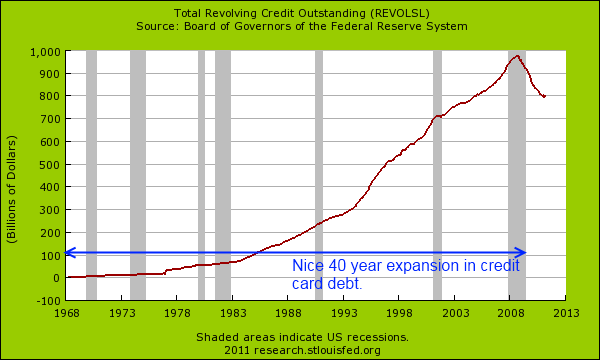

Credit cards are the gateway financial opiate of choice for many spenders. Banks understand that if consumers begin mistaking debt for actual wealth then this would lead to more willingness to borrow on bigger ticket items like cars and homes as the appetite for credit expands. This psychological gamble paid off multiple dividends over the decades as many real income strapped Americans started confusing housing debt, auto loans, and plastic shiny cards in the wallet as some kind of newfound wealth. Access to debt suddenly became a new definition for wealth. No other country has manic usage of debt like the United States. 1 out of 7 Americans carries over 10 credit cards. Another 1 in 7 uses at least half the balance on their credit card. How is it possible to give so much access to debt to a nation where the average per capita income rounds out at $25,000? The misguided notion that deficits do not matter that engulfed the country like a bad fad in the 1970s and 1980s largely set the stage for our current peak debt situation. Credit card debt is now fiercely contracting and the 40 year run is over.

Credit card debt ends 40 year bull market

Since the first credit card was introduced to the American public it took off like apple pie, pinball machines, and gnomes on the front lawn. Initially the credit card was extended to people that could demonstrate actual creditworthiness to their local bank since it was their money on the line so the prestige of carrying a card actually meant something. As we neared the peak in 2008 $975 billion in credit card debt was floating in America all the while the economy was beginning to fly off the financial cliff. This insanity permeated to other countries where even a cat landed a credit card:

“(News.Au) MESSIAH Campbell was considered a good enough credit risk to be given a card with a $4200 limit – which was surprising, considering he’s a cat.

His Melbourne owner Katherine Campbell wanted to test the limits of her bank’s identity screening process and applied for the Visa credit card on Messiah’s behalf.

She was amazed when it was approved.

“I just couldn’t believe it,” she said yesterday. “People need to be aware of this and banks need to have better security.”

What can alter a system to a point where Garfield is getting credit cards? We went from locally scrutinizing individuals to verify if they were capable of paying back their obligations to actually searching for anyone (or thing) that would be willing to sign on a dotted line so the debt could be packaged up into a security and shipped off to Wall Street for speculation. The collapse in credit card debt reflects a tipping point for the American consumer. No longer will 0 percent offers to anyone and everyone be offered unless you are a too big to fail bank searching for a quick loan from your drinking buddies at the Federal Reserve.

Why has credit card debt contracted so quickly?

The contraction in credit card debt has happened relatively quickly:

2008-11:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $974 billion

2011-03:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $785 billion

$189 billion in credit card debt (19%) disappearing is no small task. Much of this has occurred through bankruptcies and banks actually shutting down credit lines or lowering limits:

“(Las Vegas Review Journal) The typical individual reduced his credit card debt as well, to $6,170 from $7,883, Lin said. However, Lin attributed that partially to lower credit card limits for many consumers.

The typical Nevadan has a 660 credit score, about the same as 662 a year ago. That’s not far below the national average of 667, but it’s nothing to brag about.

“It’s not a great credit score,” he said. A consumer with that kind of score probably pays higher interest rates on credit cards, he said.â€

That is a sizeable decrease. Much of this is happening not by individual choice but because banks are shutting down the credit lines for most Americans. Keep in mind that the purpose of the large bailouts was to keep credit flowing to “average Americans†but the reality is most of the money has flowed to the pockets of too big to fail banks for their global stock market speculation.

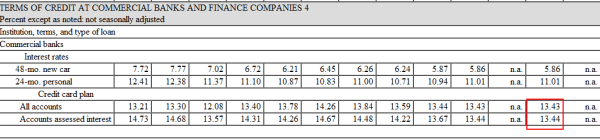

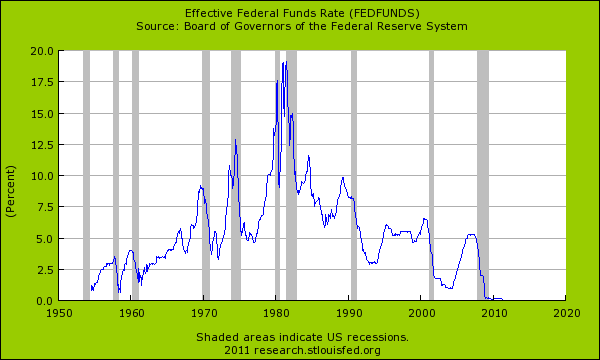

The insanity that has gone on with the bailouts as well is the fact that banks are charging absurd interest rates while borrowing at the Federal Reserve for close to zero percent:

The average credit card rate is over 13 percent while the Fed Funds rate hovers close to 0:

Now if American households are being put into debt rehab, why is the national debt increasing? Much of the spending is happening for the top 1 percent of our country that are largely vested in the too big to fail institutions. The working and middle class is being slowly dismantled while money flows to the top to protect the profits of the very few banks that control most of the assets in the United States. Now that trillions of dollars have flowed to the top thanks to working and middle class taxpayers, these banks and the government are turning a blind eye to the public and shutting them out completely by taking away their plastic, kicking people out of homes, and offering a nice consolation of burger flipping jobs.

We are quickly reaching a point where if we do not get our financial house in order as a nation, the national economy might be facing something that is already being experienced by working and middle class Americans. At some point globally the scissors will come out and cut our plastic.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

MountainHome said:

The opportunity has been lost though there were times when things could have changed. The ugly truth is that it’s going to get worse and there is nothing our govt. or anyone else can do to stop it.

October 8th, 2011 at 5:55 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!