Federal Reserve silently grows balance sheet to approximately $2.75 trillion by a shadow bailout of residential real estate and commercial real estate. The continuing hidden CRE bailout imperils future economic growth.

- 0 Comments

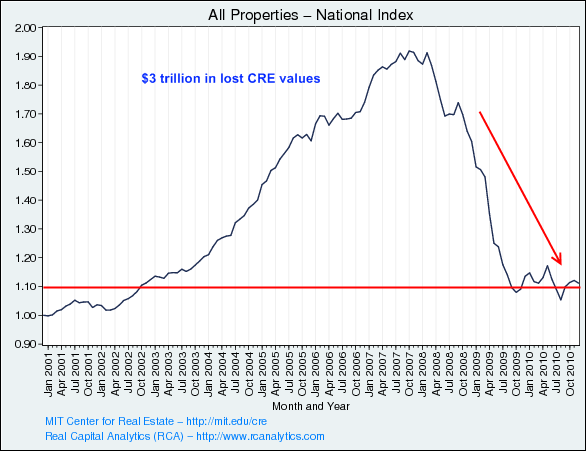

The biggest silent financial bailout going on in the nation revolves around commercial real estate. Commercial real estate (CRE) values have plummeted $3 trillion from their peak in 2008. While residential real estate values peaked in 2006 CRE waited two more years before moving lower. The two year lagged occurred because many banks, especially local regional banks have held onto trillions of dollars of CRE loans that have now lost nearly half their value. This includes hotels without adequate demand, empty shopping centers, and multi-use projects that really have little market demand in a country facing a debt base recession. Ultimately CRE had to come down to reflect the values of what people could afford. As it turns out when the average income is $25,000 in the U.S. there is little discretionary income on a per capita basis to spend day and night at the local shopping mall. We have all heard of the residential real estate bailout since this seems to be the message coming from the banks and government yet little is ever mentioned about this $3 trillion industry that is benefitting just as much.

The Federal Reserve bails out CRE without your knowledge

Source:Â MIT

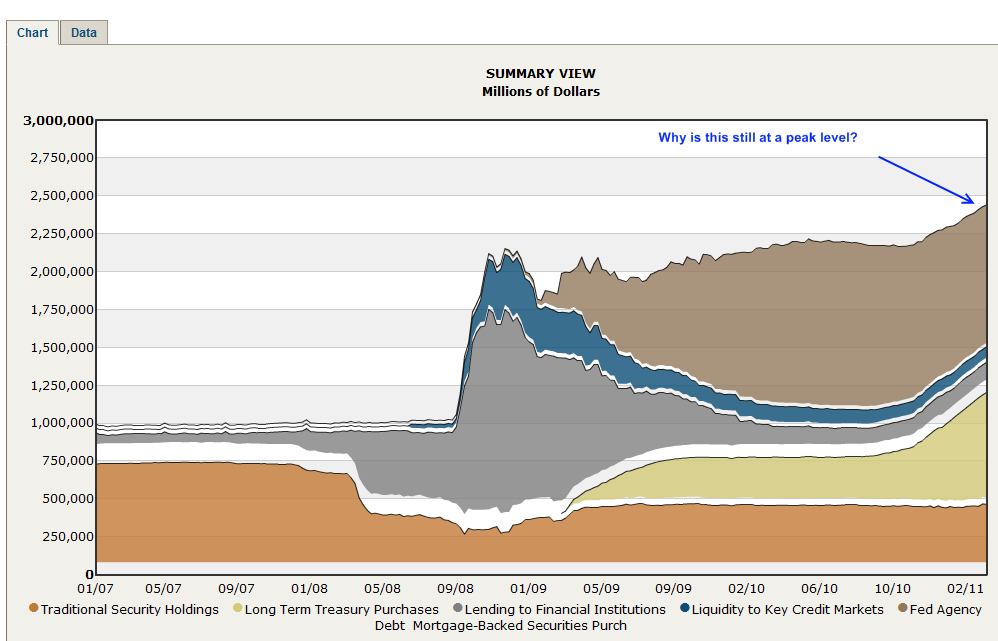

The biggest continuing bailout is occurring through the Federal Reserve. The Fed has allowed banks to suspend mark to market accounting so many institutions are merely rolling over CRE debt and allowing borrowers to renew loans even if they currently are non-paying. Most Americans do not have the luxury to stop paying on their medical bills, student loans, or car payment. It is better for a bank to pretend that their CRE is worth a peak value even if no money is coming in. This carefully mapped out calculus is problematic and the only way this can occur is if the bank of all banks, the Federal Reserve allows this to occur. The Fed has massive oversight and regulatory jurisdiction if it wishes to enforce any actions on the banks. Instead it continues to purchase mortgage backed securities and even today, the Fed is at the peak of their balance sheet:

With QE2 ongoing and other items like Maiden Lanes still in progress, the Fed is quickly approaching $2.75 trillion in terms of items they have on their balance sheet. Of course this is a recovery according to the press but what the above balance sheet shows you is a market lacking demand for real estate in all forms and the Fed is really the only buyer in many niche segments. If there were real market demand willing participants would be purchasing these properties ex-Fed. But who would buy an empty strip mall in this market:

“Looks like a lot of demand here.â€

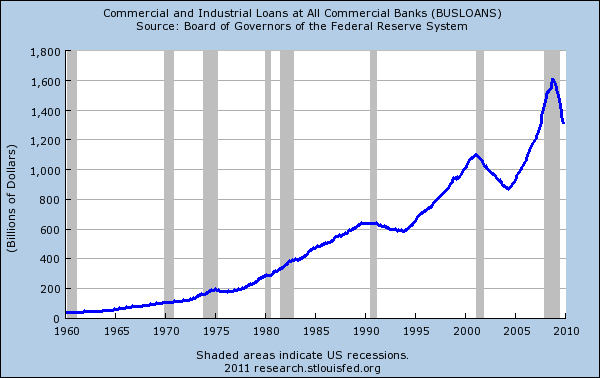

The Fed fully understands that there is little political will in the public to bail out failed luxury hotel projects or empty shopping malls that catered to a wealthy class. The middle class has just undergone the most painful contraction of income in the last decade since the Great Depression. Americans are maxed out in all forms of debt; credit card, student loans, mortgages, and auto loans all carry a heavy weight now on the purchasing power of Americans. CRE caters to the consumption class but what if consumption, that engine of our economic growth, is now entering a sustained contraction? Banks internally know problems are occurring as witnessed by the MIT chart contracting but also the amount of commercial loans being made:

The contraction is ongoing because there is little demand for new projects. If there is suddenly a demand in the marketplace it will likely come in the form of using these currently built projects. Why build new places when the storefront is already there? The Federal Reserve is trying to orchestrate a slow inflationary environment so banks can walk away from these debts. The Fed’s actions merely postpone the day of reckoning because the problem isn’t lack of credit in the market but that prices are much too high. It cannot keep prices elevated because incomes simply do not justify prices in many locations.

Ultimately this is a massive hidden bailout. There is a big cost here. The Fed artificially keeps rates low and this punishes savers. Savers have witnessed one of the worst decades in terms of savings rates. This is occurring because the Fed has made it a priority to bail out banks by allowing them to continue to keep zombie loans on their books while using current bailout funds to speculate in global stock markets to pad their balance sheets. Yet the cost is shouldered by the working and middle class of this country. This is the continuing shadow bailout here. How many times have you heard about the CRE bailout in the mainstream press? You don’t even hear much about the continuing banking bailouts. In fact, many outlets are talking about the bailouts being over. Just glance back up and look at the Fed balance sheet. Does that look like things are okay?

CRE once had an estimated national value of $6.5 trillion. Today it stands at an optimistic $3.5 trillion. Banks have not come to terms with those losses and the Federal Reserve will try to keep that under wraps in their now approaching $2.75 trillion portfolio.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!