FDIC Insuring 8,200 Banks with $9 Trillion in Deposits and Zero in the Deposit Insurance Fund. Calling Banks to Prepay Assessment of $45 Billion.

- 6 Comment

The FDIC has greatly underestimated the problems of our nation’s banking system. Earlier in the week the FDIC proposed that banks put up $45 billion to protect bank depositors. The average American must be amazed that a system backing $9 trillion in deposits is essentially broke. Clearly the FDIC has the backing of the U.S. Treasury and Federal Reserve but there is some irony in having the FDIC tell banks to pay an early assessment to protect our money. These banks are going to use bail out money to pay to protect taxpayer deposits! The banking system is going to have some deep and profound issues as the $3 trillion in commercial real estate loans go bad in the next few years.

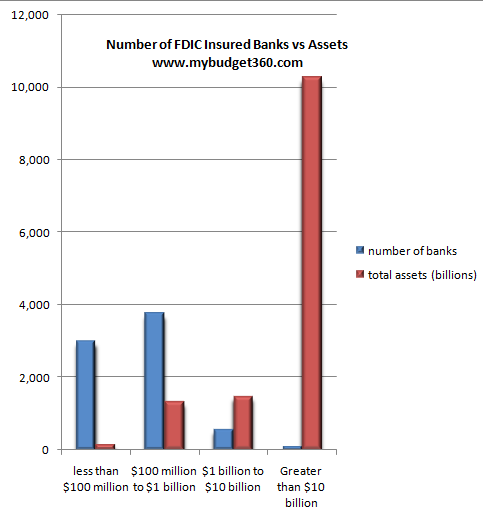

The problem is how the banking system is structured. Take a look at how assets are distributed over the 8,204 banks:

This is an incredible chart. Total assets at FDIC insured banks amount to $13.3 trillion. However, out of 8,204 banks 116 hold a stunning $10.28 trillion of these assets. We can have the smaller banks fail and the asset base would hardly move. Yet the issue of course is that the vast majority of big dollar problems are in the bigger banks.

The FDIC made the call for the prepayment this week because it is now officially in the red. It is no surprise given that a system backing some $7.42 trillion in loans with what is now no reserve is doomed to fail. It was destined to run out of money. Yet it is naïve to think that only $45 billion is going to protect the system from the $3 trillion in commercial real estate loans that are held in many not too big to fail banks. The end outcome is more trouble for banks and the taxpayer should gear up for a second round of bailouts. If you doubt this the Federal Reserve has already discussed “Plan C” which was a backroom talk to preemptively bailout the commercial real estate industry.

The plan from the FDIC would front load bank assessment fees making institutions pay up for fees that were due up until 2012. This assessment is going to wipe out the $1.8 billion in supposed bank profits from the first half of the year. There isn’t any issue with the prepayment per se, but the fact that banks are claiming that all is well is a massive bait and switch on the American people. The insurance fund is wiped out not because of great bank performance but because the FDIC is virtually taking over a few banks every Friday. Of course this flies in the face of a recovering economy.

With recent auto sales data out, car sales plummeted as expected after the cash for clunkers gimmick ran out. So banks with their $1.8 billion “profit” was nothing more than accounting chicanery and bailout money moved around to give the appearance of profit.

To show you how quickly things are changing the FDIC in May had projected losses of $70 billion from failed banks. That number is now up to $100 billion and this is with the stock market going gangbusters and the financial sector rallying with hot money. The insurance fund started out the year with $30 billion but most of that has already disappeared with rising delinquencies and high unemployment.

The problem with the FDIC approach is that it is exchanging liquid assets from reserves and taking over toxic mortgages from these failed banks. These assets have much lower values in today’s market and chances are the FDIC is over estimating the value of the assets they are acquiring. What is even more disturbing is their extremely optimistic outcomes on commercial real estate which are more toxic loans than even their residential property siblings.

The problem with the deposit insurance fund is we are told no depositor has ever lost a penny from insured deposits:

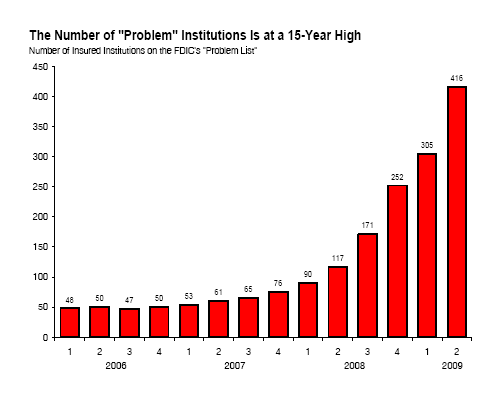

Of course this isn’t taking into account the subsidies and taxpayer money going to bail out banks or the devaluation and destruction of the U.S dollar. You don’t lose a penny, you lose a dollar with how things are being approached. The number of troubled institutions is growing exponentially:

This is by the FDIC estimates so we can assume that more are on the troubled list. By the end of this recession (or two) we will have 1,000 or more failed banks.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

6 Comments on this post

Trackbacks

-

Rocko Chen said:

How long will it take for American people to see through this?

October 2nd, 2009 at 5:32 pm -

mthomas said:

Rocko, I think it will take another severe financial crisis for this to occur. Most Americans do not follow the day to day news on the economy, they only pay attention when the Dow falls 200 points or their company has rounds of layoffs. And unfortunately I don’t think this will change. But I do think another severe crisis will occur, because the govt hasn’t done anything to fix the structural problems in the economy. I recently read some good articles about this at http://www.goldalert.com, especially the one on the left side of the page titled “Gold Price Up, Dollar Down – Does it Really Matter?” which discusses the methaphor of the government giving the drug addict (debt laden consumers) more drugs (more debt), the relationship between the dollar and the gold price, and potential investment implications for gold mining companies who could stand to benefit from a continued rise in the gold price.

October 5th, 2009 at 12:46 pm -

Bobby R. York said:

There are always chicken littles who say the sky is falling!

I HAVE DETERMINED BY TECHNICAL ANALYSIS THAT, USING IMPROVED NASH EQUIBRIUM TECHNIQUES THAT-YES AMERICA IS FALLING. HOWEVER, THIS IS NOT SOMETHING THAT IS GOING TO CRASH INSTANTLY,

THE MATHEMATICAL DETERMINED PRESENT EQUILIBRIUM FOR THE DOW IS 8600. SOMETIME IN THE NEAR FUTURE, THE DOW WILL RETURN TO THIS LEVEL, AND BEGIN A SLOW DECLINE WHICH WILL BE SYMETRICAL TO THE PRICE CURVE THAT GOT US HERE.

THERE WILL BE DISASTROUS, WORSE THAN OURS, WORLDWIDE BECAUSE THEIR CALCULATED EQUILIBRIUM IS MUCH LOWER THAN OURS.

THERE IS NOT MUCH WE CAN DO ABOUT IT. THIS IS NOT A REPUBLICAN OR A DEMOCRATIC PROBLEM. IT IS A NATURAL LIFE CYCLE OF A COUNTRY AND WORLD. HUNDREDS OF YEARS FROM NOW, PEOPLE WILL STILL BE HERE AND WONDER HOW WE ACCOMPLISHED SUCH MAGNIFICANT THINGS IN OUR TIMES.

October 6th, 2009 at 8:14 am -

Karl Mollman said:

American people will NOT see through this until it will be too late

The reason is easily to be seen in history.

All empires failed

All paper currencies failed

America was build on freedom, honest freedom

The present is built on the past, and as the past of America was the biggest holocaust mankind has ever seen, wiping out the Indian owners of America – divine justice is finally taking place …

Germany has quickly learned from it’s holocaust

Will America be able to learn?

Observing from abroad, I see too many criminals in high places, and I see not enough courage to be honest, too much respect for those criminals in public offices.

There is crime all over the CIA

There is crime all over the COMEX, the FDA, FDIC etc …

If you people of America don’t clean up that place – history will do …

That is the lesson we germans have learned with your help

Thanks for that

Good luck,

Karl Mollman / Germany

October 6th, 2009 at 11:09 pm -

Baddboyfilms said:

Life is like a box of chocolates, You never really know what you may find in your future though you might never really wonder if this country wasn’t actually founded by four fathers who were gay. maybe they were.

Break it down, 4 x fathers + two kids in a candy store = FREEDOM.

The equation is simple. 1+1 – 1 + 8 – 3 = Six then you add 2 humans and you multiply that 6 by 2 and you get 2T’s and 1 Father, One Son but no relation to one another. Like I said, The math comes out to ZERO. My finger is ok, My thumb is numb, but I am good.Make sense, yet ? Not Yet? Well, neither does this country since the dollar isn’t supported by anything but the hand which is holding it. It’s just paper and ink, printed in a mass of weight which since 1906-1933 hasn’t held any value except a promise which was a lie to begin with. All it is is a piece of paper of receipt stating you must believe it is really telling the truth which it is printed on it. Back in 1933 you couldn’t own gold. That was the law. Paper you could. 75 years later, that paper you saved from back then is worth the same as it was then yet it is obsolete. It is only worth what the government backs it up, but the Fed doesn’t support it? So what is a Fiat Currency if it holds nothing but lies? It is pointless and that is what the Equation of evolution means: ZERO. Einstein was a crazy wacko. He was a good man yet he just didn’t choose his friends wisely. But Einstein isn’t part of the fault of the falling American Dollar. He just was recently used as a crutch for the cause of the falling Dollar by those whom hide behind the paper and ink. Those are the Liars who caused the Recession in the first place. US Legislators and foreign leaders . I only write from News articles I’ve read online and watched in Market Watch and Learned from the Economy News on TV. I only learn by Experience in a daily living life in the Free Country (So call it that) The U.S.A. .

First the Fed kills the insuring banks which backed the U.S. Dollar/paper Money, then they Killed the rights to Bare Arms, Then they kill the freedom to Think and Live for ourselves, Then They Try to monopolize our properties and farms our Great Grandfathers willed us, Then they attempt to rule the world. What’s next? Burn the Constitution? They have already Sold it’s actual authentic paper it is in Government auctions three times over to private collectors from around the country, Placing fake ones inside Museums so Whats the difference between doing what you want to do and not doing what you want to do in the United States? Is it not the Fed who runs this country? NOPE. It is WE THE PEOPLE, You and Me who run them Chickens off our land. Just remember, While you are at the grocery store , waiting in line and some Minority pulls out his Flashy $9,000.00 in can wad billfold in attempt to impress everyone, and swipes his E.B.T. Welfare Food stamp card to pay for his purchase, Don’t laugh too hard, At least try to contain yourself Because under educated people do the most darnedest things in public while not even knowing what people are THINKING around them, Foolish paperboy.

March 25th, 2010 at 3:07 am -

potla said:

Good work, keep it up.

October 1st, 2013 at 12:13 pm