Federal Reserve ultimate protector of the banking class – Fed Reserve sends a thank you to American middle class and world for bailing out the banks with a gift of inflation. MIT chart tracking millions of items shows much higher inflation than CPI.

- 0 Comments

The Federal Reserve has one clear mandate. That mandate involves protecting the biggest investment and commercial banks on Wall Street at the expense of the American people. This deflation of quality of life is being felt in the most clandestine and subtle ways like a shift in the wind. The Federal Reserve through archaic money operations has bailed out the too big to fail and has passed on the bill to millions of Americans. We are now seeing this through the rising cost of goods outside of housing. As noted before manufacturers unable to charge Americans with an average annual income of $25,000 anymore on goods for fear of losing customers, many producers are simply shrinking the package of items hoping customers do not notice. Aside from this hidden cost since the US dollar is being devalued by virtual money printing, the CPI which is heavily weighted by housing is also showing increases in inflation. As expected it looks like the Fed is only concerned with protecting one sector of our economy.

The Federal Reserve causing another bubble?

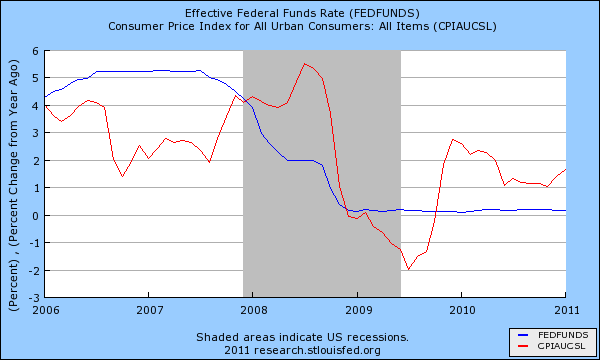

The above chart shows the Federal Funds Rate and the current CPI year-over-year change. The above chart highlights the minor bout of deflation we faced in 2009 after the 2007 and 2008 market collapse. Yet the CPI is now steadily up but the Federal Funds Rate has been stuck at near zero since late 2008. If you recall, the housing bubble was largely fueled by the Fed holding the funds rate too low for too long. Why? Former chief of the Fed Alan Greenspan was trying to re-inflate the economy after the technology bubble burst. The result was the biggest housing bubble the world has ever witnessed. There has never been a period in history where the entire globe from Sydney to Los Angeles to London all faced simultaneously rising housing bubbles.

The Fed currently has a negative real interest rate and their propaganda to the public is that they are trying to increase lending. Yet as we have documented many times before banks are not lending to the average American or small businesses in any meaningful way. The real reason the Fed is keeping rates at these low levels is to allow banks all the time in the world to inflate their toxic assets via a transfer of wealth from the public to the banking system. Inflation does this through an insidious way. The US dollar losing its purchasing power is making it harder and harder for Americans to achieve any semblance of the middle class lifestyle. It is rather clear that the Fed and the banking system has no remorse for the middle class of America but current chair Ben Bernanke does not even care about the problems caused by these actions on a global scale:

“(Mercury News) China and other emerging markets have blamed the Fed’s strategy for sending waves of capital rushing to their shores, creating a threat of inflation. But Bernanke said the influx of capital appeared to be driven more by investors’ desire to get a higher return in emerging economies than by the Fed’s policies.

He admonished emerging nations to acknowledge that they have “a strong interest in a continued economic recovery in the advanced economies,” and said they should consider deploying their own tools to manage their economies and prevent overheating.â€

This should make it clear who the Fed is really fighting for. It is primarily concerned with protecting the banking system. It is essentially playing chicken with the world banking system since the US dollar is still the biggest reserve currency. Yet for how long? Inflation in these countries cannot continue without domestic political ramifications. Say China allows their currency to appreciate. What do you think that will do to the cost of goods Americans buy? With stagnant wages is this going to help? Of course not but the Federal Reserve is really looking at bailing out the massive debt of banks through a slow loss of the middle class.

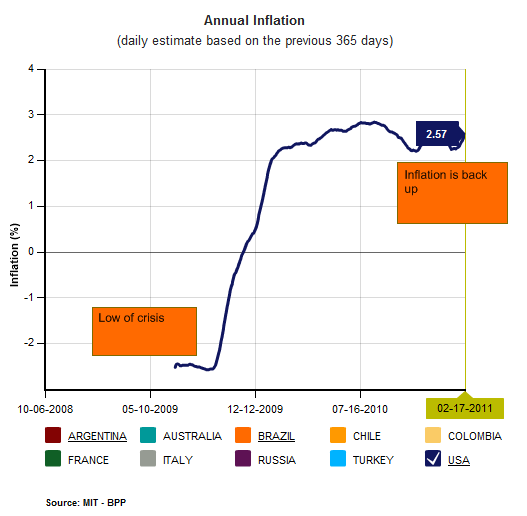

MIT has a fascinating inflation tracking tool called The Billion Prices Project:

“The Billion Prices Project is an academic initiative that collects prices from hundreds of online retailers around the world on a daily basis to conduct economic research. We currently monitor daily price fluctuations of ~5 million items sold by ~300 online retailers in more than 70 countries.â€

This is showing a much higher inflation rate:

Source:Â MIT

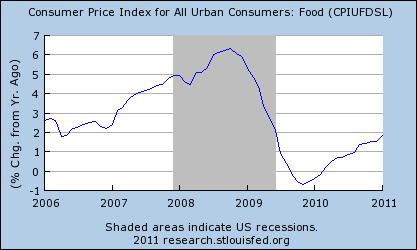

Most of us already know this. Outside of housing which many Americans only buy on a very infrequent basis (at least before the housing bubble) many key items are showing giant jumps in prices:

Food is heading up:

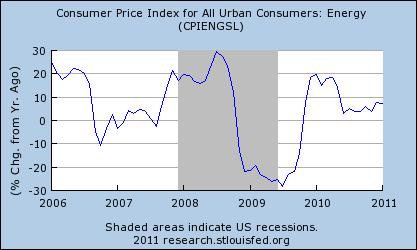

Energy is way up:

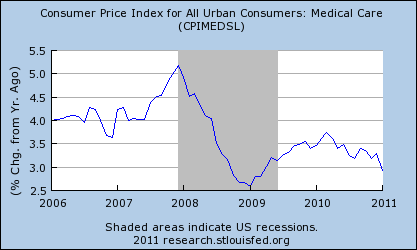

Medical care has only gone up:

In the end what most Americans are realizing with the above changes is that their paycheck is buying less and less each year. The Federal Reserve is purposefully trying to create inflation not to help the public, but to bailout the decade long fiasco wrought by the investment banking sector. Typical of the Fed the stock market has rallied 100 percent since the March 2009 low even though the vast majority of Americans cannot participate in the market (the average retirement account is $2,000). Instead of lending banks are merely recycling money back into the Wall Street casino by chasing global bubbles.

Those who think inflation is the answer to this crisis need only look at countries that have suffered major bouts of inflation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!