FICO and the Credit Card Financial Prison: How a Three Digit Credit Score Reflects Consumerism and not Financial Independence.

- 10 Comment

Americans carry $900 billion in credit card debt. Approximately 75 percent of all those eligible for credit, those that are 18 years or older, have a credit rating score at any given time. This mysterious three digit score named a FICO Score is the basis for loans, interest rates, and should reflect your ability to manage debt. Yet this is one of those confusing public relation developed ideas that tries to water down the fact that going into debt is somehow good for average Americans. Not only is going into debt good, you now have a credit score that is supposed to be some kind of financial report card.

Like the rating agencies labeling crap mortgage backed securities as “AAA” and turning out to be more like “FFF” people need to examine the entire system from the ground up. The credit card industry is gouging the living daylights out of consumers as the unemployment and underemployment rate hits 17.5 percent. You would think that the banking sector that owes its life to the American taxpayer for bailing it out would have some sympathy. Instead, the new Wall Street oligarchy is running the show and we have new feudal lords running this country. The credit card is merely your key into the kingdom of serfdom.

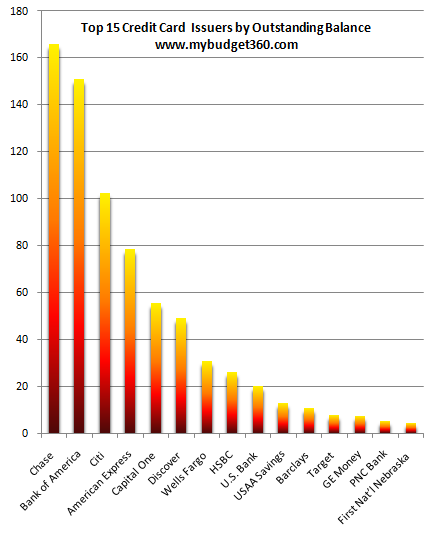

The credit card industry with the mysterious FICO score would like you to believe that there is some enormous world of credit cards out in the market. In reality, it is simply rebranding. 5 issuers make up over 60 percent of all credit card debt:

FICO stands for Fair Isaac Corporation and provides services to the world’s 10 largest banks. No shocker there. The FICO score is based on multiple factors and ranges from 300 to 850:

Source:Â PBS

Fair Isaac Corporation doesn’t store the credit scores but provides the big three credit reporting agencies with the algorithm to compute the score. It is a very tiny and selective world. You would think that something as important as a credit score would be open to the public but it isn’t. In our current market with bail outs and hidden agendas on Wall Street, transparency is of paramount importance. But of course why would they give up the algorithm since so much money is based on this score?

Looking at the chart above, there are flaws in the way the system is based. This is what we are told on the surface regarding the credit scoring model. I’ll give you a personal experience where my score dropped a few points for an otherwise financially wise move. The bottom feeders of the credit card industry have taken it upon their shoulders to now put clamps around good paying customers. Since they can’t squeeze any more blood out of 27 million unemployed or underemployed Americans, many who were recruited from companies like Providian, credit card companies are now going after “good FICO score” customers. On one card I had a line of $7,000. I rarely used the card but it had a “fixed” rate of 8.99%. Not bad for emergencies. But during this crisis as they were sucking the taxpayer dry and uncle Ben has opened up the Fed for banks to borrow at practically zero percent, these kind criminals decided to hike my rate up to 19.99 percent. No late payments. A few years of history. Since they were experiencing “unusual” changes in the economy (like screwing it up to being with) they had to raise my rate. So I called them up and canceled the card. What use is it raging against someone in India (I did ask my representative his location) when the true criminals are sitting on Wall Street? He stated that the only option was accepting the 19.99 percent rate or closing my account. I wonder if bailed out banks got ultimatums like that?

A few months later I noticed my overall FICO had dropped by 15 points. Not a big deal but what kind of logic is this? Is this the algorithm that is super top secret? This is like penalizing a gymnast for landing too many perfect dismounts. According to the system, the overall debt ratio increased because that $7,000 line is now vanished in thin air. Yet any person heading on the path of financial independence realizes that less credit card debt is good. The financial industry is fleecing the American public in so many ways they don’t even bother being careful about it anymore.

The Department of Justice did an interesting report a few years ago looking at Chapter 7 bankruptcy cases. As you would expect, as people got older the debt simply spiraled out of control:

The chart above simply shows the damage being done over years. Credit card debt is merely one factor in many bankruptcy cases. So you might say “well stay away from any form of credit then!” The problem is, even if you are looking to rent a home many people will simply run your credit score. Looking for a decent mortgage? Getting a good rate is largely based on your credit worthiness (at least now it is). Even some employers (the two that are hiring) will run your credit report. To function in our society the financial sector has largely forced people to comply like sheep. Think of overdraft fees. Why doesn’t the banking sector simply setup an opt-in policy instead of having everyone by default taking overdraft charges of $39 for a $5 cup of coffee? Because they make billions from this:

“Nov. 24 (Bloomberg) — U.S. limits on overdraft fees may cost banks more than $15 billion in revenue and prompt lenders to impose charges to close the gap, said the head of consulting firm Oliver Wyman’s North American financial-services business.

“We’re talking about $15 billion of revenue that basically falls right to the bottom line, so to take that out of the banking system then that’s $15 billion of capital that is not being created,” Michael Poulos said in an interview yesterday. “For some of our clients, this is a very big deal and it’s not clear that regulators have thought everything through.”

You notice how they call this revenue? PBS had a special on Frontline showing a banking industry lobby front man saying that the public wants overdraft access. Really? Show us the data. I wonder how much the public can take from this industry. It is literally bank robbery. They hide behind phony data and a structure that traps many Americans. Now that they can’t trap the poor, they are going after middle class Americans that are merely trying to make ends meet.

Of course, recent legislation is merely a token gesture. It has been gutted and practically written by the industry. The system is flawed. Wall Street and the banking industry have become invalid just like the FICO credit score. In California, we are seeing thousands of people default on mortgages strategically that had “excellent” credit scores. Why? Many don’t want to be paying for decades on an asset that has collapsed by 30, 40, or even 50 percent.

Until we reign in the financial sector, the average American is going to see their financial future sucked into the Wall Street vortex. Wall Street wags their finger and says, “keep up your credit score you little consumer” while they gamble like ADHD maniacs funded by the U.S. taxpayer on the most speculative products on the planet. Do as I say, not as I do.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

FatNSassy said:

Four years ago I declared bankruptcy after 28 years of perfect credit. A major reason was standing up for my beliefs at a major corporation whose name you would recognize immediately and suffering from years of harassment. No matter. I refused to rebuild my credit score and pay cash for everything. I have never been happier or more at peace. Yes there are moronic landlords and employers who are too stupid to realize the limitations of credit scores. I am glad I don’t have to deal with them as they don’t deserve me. I am NEVER late with the rent, or missed a day of work in years. We do need consumer protections against allowing insurance rates to be based on credit scores. FIGHT BACK!

December 3rd, 2009 at 8:56 am -

Willow said:

Thank you! I really appreciate that you wrote this column. None of us can hang on much longer and it seems nobody at the top really gives a damn. Do they want a revolution? Honestly, how stupid can they get? I read that the executives at Goldman Saks are now obtaining concealed weapon permits and buying guns to protect themselves. Guilty conscious? Perhaps they are knowingly and intentionally driving this country and its people to civil war. Perhaps to break it up…the old divide and conquer routine.

Obviously, something is WRONG. Very, very wrong and it’s been building insidiously for 30 years or more. People are more than scared, they are angry, hungry and getting more desperate by the day. Our leadership is failing. I don’t know one person who trusts the government anymore. This is not a good sign.

No one I know trusts the banks, either. My friends are cutting up their credit cards; they refuse to spend on anything over and above the necessities. They only put very little money in their accounts. Just enough to cover bills. With a 1% interest on their savings accounts, it is probably better to stuff the cash in a cookie jar. Seriously. Everybody I know is asking for cash only. They don’t even want checks. My girlfriend was charged $6.00 to cash a check at Chase on a draft that was issued by Chase just because she didn’t have an account at their stinking bank. WTF?

I wonder, Mr. 360, if credit unions and local banks are any better? Care to comment or write an article about any kind of alternatives? There’s got to be something better than the mattress.

Thanks so much for this FICA article. We all appreciate it.

December 3rd, 2009 at 11:06 am -

bubba said:

Revolution is the solution. Coming to a haven near you…

December 3rd, 2009 at 8:11 pm -

Carter said:

Ruthless default will crash their scheme.

December 4th, 2009 at 2:17 pm -

OC House Hunter said:

Thanks for another interesting commentary “360”. We have now experienced first hand the results of the greed driven financial sector. We also now see that our representatives in Washington will do anything to bail them out. Punishment is out of the question. With this knowledge, what can we do to beat them at their game? Have there been any lawsuits against Fair Isaac for distorting the credit worthiness of an individual? As you say, perfectly rational actions, such as seeking multiple quotes for a new loan can reduce your score if you don’t do it just right. It seems that we should be able bring suit if our scores are improperly reduced.

December 6th, 2009 at 10:06 pm -

carlos carboney said:

the shadow foreclosure market is trying the same trick japan tryed and the results will be catastrophic to say the least, and it can last for years. the banks do not need to liquidate any assets (they got fat mooooney) and can hold out FOREVER, ha ha, so don’t expect the housing to correct in the future. rents will even go down, or they won’t be able to rent the place out. credit? forget it! got the monthly ur in, its that simple. it s a new day and new rules will apply. the silly landlords have not come to terms with it yet, but don’t worry bunny they will very soon. nobody i know is even thinking of using credit, do you? maybe for a car, but thats it.

the credit kings have been deposed. the new standard will be “a job” and the next job market is security. everybody ignored the bubble even though they knew it was coming. the next ignored issue is security… lets say about mid 2010 and on… look out! its gonna get hot.

there are 20,000,000 people that will be on permanent wealfare or they will live in the streets. these people do not like living in the street and when enough of these people hit the street its gonna be a party, if u wanna call it that, ha ha. watch for food snatching, being harassed at the market for change and even robed. the future is security, like it or not believe it or not. i’m going to guard school. ta taDecember 11th, 2009 at 2:16 am -

Skittles said:

Over the last 30 years or so, credit, via FICO, has a stranglehold over modern life. Anyone intending to participate in society will find their score affects everything from insurance premiums to whether they can rent to whether they will be hired. Interestingly, prospective employers like to see a little debt on a candidate’s score not merely because it demonstrates reliability but because an indebted employee is less likely to quit.

Credit companies have also thoroughly enmeshed our SS#s into their tracking systems. These entities have accumulated tremendous power, and are not accountable to anyone, certainly not their customers. Woe betide you if you’re a victim of ID theft or if you try to correct a mistake on your FICO score.

February 18th, 2010 at 9:19 am -

Vendetta said:

In order to bring down “the system”, borrow to the hilt and max out all your cards. Take out cash draws and keep the cash in a safe place, and buy strategic as well as tactical items with that cash (so as to be untraceable) – like beans, rice, guns and lots of ammo.

THEN, default on it all. The creditors will call you day and night, and mail threatening letters. Let them. Drain their time, energy, and finances harrassing you.

And when they come to repo all your possessions, take whatever defensive measures are necessary to protect yourself, your loved ones, and your possessions – because you have NO ability for self-defense if they take it all away from you – because that is what they are going to do EVEN against those who are debt free!

BECAUSE … big government is against you, big business is against you, big finance and banking are against you – “they” are ALL against you. They take perverse enjoyment in demeaning you, torturing you, and eventually, killing you.

Stay at the ready, American Citizen, and fight for your life, your country, and your God against those whose plans are to take it all away and enslave and murder you and yours.

“As for me, give me liberty or give me death.”

February 19th, 2010 at 11:55 am -

Nemo said:

If your job sucks and pays less than 30K gross a year, and you have debt that is unpayable, stop paying. Don’t ever miss a meal (at home, natch’) or not change the oil with synthetic and a K&N oil filter.

They don’t call CC’s “unsecured loans” for nothing. They can call as long as you let them. The bank you borrow from can call forever, but they won’t (6 months, max). Then, find out who the collectors are and send them a “drop-dead, do not contact by any means” letter by registered mail. In most States, if they contact you, you sue and win cash-money. In Washington State, CC’s are uncollectable in 36 months from the last payment. They won’t bother to file a judgement on you (turnips don’t give blood or money, but lawyers want cash to work). Don’t even bother to file bankruptcy (that’s 7 years), just wait and keep your bank account below 4 digits. Work for cash/trade in the free market as much as possible. Always pay your taxes 😉

If your house is underwater 40+% and it’s a “non-recourse” loan, stop paying and keep living there. Save your valuables (junk silver, gold, and your health), ’cause you’ll need it. Keep working as much as possible and don’t leave money in a bank!

An older RV that you own free & clear in good condition is much better than a house that makes you a slave. Keep your job and a down payment and you will be able to buy a house in less than 5 years with almost no significant financial penalty (like everyone, you will need 30% down and a legitimate payroll-taxes job that nets 3x the payment, or you keep renting an RV slip).

Scum-skimming collectors will contact you for the rest of your life, but they are bothering 40% of Americans at that point, so so what.

NEVER-EVER make a payment or the clock begins again at zero. Time is your friend.Eff them and their fake currency.

They have forgotten that the law protects them from me more than it protects me from them.

-Nemo

February 22nd, 2010 at 11:51 pm -

unclejoe said:

Willow asked if local banks or credit unions are any better.

M&T bank, a Mid-Atlantic regional institution has a similar policy. I went to a branch to cash one of their checks for $35 that I had recieved for rototilling a lady’s garden. They wanted to charge me $5.00 to cash that $35 check.

So no, it’s not just the biggest banks. They’re all trying to steal your money in any way they can. They’re broke and don’t have the dignity to just roll over and die without taking the rest of the country with them.February 23rd, 2010 at 7:37 pm