European Union reaches highest unemployment rate since crisis started – Spain hits 25 percent unemployment rate for first time. The missing EU crisis headlines.

- 0 Comments

During the height of the US Great Depression, the unemployment rate stood at 25 percent. This was a devastating experience for our economy and shifted policies and geopolitics for decades to come. So when you have the European Union, the world’s largest trading bloc with two countries experiencing unemployment rates of 25 percent people should be paying more attention. The unemployment rate in Spain for the first time hit the 25 percent mark last month. The figures are more troubling when you dig deeper into the data. Greece is also facing tough economic times. At the core of the crisis is the subject matter of too much debt. Spain is pulling back from a busted housing bubble and Greece is dealing with massive debt-to-GDP ratios. We trade heavily with the EU so what happens in Europe is bound to have an impact in the US. Is the crisis in Europe solved?

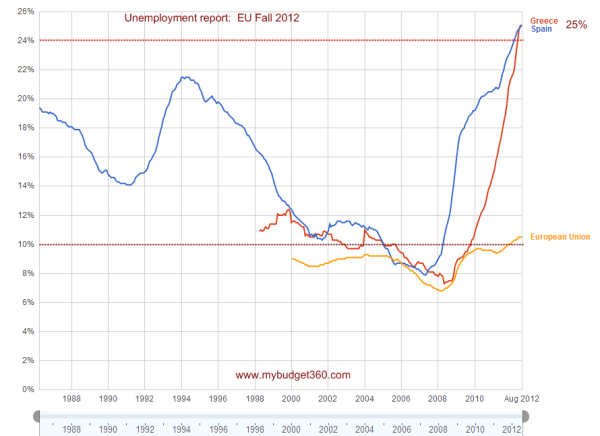

Unemployment rate of Spain and Greece

The unemployment rate of both Spain and Greece has breached the 25 percent barrier:

“(Daily Mail) The unemployment rate in Spain is above 25 per cent for the first time – with more than half of young people out of work, new figures have revealed.

Between July and September, 85,000 more people joined the ranks of the unemployed raising the total to 5.78 million, the National Statistics Institute said today.

The figures brought the country’s unemployment rate up by around 0.4 per cent to 25.02 per cent.â€

The unemployment figure of 25 percent is troubling enough but the fact that 50 percent of young Spaniards are out of work is disturbing. In the US, we have half of young college graduates under the age of 25 either not working or working in positions that do not require a college degree. There seems to be global epidemic of young people out of work. For those that care about the future of their economies it is important to set out a clear path of prosperity for those coming up through their respective economic systems.

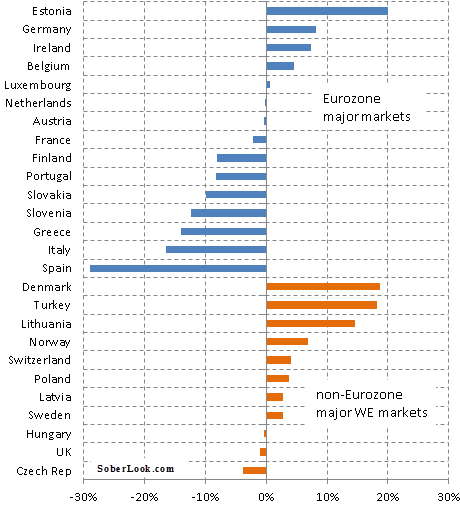

Even more important in the chart above is the overall EU unemployment rate that is now well over 10 percent. This is even higher than at the peak of the crisis in 2008 and 2009. While the US has seen this figure slowly inch lower the EU is going in the opposite direction. The massive amount of debt being pumped into the system is amazing. While our stock market might be up in 2012 this is not the case in many other countries:

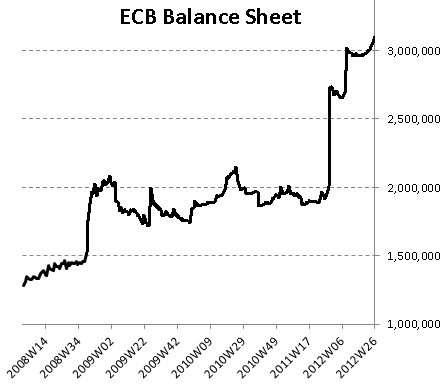

The Spanish stock market is down over 30 percent. The European Central Bank is following in the same path as the Fed and now has a balance sheet of over €3.1 trillion:

The action of the ECB has seemed to create a lull in the media about the EU crisis yet the unemployment situation continues to get worse. The stock markets in these respective markets are certainly not going up. It is hard when central banks begin bailing out the financial industry while forcing austerity on the workers in each country. Instead of dealing with the inflated debt brought on during the bubble, these financial institutions want to inflate their way out of the mess by lowering the standard of living of those in each country.

We are seeing this in the US as the standard of living is crushed all the while we have nearly 47 million Americans on food stamps while the stock market is up over 100 percent from the 2009 lows. The system is now setup for extreme dichotomies where connected institutions can receive subsidies and bailouts while the public is forced into a lower standard of living. The crisis in in Europe is not something that is passed. This is ongoing. It appears that this crisis has been missing in the headlines for the last few months but the debt is certainly still there and the citizens in each country I’m sure are still feeling it. Ask the 25 percent unemployed in these nations and see if the global debt crisis is now over.

Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!