Financial Brinkmanship: Forcing Americans to Spend and Discouraging Savings. Americans Decide to Save Forced by a New Austerity. Banks Offering Zero Percent on Your Savings Account.

- 3 Comment

Spending more than you earn is a financially devastating recipe for individuals and nations. I’ve read countless pop financial books on how to gain and sustain wealth and those that have any substance always emphasize saving your money, spending less than you earn, and being prudent with your funds. In no book did I ever read that going with a cash for clunkers gimmick was a way to automatic wealth. Many Americans faced with a deep unemployment crisis have had to morph their spending habits by force. I’ve talked about this new found austerity and how it is having a profound impact on society. These will be fundamental structural changes. Just like the Great Depression generation some of these new habits will stick for life.

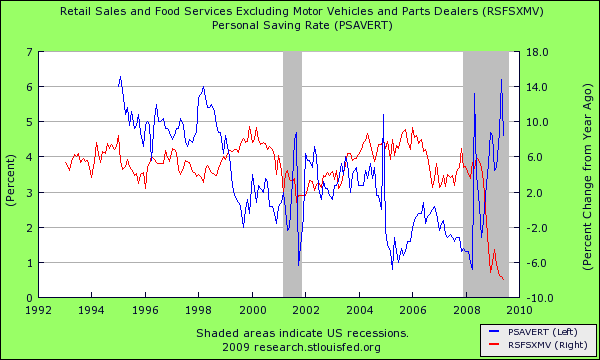

Now Americans are coping with the recession by spending less and saving more:

As you can see, the savings rate spiked up since the start of the recession and retail sales are still declining. You don’t need to read 100 financial books to understand this simple rule of finance. In tough times, you need to spend less than you earn. It is a simple equation.  And this fact also applies to our entire country:

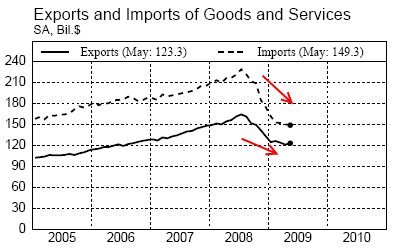

As a country we are exporting and importing less. Many other countries are doing this in this global recession. Given that this was an epic bubble spurred by easy access to debt and the housing bubble, you would expect that the market is trying to find a true bottom. Yet here we are giving tax credits for people to buy homes and massive incentives for people to buy cars. Isn’t this the reason we entered the crisis in the first place? Spending more than we earn is not the solution for a problem caused by, spending more than we earn. Wall Street would like to keep the game going further and has easy access to the American Visa Card known as the U.S. Treasury and Federal Reserve. Most Americans do not have access to this and are seeing credit card companies hiking up minimum payments and charging fees for many items looking to collect more revenues. It would be one thing if we spent $13 trillion on education, infrastructure, fixing healthcare, or lowering the tax rate. Instead, that $13 trillion has gone straight to Wall Street.

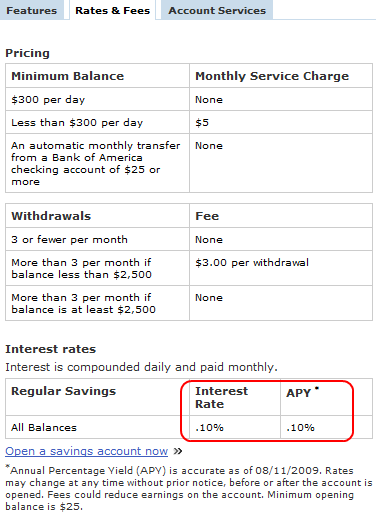

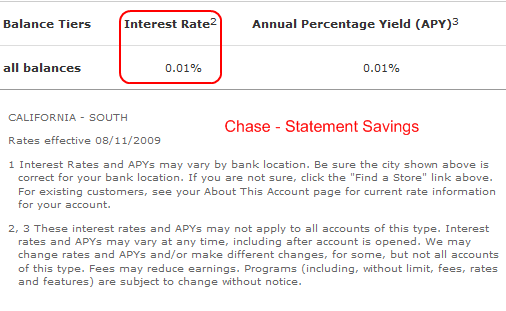

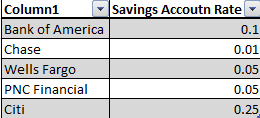

Some Americans are being lured back into the stock market because the 50 percent rally has been too good to resist. After all, saving money seems to be for chumps if we look at Bank of America and Chase regular savings account rates:

And this goes beyond these two banks. For your typical brick and mortar savings account, here are some of the top bailout recipients and the rates they are offering customers:

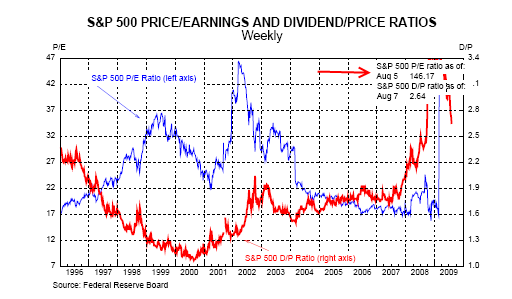

Why would you want to put your money in a savings account at this rate? And keep in mind, banks not only have cheap access to the Federal Reserve but now, they can offer you no interest rate while lending out mortgages at 5.5 to 6 percent to quality customers. Many Americans are now jumping back into the volatile stock market simply because they feel they have no other alternative:

If you didn’t look closely, you would miss the P/E ratio for the S&P 500. The P/E ratio for the S&P 500 as of August 5th is at a ridiculous high of 146 putting the blue line off the chart. I know that the mainstream media is reporting better than expected earnings but these targets are set by Wall Street so take that for what it is worth. Companies have lower earnings from 2008 and that was already a dismal year. During the Great Depression, we saw some true P/E values below 10. Right now people are buying over valued stocks on hype. They are assuming unprecedented earnings and a resumption of bubble spending. Look at the previous graphs. Americans have lost nearly $14 trillion in household wealth and many will never go back to spending how they once did.

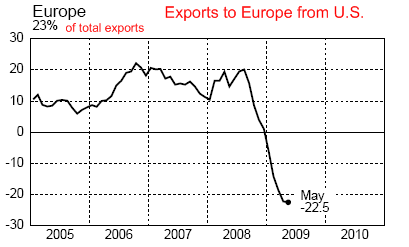

Credit card companies realize this and have cut access off to 8,000,000 credit card users. Limits are being lowered. So the era of financing everything on debt is coming to an end. All these gimmicks are desperately trying to keep in place a system that no longer functions. Our biggest trading partner in Europe is buying less from us:

In the same fashion we are importing less from them. The average American understands that things are different. Daily necessity items like food are going up in price. Energy is slowly creeping up again. Healthcare costs are still sky high and outpacing inflation at a time when baby boomers are going to retire in large numbers. We are witnessing price destruction deflation in housing and automobiles. It is a mixed bag but the reality is, most Americans realize that spending with no second thought is now over. For many this is a new concept. I shop at a local store and most of the time, you would see a cart full of expensive goods during the boom times charged on a credit card. Now, you see the family making an outing of shopping and you see parents cutting back to necessities and using a debit card more often. This is a middle class area. But seeing someone checkout with $300 in goods was common. Now, I see people checking out with $100 to $150 and I’m betting this is for their weekly food.

The reality is things are different now. Wall Street through its proxy in our government wants Americans to go back and spend. But on what? Housing and cars? We have decimated our manufacturing sector and now all we have are cars and homes? There has to be some resurgence in real industry and bringing back a mixed economy. The financial industry on Wall Street doesn’t understand this because they can’t envision their world without getting their hands dirty and breaking a sweat. They like to think that screwing people over by funneling money to unproductive industries like subprime loans and collecting middleman fees is the way to a healthy economy. In past times, the financial industry served the purposes of the real economy. Now, the real economy seems to work for the financial industry.

Yet the plans being put on the table will ultimately fail. Average Americans are largely cutting back because they know what their family balance sheet looks like.   Even though we are told that everything will be back to normal, the vast majority know this isn’t the case.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

smarly said:

Take your money (if you have any) and deal only with community credit unions for banking needs. If you don’t have access to a credit union, put your money in your mattress. Why reward them with your money when they use it for lavish executive compensation and shaft the consumer? The only power we have left is the power of the purse. Use it!

August 12th, 2009 at 6:57 am -

Justin Bowers said:

I just went to my bank to get a used car loan. They want to charge me 8.5% on my car loan, but only give me 0.15% on my savings account. No wonder these banks are posting billion-dollar profits again.

August 12th, 2009 at 8:47 am -

Glen said:

Don’t banks exist in a competitive market? If so, why aren’t some of them offering what we would judge to be a reasonable spread between loan and deposit interest rates. There’s something else going on here. Is it simply risk pricing for lenders based on the weak financial capacity of borrowers?

August 17th, 2009 at 8:47 am