How the financial elite have dismantled the American middle class – top 1 percent share of wealth at levels not seen since the Great Depression. Goldman Sachs offering average bonuses of $430,000 while a record 43,200,000 Americans receive food stamps.

- 8 Comment

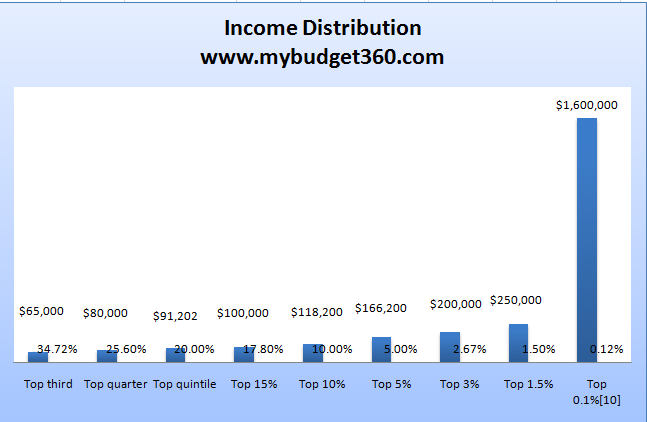

The U.S. economy is now operating like a finely tuned engine bent on dismantling the middle class and protecting the tiny elites in our nation that have learned to manipulate both political parties to their financial benefit. This did not occur over night but started in the 1970s when the U.S. government and investment banks juiced up the nation with deficit and debt spending. A single family cannot go into debt for a very long time without consequences but a rising housing market hid much of the inequality developing in our system for a very long time. It was an illusion of stability. The top 1 percent in our nation now control 43 percent of all financial wealth. These are levels not seen since the years before the Great Depression consumed the global economy. The fact of the matter is the top 1 percent has massively gained in real financial terms because of political maneuvering and selling out the middle class. Since these people protect their wealth through investment banks and tax breaks politicians have not dared touch these sacred cows or even asking banks to pay for their decades of personal irresponsible lending. In the end the elite have created a system where the working and middle class are paying for their own demise.

“(UK Guardian) A homeless encampment known as Tent City, in Sacramento, California, in 2009. Since the 1970s, real wages stopped growing and the gap between rich and poor expanded as the US economy slowed down after decades of growth. Photograph: Rich Pedroncelli/APâ€

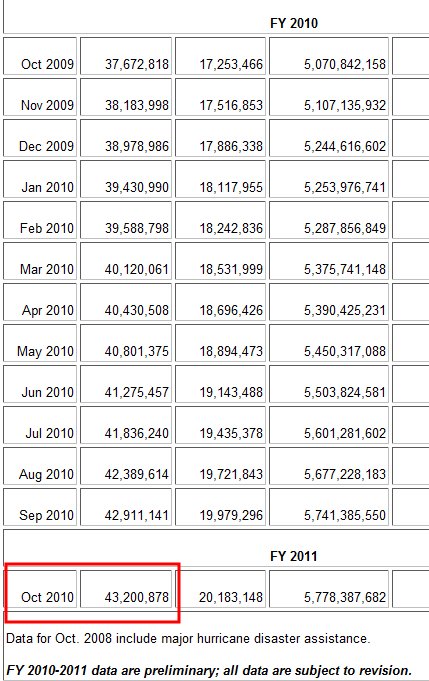

I find it disturbing that foreign news organizations are covering our financial reality better than local media outlets. This probably has to do with many large media outlets being controlled by the same Wall Street power brokers. This is no conspiracy story but a logical extension of money infiltrating and controlling politics, laws, and the trajectory of our economy moving forward. The above comes from the UK and shows a grim reality that many Americans do not want to face. Those that do face it are usually left voiceless (ironically the viral star Ted Williams was a homeless man with a golden voice). We have a very large problem with many people falling off of the economic radar. Tent cities are now a staple in many areas of the country and food banks are facing unprecedented demand for their services. Why is this occurring in the midst of a recovery? Well take a look at how many people now receive food assistance from the government:

Source:Â SNAP

The latest uninviting data shows 43,200,000 Americans receiving some form assistance, an all-time record that seems to be broken each month. This number has been moving up steadily for the entire decade. Many of these people are families that have been thrown off of the middle class track. With 1 out of 3 families with no retirement savings many people are one paycheck away from being homeless or being evicted, a fact confirmed by the record number of foreclosures in 2010. What is disturbing however is how many people are anesthetized by the mainstream media and somehow blame each other for these problems. Have they not noticed the record profits at investment banks? Did they miss the memo that Goldman Sachs, a bank that would not even be around without taxpayer support, is now going to give out bonuses that average $430,000? Did people forget that it took Wall Street years to create these financially destructive products to gamble away the wealth of average Americans and distribute it amongst themselves? While most working and middle class Americans operate in the rugged individualistic capitalism world of Social Darwinism many of the elite operate in a plutocracy model where they win no matter what outcome hits in the market. If they make a failed bet they can extort politicians and force their hands for bailouts.

“US employers took advantage of the changed situation: they stopped raising wages. When basic labour scarcity became labour excess, not only real wages, but eventually benefits, too, would stop rising. Over the last 30 years, the vast majority of US workers have, in fact, gotten poorer, when you sum up flat real wages, reduced benefits (pensions, medical insurance, etc), reduced public services and raised tax burdens. In economic terms, American “exceptionalism” began to die in the 1970s.â€

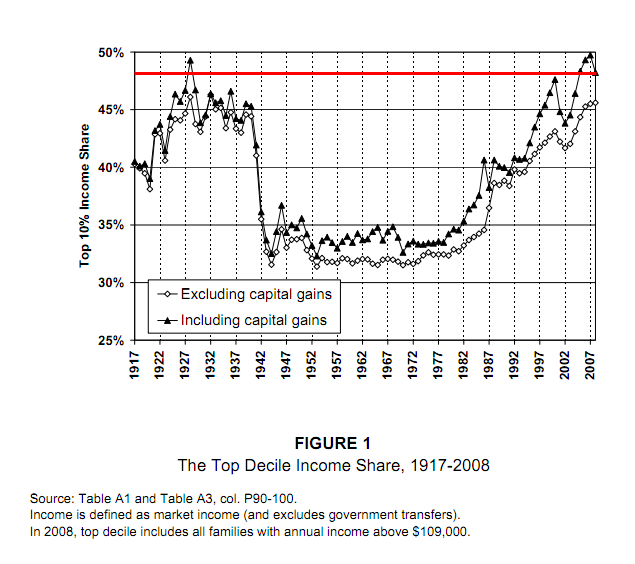

The disparity is obvious by examining the above chart. Income is now flowing to the top 10 percent in a way that it has not since the 1920s all the while middle class American have been increasing productivity and have actually added more family members to the workforce merely to stay afloat. Half of all American workers make $25,000 a year or less. Wages have been stuck for over a decade and have gone virtually nowhere for a few decades in real terms. Yet these gains in productivity and favorable political climate have flowed one way:

“The rich, however, have got much richer since the 1970s, as every measure of US income and wealth inequality attests. The explanation is simple: while workers’ average real wages stayed flat, their productivity rose (the goods and services that an average hour’s labour provided to employers). More and better machines (including computers), better education, and harder and faster labour effort raised productivity since the 1970s. While workers delivered more and more value to employers, those employers paid workers no more. The employers reaped all the benefits of rising productivity: rising profits, rising salaries and bonuses to managers, rising dividends to shareholders, and rising payments to the professionals who serve employers (lawyers, architects, consultants, etc).â€

So even with the top 10 percent we see the inequality spike as we move up the chain. The narrative coming out of Wall Street is all of this was inevitable. That somehow the middle class disappearing is just the market working itself out. That is a blatant lie. If that were to be the case all big investment banks on Wall Street would be in the ash heap of history. That would be the market working things out. Instead, we have subsidized cronyism for the top 1 percent all at the expense of the working and middle class:

“Since the 1970s, most US workers postponed facing up to what capitalism had come to mean for them. They sent more family members to do more hours of paid labour, and they borrowed huge amounts. By exhausting themselves, stressing family life to the breaking point in many households, and by taking on unsustainable levels of debt, the US working class delayed the end of American exceptionalism – until the global crisis hit in 2007. By then, their buying power could no longer grow: rising unemployment kept wages flat, no more hours of work, nor more borrowing, were possible. Reckoning time had arrived. A US capitalism built on expanding mass consumption lost its foundation.â€

Average Americans need to wake up and get a handle on the situation. College tuition now is even outpacing inflation compared to other sectors so it is likely that fewer Americans will gain the knowledge base needed to combat these entrenched interests without going into massive debt at these institutions. Many would rather be fixated on a homeless man with a golden voice instead of looking at where all the real gold is in our economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!8 Comments on this post

Trackbacks

-

Hambone said:

As always, well written and well done. Funny, I talk to so many angry former repubs who have moved to the blame unions, blame government for all the woes of America. Unfortunately they just aren’t seeing that there is more than enough blame for all of us and that any resolution will require a shared pain from top to bottom…rather than simply destorying the middle.

January 20th, 2011 at 3:12 pm -

tom dee said:

There is just no way to know how bad the situation happens to be. The Federal Reserve as of yesterday is holding 5 trillion dollars of USA Treasury notes. The federal reserve has loaned at zero interest more than a trillion dollars and how much more is not known to the banks who then purchased USA Treasury notes. I suspect that those notes will never be paid off but the massive amount of money will be used to make loans. The federal reserve cries that it will lose financial freedom if they are audited. What other organization gets to refuse an audit. What other organization gets to make agreement with foreign organizations without anyone knowing what the agreement happens to be. The only hope we have it to get rid of central bankers who clearly have no nation to answer to. Our founding fathers almost to a man knew the danger of central bankers and they were opposed to having one.

The disaster in 2008 just did not happen but was caused by the very bankers who own the Federal reserve.January 20th, 2011 at 3:35 pm -

Bill Boyd said:

The major banks were subsidized by the government instead of being allowed to fail as the free market would dictate. So now you have banks that could not survive in the free market using tax payer funds to finance unprofitable endeavors. Our government does not have a revenue problem, they have a spending problem. If you would make a list of the ten stupidest ways to spend our tax payers money, you would find that the government has already implemented your ideas.

January 21st, 2011 at 8:38 am -

lyndon messer said:

Will not hear this from Tea Party, Rush Limbaugh, Dave Ramsey or any other Republican – 1789 France and 1917 Russia were in similar situations…..

January 21st, 2011 at 9:17 am -

JEHR said:

If you google “tent cities in US” and click on “images,” you will get 1,570,000 pictures of people living in tents!

January 21st, 2011 at 10:11 am -

keep it simple said:

How does that saying go?

When the pain of doing nothing becomes intolerable or much greater than the less pain of doing something, the rebellion will start by the masses.And from the charts above, it’s an obvious class war. Interestingly, the oppressed bottom 2/3’s don’t yet know they’ve been in a war perpetrated by the wealthy. When the cat gets out of the bag, the wealthy will get drawn and quartered. And rightly so!

January 21st, 2011 at 3:11 pm -

kennyg said:

IT’S LIKE WATCHING A TRAIN WRECK IN SLOWWW MOTION…….BUT YOUR ON THE TRAIN.

January 22nd, 2011 at 1:53 am -

John said:

More people than ever receiving food assistance?

The population of America has been growing too, so I’m not surprised..

January 22nd, 2011 at 5:28 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!