FDIC and Federal Reserve Protector of the Big Banks – Four Institutions with Bank of America, JP Morgan Chase, Wells Fargo, and Citibank make up 55 Percent of all FDIC Backed Assets. Big Banks Pillaging the Middle Class.

- 3 Comment

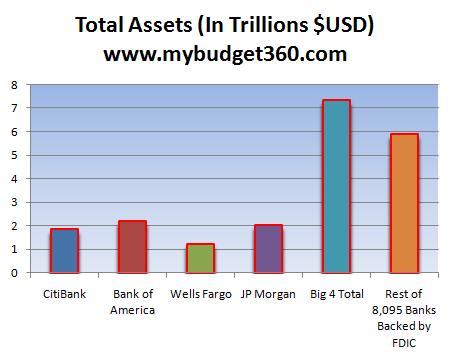

The FDIC provides deposit insurance at 8,099 institutions. Collectively the FDIC overlooks $13.247 trillion in assets at these institutions. Instead of feeling protected you should feel weary because the FDIC deposit insurance fund is insolvent. Now the assets at these institutions range from softer side financial instruments like CDs and regular deposits but keep in mind that saving accounts are actually viewed as liabilities on the balance sheet of banks. This is money owed to you, the typical American saver. What is more nefarious is that these banks label high flying “assets†like commercial real estate loans and home equity lines as assets. In other words banks are optimistically pretending that many of their toxic assets are worth more than they claim they are really worth. And what is even more disturbing is the too big to fail banks make up the bulk of the FDIC total asset pool. Out of 8,099 institutions 4 banks in Bank of America, JP Morgan Chase, Wells Fargo, and Citibank make up 55 percent of that total asset pool:

Source:Â FDIC, Bank Financial Statements

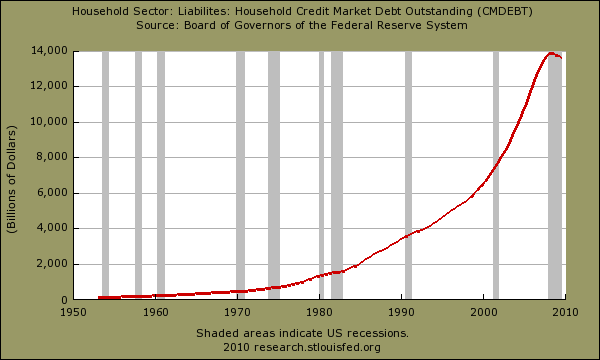

In the last couple of weeks, there has been much scolding being thrown at Greece for their spendthrift ways. Yet has anyone really even looked at the balance sheet of our banks and country? In fact, Americans are carrying nearly as much household debt as our annual GDP. This is the so-called assets on the banks balance sheet:

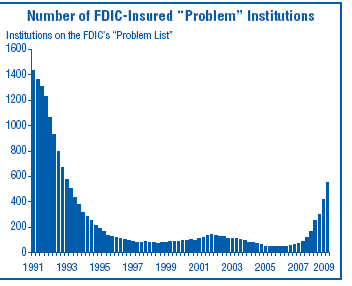

The big four banks have been pushing households for over three decades at a blistering pace to go deeper into debt. The middle class has been sold a bill of goods with the faux prosperity of the last few decades. Certainly we have been able to consume more and purchase more goods but where has this led us? We are now witnessing the highest foreclosure rate since the Great Depression. Unemployment and underemployment has now pushed the rate up to levels unseen in generations. Banks have become pushers of debt to the middle class and in reality, it was all a front to consolidate power in their corporatacracy. The fact that only four banks control 55 percent of all banking assets is simply amazing. It is an oligarchy in the banking sector. And the troubled bank list keeps growing but the bigger banks will have no chance of failing (their risk is now transferred to the public):

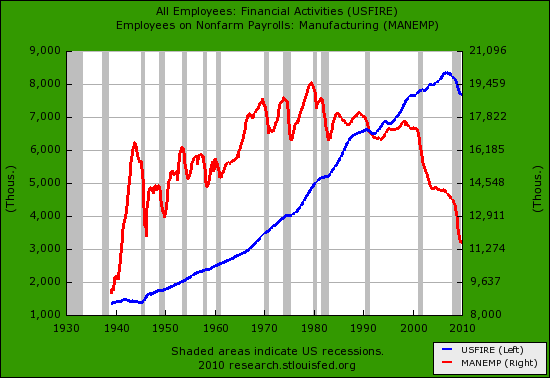

Now why would there be a growing number of problem banks if the economy were truly recovering? Your typical banks has to deal with the real world just like most businesses. They don’t have the luxury of expecting bailouts for every misstep that they take. They also interface with the middle class of America that are seeing their ability to keep up become harder and harder. Everyone is being sold that “we need to tighten our belts†while these big banks are dolling out billions in taxpayer bonuses and somehow are adding no actual benefit to the real economy. This is the conclusion of 40 years of irresponsible growth in the banking sector. Finance was never intended to be a big part of our economy but that is what we have gotten over the years:

The trend is rather unmistakable. Manufacturing topped out in the 1970s and the financial sector has grown nonstop and only this gigantic financial mess has slowed its growth. Yet keep in mind where this slow down has occurred. There are many more efficient and better run smaller banks and they have had to tighten their belts like everyone else but the too big to fail have gone on shopping sprees acquiring toxic mortgage outfits and investment firms like Bear Stearns or Merrill Lynch. How is this part of the cutting back plan? It is more of a coup from the corporatacracy to cement their concentrated power.

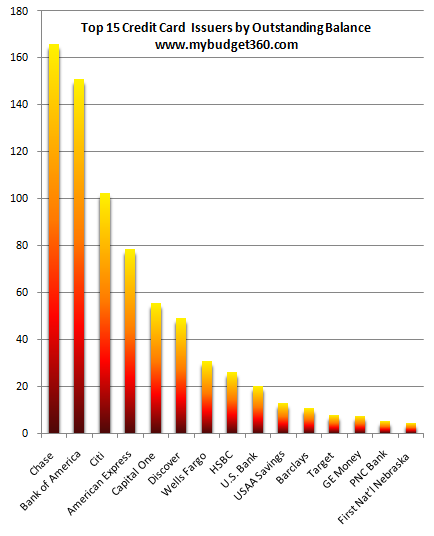

The big four are also part of the biggest issuers of credit cards. As you may have noticed these banks while speculating on Wall Street and turning enormous profits in their investment units have done very little in advancing the cause of the middle class. Instead, they have now gone after good credit standing customers to ring out every penny in absurd fees and gimmicks. Some argue that people should simply not spend. Well, if the American public had the same access to the U.S. Treasury and Federal Reserve I assure you that the playing field would be very different yet some of these people have the inability to see the macro picture of what is occurring. You can’t tell the public to act one way while so much money is funneled back to the top.

The biggest propaganda fraud is how big banks try to confuse the public that they have actual choice in the various credit cards they have to offer. Just because you can put a puppy on your card doesn’t mean a big bank won’t gouge you for every penny you have. Take a look at the top credit card issuers:

*In Billions of $USD

The big four banks show up in the top six institutions. As you can see our banking system is largely concentrated in a few hands and the Federal Reserve is merely concerned in protecting these gigantic institutions even if it means using middle class Americans as cannon fodder in this economic battle. Even with mortgage rates, we keep hearing how wonderful rates are. Well of course because we are destroying our U.S. dollar to allow banks to borrow at near zero percent! And this is sold to the public as good? Why not let the average American borrow directly from the Federal Reserve and get the same terms at near zero percent?  We are then told that banks need to verify the actual data. How well did that turn out in this massive housing bubble decade?

The bottom line is the big banks are getting bigger in this current structure. This is unhealthy for the system. Why? Banks that ran inefficiently and took on too much risk should fail. That is the nature of business. If you run a horrible restaurant you will lose customers and ultimately fail. With banking, as long as you serve enough crap throughout the system you will eventually rise to the top and then become part of the corporatacracy that is somehow unable to fail. To the contrary, they have expanded and grown while every other business has to compete with tougher restrictions. Even a basic definition of capitalism is sufficient to show us that banking is operating in a socialistic handout from D.C. to Wall Street. In the end it is the middle class that suffers from this concentration of power in a few banks.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Anony B. said:

In the chart “Number of FDIC-Insured “Problem” Institutions”, why is the magnitude so high in ~1991?

February 17th, 2010 at 7:06 am -

BigSkyBear said:

Anony B. said:

In the chart “Number of FDIC-Insured “Problem†Institutionsâ€, why is the magnitude so high in ~1991?

ANSWER: S&L Scandal – a drop in the bucket to the crisis we find ourselves in today.

February 25th, 2010 at 6:32 am -

Alessandro Machi said:

Great article. The rising consumer debt has created a perpetual and residual income stream for the banksters who have become addicted to consumers who can only tread water or go further into debt.

That 15 thousand in credit card debt may not seem like that much but that works out to a 300 dollar to 400 dollar drain each and every month.

When take home pay after all taxes is anywhere between 25,000 to 30,000 for many americans, 350 dollars a month comes out 4,200 dollars a year, which is well over 10% of main street’s yearly after taxes paycheck is just going to tread water on credit card debt.

That’s why I proposed a 4 point economic plan that helps stabilize the economy without requiring any bailout money.

http://wallstreetchange.blogspot.com/2010/11/2010-after-election-4-point-economic.htmlJanuary 5th, 2011 at 2:41 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!