The epic crisis in retirement savings: Vast majority of Americans unprepared for retirement. Median retirement savings for those 25 to 34? Zero dollars.

- 2 Comment

If actions are a method of gauging interests Americans have little desire or ability to prepare for retirement. In fact, the amount of money saved for retirement is absolutely shocking on the low side. When you mention that the American per capita wage is $26,000 people seem shocked. This figure doesn’t coincide with the spend happy media’s perception of the American family. Even after the lows of the recession, much of the employment recovery has come via low wage jobs and cutting back pay. Saving money can only be accomplished if people have enough left over each month after necessities are taken care of. Many financial blogs seem to speak to a small portion of society and fully ignore the overarching data. For example, the median retirement savings amount for those 25 to 34 is $0. That is right, the majority of young Americans don’t even have a penny saved to their name. Do not think that as you move up the scale that things get all that better. We have an epic crisis when it comes to saving for retirement.

Is anyone saving for retirement?

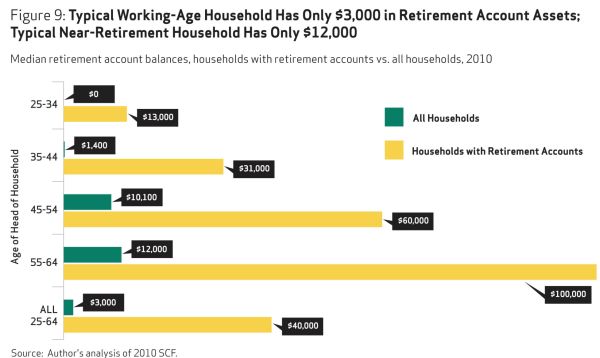

The below chart is rather startling:

Source:Â National Institute on Retirement Security

What we find in the above chart is that most Americans are flat broke when it comes to saving for retirement. You might say that those 25 to 34 years of age have simply avoided dealing with the future. However, this is the most indebted young cohort of Americans we have ever seen largely due to student debt. Yet look at the other age brackets. The median amount saved for those 35 to 44 is $1,400 (one month of rent and food in many parts of the country). Those 45 to 54 do a little bit better coming in at $10,100. Those 55 to 64? About $12,000.

In total, the median saved for retirement by all US households is $3,000.

Even those with retirement accounts (obviously a small figure) have a median amount saved of $40,000. The $3,000 figure should shock people into realizing that programs like Social Security are going to become the default “retirement plan†for millions.

Why so little saved? First, as we have discussed, inflation is slowly eroding the purchasing power of the American household income. In the last decade, healthcare, college, housing, and food have all gone up in costs considerably while wages have gone in reverse. That is a big problem. Modest inflation is troubling when wages are stuck.

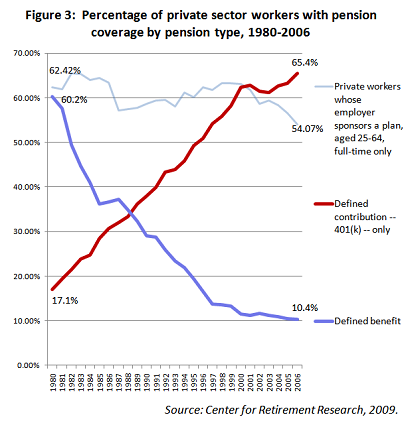

The disappearing of pensions means many Americans have no plan for retirement

Couple this dismal savings for retirement with the disappearing pension and you realize that the default plan for most Americans when it comes to retirement is no plan at all:

Back in 1980 60 percent of Americans had some sort of pension. Today it is down to 10 percent and the trend is obvious. The red line above ties in with our first chart. Most companies offer 401ks but these are optional. Clearly most Americans have proceeded with saving for retirement with:

-1. Not saving at all (reflected in the current figures)

-2. Inability to save (which for younger cohorts is very likely)

So we are left with a couple of decades of flat out no plan for retirement outside of what you would get from Social Security. Given our massive government debt, is this really going to be healthy moving forward? Social Security is a pay as you go system and this will depend on younger workers (which as you see, have virtually no money to their name).

It is a troubling issue and we definitely have an epic crisis when it comes to saving for retirement. It helps to explain why we have 47 million Americans now dependent on food stamps. Yet seeing these figures makes you pause, that is for sure. Saving for retirement is a slow race, like the fable of the tortoise and the hare. It appears that most have been living the hare’s life and not saving anything at all. For the higher age brackets, there is very little that can be done. Putting away $500 a month at 20 can make a big difference at 60 but starting at 50? Not much especially given the insane volatility of the stock market. Of course, as with many things, this is something that we will deal with when it blows out of complete proportion.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Zed said:

While I would not disagree with overall message from this article, I would mention that more and more people are moving away from traditional retirement savings vehicles. The notion that a company 401k or an IRA are viable ways to save for the non working years has been fully exposed as nothing more than a government program for future confiscation. Just ask an Argentinian.

August 21st, 2013 at 3:40 pm -

johncoward@earthnet.com said:

Any body than saves fiat paper, will losses above seven per cent.

Spending all monies make logic sense.

Calculate taxes, living tax, cost of shelter, food, and forget not

what paying hidden inflation. Typical one person paying in excess

of 145 0/0 of income.

Now add in inflation above seven per cent, return on income

is less than negative. First pay yourself. Forget to pay thief

, and or guvmint. Only then may you survive.

origin 72 year old man.August 22nd, 2013 at 8:10 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!