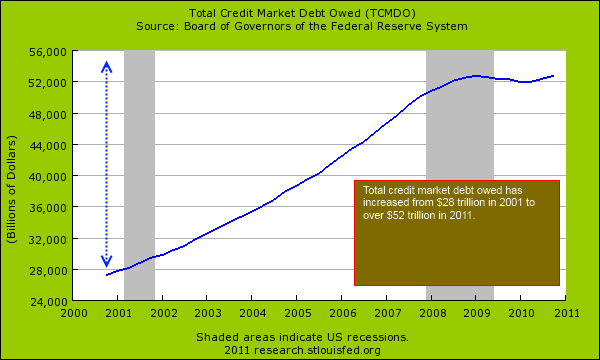

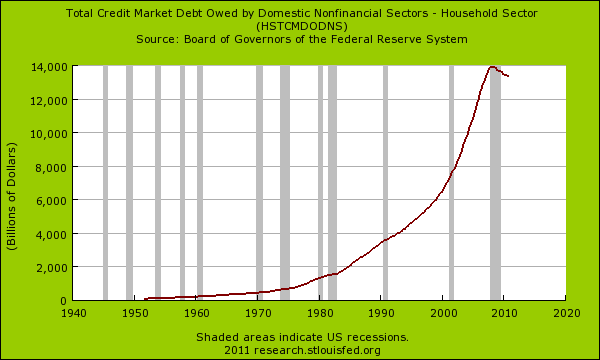

The financial tipping point of peak debt – Total credit market debt owed increased from $28 trillion in 2001 to over $52 trillion in 2011. Household debt contracting while Fed juices up the banking sector with more debt.

- 2 Comment

At the dark heart of our financial dilemma is debt. Too much debt was used to bolster households during the real estate bubble and now too much debt is being used by the government to bail out the financial sector. Is there a tipping point in the amount of debt the American economy can shoulder? I believe there is and looking at the data carefully we begin to see unusual patterns not seen in a generation. The mosaic of tools used for this financial crisis would have worked if the problems we faced were merely issues of confidence. Of course the problems were very real and dealt with more than just perception and instead of confronting the reality of an over leveraged debt addicted machine we have only stepped on the accelerator. Yet this time instead of credit flowing to households for added game rooms or a trip to Hawaii credit is being extended to Wall Street courtesy of the Federal Reserve. Total credit market debt owed jumped from $28 trillion in 2001 to over $52 trillion today. During this time GDP went from $10 trillion to $14 trillion. You do the math where the growth is occurring.

Peak debt

I find the above chart startling because it shows how heavily our society relies on debt. Atlas can only support so much even in a myth. There is no doubt that credit serves a very useful purpose in society. Yet when debt begins to over shadow actual GDP or serves as a substitute for income, then we have a serious problem on our hands. During the real estate bubble many families started to rely on their home equity as if it were normal for homes to throw off $50,000 or $100,000 a year in appreciation like some money tree. Households enjoyed this because wages went stagnant and surely pulling money from a home is easier than saving money for a rainy day and living within a budget. However all of it was a charade and American households are now paying the bill.

For the first time in record keeping history have we seen total household debt contract. Yet think of how flawed our system was when we had American households in debt to $14 trillion while annual GDP was at $14 trillion. Much of the debt was linked to homes, cars, and consumer spending that really didn’t create anything long term for our economy. All the while banks were enjoying the system taking their cut at every turn.

The two previous charts tell you the actual story of where things now stand. The American household has to deal with austerity and deep cuts while other parts of the economy are being bailed out with additional debt. As the easy access debt is withdrawn American households are now waking up from a slumber and realizing how much of their economy is now lost. Much of this can be seen with the hidden tax of inflation:

Source:Â dshort.com

It is helpful to keep in mind that the median household income since 2000 has not increased when looking at the above chart. What you will find above is not surprising and most Americans need only look at their monthly expenses to see this reality. The paycheck has shrunk like a cheap shirt thrown in the washer.  Energy has gone up by 115 percent since 2000 and the most visible translation of this is seen at the gas pump. College tuition and fees have gone up 101 percent and since manufacturing jobs have been outsourced in droves, a college degree is necessary for solid middle class careers.

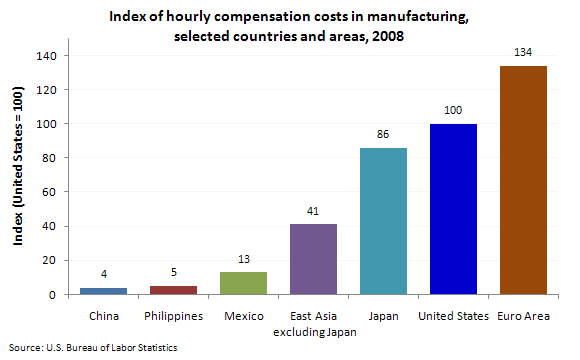

I found this chart fascinating in what awaits the new low wage capitalist world:

Source:Â BLS

The BLS uses the U.S. as a baseline here at 100. Manufacturing costs in the Euro Area are 34 percent higher than they are in the U.S. But more critical is how cheap it is to manufacture in places like China for example. It is 25 times cheaper to manufacture in China than it is in the U.S. Yet this brings up a question that Americans will have to contend with for years to come.  Do people want to enter into a race to the bottom or actually play on an equal playing field where mercantilist and currency manipulation are not practiced? I’m not even sure if Americans view this as the key issue.

The current rhetoric revolves around cutting government and not adding jobs. I think the above chart should give pause to anyone that is part of the working or middle class. Do you think bailed out banks have loyalty to you? Just look at what they have done to average Americans that helped them survive the actual financial collapse. They are kicking people out of homes in droves and raising fees on credit cards and slamming access to credit to small businesses. A small business owner has a hard time competing with systems that play on a very different level than we do here in this country. Banks are investing with your subsidized dollars abroad and blaming you for the current mess. I think this is twisted and it is troubling Americans are not debating this more openly.

As I have mentioned the top 1 percent owns over 42 percent of all financial wealth in this country. For this group the recovery is going well:

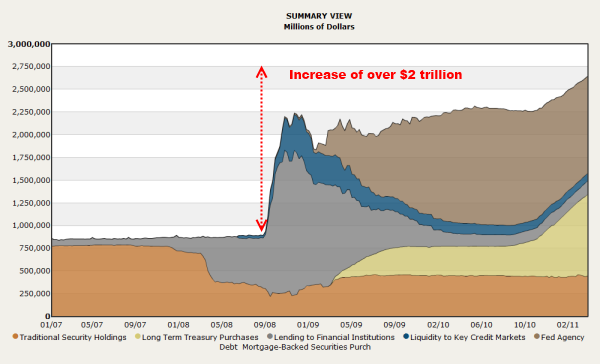

The stock market is up nearly 100 percent since the March 2009 lows. Yet households are still mired in debt, wage growth is non-existent, and there is little sense of protection of a stable middle class in America anymore. The market is still over burdened by too much debt and banks are still seeking out new and innovative ways to speculate and siphon out real wealth from the global economy. It would be one thing if they did this with their own money but they are doing it with the aid of the Federal Reserve. Make no mistake, the Fed has become a dumping ground for bad bets from banks over the last decade:

Now think if you had the power to move over your mortgage, credit card debt, student loans, and any other debt you had into a “bad bank†for the moment. Not only can you move this debt, you now have access to loans at near zero percent and can invest anywhere you want. Sounds like a good deal right? Well this is essentially the deal the financial sector is getting and why the stock market has recently boomed. Banks at their core should serve as the grease that makes the real economy go around. Today they are the economy and the government for that matter and the fact that the total credit market debt owed is $52 trillion is simply stunning.

Have we reached peak debt? The Fed doesn’t think so at least when it comes to the too big to fail banks but the American households looks like it has reached a tipping point. If nothing is done in the next few years your children will wake up in a country with no middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

JJT said:

During a class in my econ grad program the professor mentioned the idea of the marginal productivity of debt (peak debt/debt saturation) after prodding from a student. The professor discounted it as —- quackery. Of course. The exchange lasted less than a minute but was the most important moment in my education. I’m delighted to see you write of it.

http://www.financialsensearchive.com/editorials/fekete/2009/0330.html

April 25th, 2011 at 11:54 pm -

Cory said:

This debt crisis is closely related to the systemic implosion of state capitalism derived from the over-accumulation crisis. This is the tendency for (state) capitalism to build up tremendous productive capacity that outruns the population’s capacity to consume, owing to social inequalities that limit popular purchasing power or other declines in demand. Profitability is thus eroded. this period of high growth came to an end in the mid-1970s, when the center economies were seized by stagflation, meaning the coexistence of low growth with high inflation, which was not supposed to happen under neoclassical economics.

Stagflation, however, was but a symptom of a deeper cause: The reconstruction of Germany and Japan and the rapid growth of industrializing economies like Brazil, Taiwan, and South Korea added tremendous new productive capacity and increased global competition, while social inequalities within countries and between countries worldwide limited the growth of purchasing power and demand, thus eroding profitability. This was aggravated by the massive oil price rises of the ’70s.

Capital tried three escape routes from the conundrum of overproduction: neoliberal restructuring, globalization, and financialization.

June 27th, 2012 at 9:09 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!