To taper, or not to taper. Not the question if you are the Fed: Austerity intact while Fed balance sheet continues to expand.

- 1 Comment

The Federal Reserve has hinted at slowing down its Quantitative Easing machinery but that might face some challenges as the stock market experienced one of its worst months in over a year. This is not to say that the Fed should respond to the stock market when it sneezes but it makes it more unlikely that the Fed will adhere to its September taper announcement. Keep in mind that the entire QE strategy on the surface was to provide additional liquidity to US households. If that was the measure of success, QE has been a royal failure. As we will shortly see, credit to US households has not expanded in light of unprecedented Fed balance sheet growth. Money is being deployed but very ineffectually (if you are your regular US consumer). Funds are being diverted to large financial institutions while the public struggles with credit austerity.

QE and credit austerity

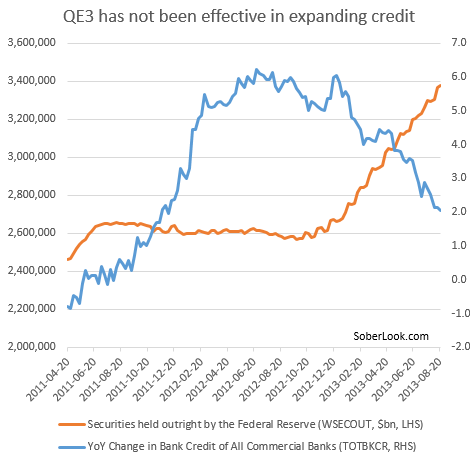

If we take a look at securities held outright by the Fed and overlay this with year-over-year bank credit growth we see two different stories:

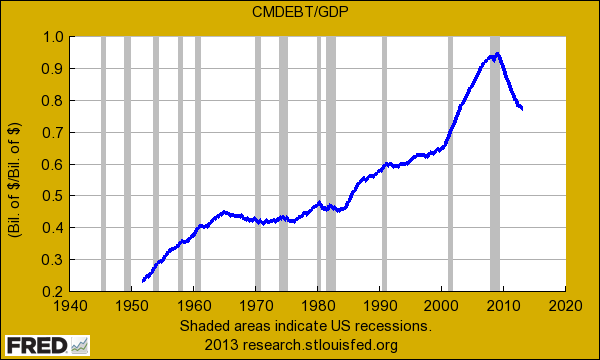

If the purpose was to expand credit, we are not seeing it on a large scale. What has happened is that US households are still in a slow methodical process of deleveraging. Financial crashes do not resolve overnight especially one of the magnitude that we recently experienced. So the Fed’s balance sheet growth has largely allowed banks to transfer loans from one balance sheet to another freeing up banks to once again speculate. This is how we are seeing large swaths of investors plunging into the residential real estate play. At the same time, household debt clearly peaked in 2007:

If we divide household debt to annual GDP, there was a significant event that occurred in 2007. There is no set rule in markets but for the US, it appears that when US households reached a 1:1 ratio of household debt to GDP, a breaking point was faced. This seems to make sense if you consider a household that makes $50,000 a year but spends $50,000 a year via borrowing is also on shaky ground.

The unwinding may be worse than the above chart signifies. Why? First, a large portion of the deleveraging is occurring via foreclosures. So debt is being purged quickly out of the system. However, many of the recent home sales are going to large banks and investors leveraging the easy debt system that has been setup by the Fed. What you don’t see in the chart is the massive expansion of even more risky debt in the form of student loan debt. This debt is growing at the fastest pace but you have to pull it out of the overall total debt market picture because the millions of foreclosures since 2007 have largely pulled the total household debt ratio lower (mortgage debt by far is the biggest debt sector for US households).

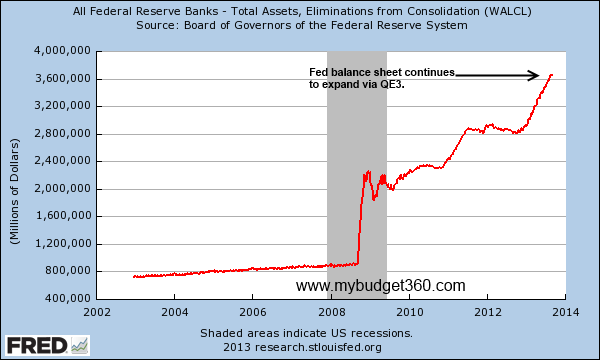

So you have to wonder what the end-game of the Fed’s massive balance sheet expansion will look like:

Do people even realize how big $3.6 trillion is? If you try to talk to regular people about the Fed their eyes simply glaze over. Yet they fully understand that something is amiss in the economic system especially when the stock market has rallied 100+ percent since 2009 and real estate values are soaring at annual rates last seen in the last bubble. If you mention tapering good luck trying to discuss this (but of course, the mainstream press has provided plenty of nonsense fodder to keep the circus going).

Many households are dealing with the pangs of austerity but it is abundantly clear that banks are not. You need to remember that the Fed looks out for member banks first, any other secondary benefits are merely that. Don’t expect the Fed to worry about the US middle class or prosperity for the American family. They are too worried about providing a landing place for all the odd assets and liabilities of US banks to worry about the general public and their struggles with austerity. To taper, or not to taper. Just look at the above charts and I think you know what the answer to that will be.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!            Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!            Â

1 Comments on this post

Trackbacks

-

Liquid said:

With the capital markets doing so well It makes me nervous to think what if we’re headed for another credit induced bubble again? As much as I want the Feds to taper QE, they probably won’t change their current course of action much. Their goal seems to be to provide more credit in the markets even though that doesn’t seem to be working all that well. Guess we’ll find out in a couple of weeks at the next FOMC meeting.

September 4th, 2013 at 1:56 am