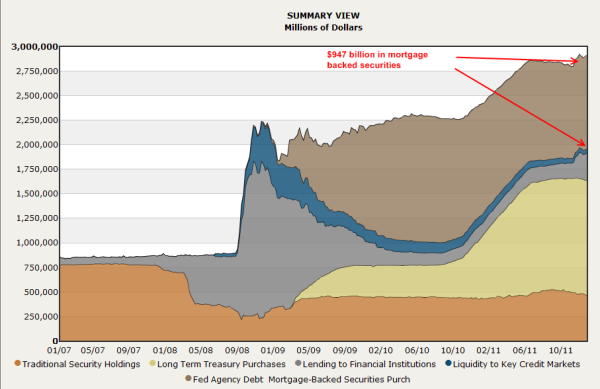

Federal Reserve continues shadow bailout of banking industry – $947 billion of overpaid and low demand mortgage backed securities sit on the massive $2.8 trillion Fed balance sheet. The price of this hidden bailout will hit all Americans.

- 0 Comments

The Federal Reserve continues a secretive bailout of the banking system by purchasing more and more questionable mortgage backed securities. You would think that $1 trillion would catch the attention of the media but they seemed focus on other trivial items. The Fed balance sheet is still at record levels above $2.8 trillion to be exact, but the more troubling aspect of all of this is the amount of mortgage backed securities they have purchased. They continue to hoard toxic commercial real estate loans and a massive amount of residential mortgage backed securities. How much? The Fed now holds over $947 billion in mortgage backed securities. Keep in mind that prior to this financial crisis the Fed rarely held anything else except quality paper on its balance sheet. Yet this is the cost of the shadow financial bailout.

The shadow bailout of the financial system

The Fed continues to artificially interfere with the market by purchasing securities that have little demand in the real marketplace. Because of this, the Fed balance sheet looks like a dumping ground for toxic paper:

Examine the above chart very carefully. Prior to 2008 the Fed principally held traditional security holdings “aka things not toxic†but now a large portion of their portfolio is toxic paper. When we say toxic we mean that the Fed is overpaying and storing these paper assets like a nuclear waste facility. At some point, people need to recognize what is being pushed into the Fed balance sheet. The banking system has failed to deal with these problems or to confront them head on. Most of the loans in the balance sheet are backed by the ailing real estate market.

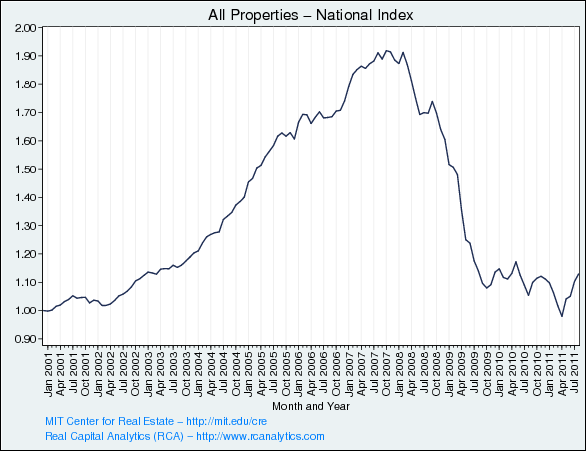

Take a quick look at the commercial real estate market for example:

Source:Â MIT

Although prices have moved up from the bottom, they are light-years away from coming close to the face value of the loans. The Fed is simply storing failed strip-mall projects, luxury hotels, and other non-crucial economic loans to aid the failing banks. The cost of course is shifted to taxpayers in the form of a depreciating currency and the devastating cost of inflation. The only reason interest rates are so low at the moment is because the Fed is buying so much of this paper and sticking it into their own balance sheet. Ask yourself this, if things were so good why is the Fed balance sheet still near the peak?

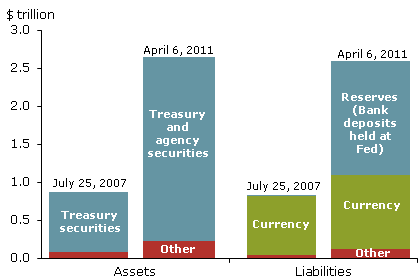

The Fed has gone bananas with its balance sheet:

Even the Fed openly talks about this:

“(Fed) As Figure 1 shows, the Fed’s recent securities purchases have caused its balance sheet to grow enormously. Just before the financial crisis, the Fed’s largest financial asset was about $0.8 trillion in Treasury securities, and its chief liability was a similar amount of currency outstanding in the form of Federal Reserve notes. The Fed now holds about $2.4 trillion in Treasury and federal agency securities. These assets are roughly balanced by a similar amount of currency and bank reserves, which can be thought of as the electronic equivalent of currency.â€

Electronic equivalent of currency? Not exactly. But in our modern day system debt is money until it implodes. That is the issue with having the ability to digitally print money in the shadows and bailout financial institutions with no oversight from government. We are talking trillions of dollars here and we still don’t have a full picture of what the Fed is holding. The recent audit only gave us a tiny snapshot of what is transpiring at the Fed.

The challenge of course is what will occur once the Fed comes clean with this balance sheet. The idea is that they will engineer enough inflation through all these shell games that at some point, they will be able to release the assets to market and then allow banks to sell them off. The Fed realizes that this is not possible so they are actively trying to create asset inflation and have conducted little focus on helping the ailing economy. What do they care? The financial bankers care not about nations but their own bottom line. At the moment they rather sacrifice the middle class than realize and deal with the bad bets they made over the past decade. And the Fed continues to aid in this massive shadow bailout.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!