Fiscal Situation of 50 States: Combined Budget Gaps Estimated at $350 Billon for 2010 and 2011.

- 17 Comment

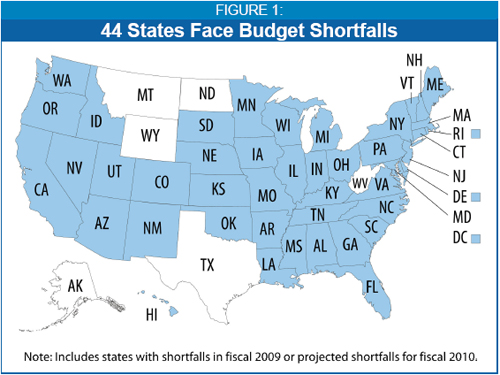

It is simply stunning that 44 states are facing shortfalls either for this fiscal year, or will come up short in 2010 or 2011. This puts virtually the entire country in a difficult financial situation. It is hard to understand how the media feels that the federal government is somehow better able to get money from people than states. The federal government’s largest income source is the federal income tax; yet this is income from employees in those same states were fiscal problems are running deep. The government is also going to have a challenging time taxing someone with no job right?

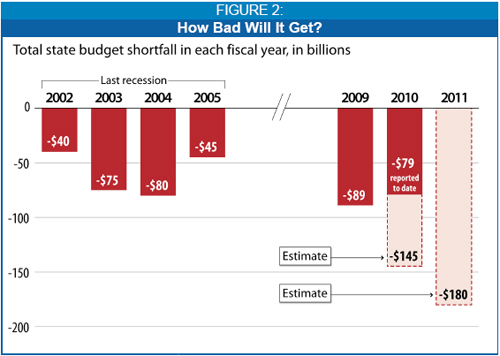

The combined budget gaps for the remainder of this fiscal year and then those of 2010 and 2011 are a stunning $350 billion. This number is simply jaw dropping and Wednesday’s horrific retail sales numbers tell us that this recession is already going to be the worst since World War II and possibly since the Great Depression. First, let us take a look at the situation on a map:

Source:Â Center on Budget and Policy PrioritiesÂ

You’ll notice that the only state with a sizable population without a budget shortfall is Texas. The rest of the country is virtually in the same predicament. You also need to remember that many states project these figures. That is, many are probably too optimistic in their assessments. The retail numbers that came out today tell us that many states are going to be dealing with a horrible budget situation. That is why in the upcoming fiscal stimulus package there is a large portion dedicated to state relief.

Looking at the data, it looks like many states are just too optimistic and are betting on the 2nd half recovery which will not happen. This crisis runs deep and the actions taken by the Federal Reserve and U.S. Treasury put our U.S. dollar at risk. If there is a run on the dollar, it will leave us as a nation with very few options. State and local governments stand to receive $160 billion in federal aid with the new stimulus plan. But you have to ask where is this money coming from? Printing money.

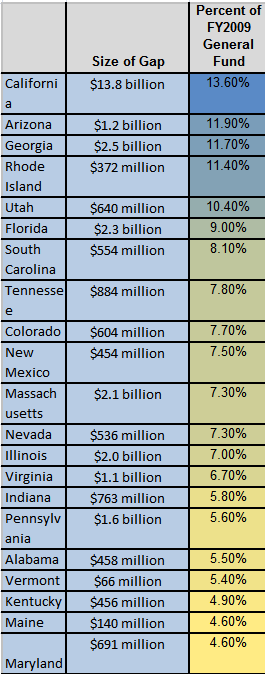

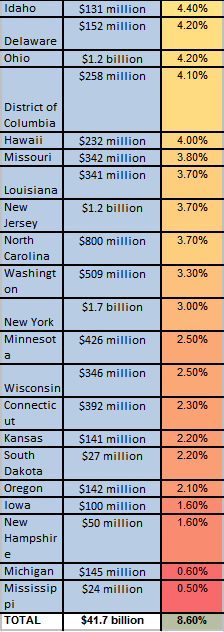

I’ve combined the state data into a list to make it more viewable. Let us break down the problems by state for the 2009 fiscal year:

First, 4 states with the most dire housing markets those of California, Arizona, Nevada, and Florida made the top 12 on the list. In fact, the number one state and most populace state in our nation California has the most troubling housing market in the nation that won’t see a bottom for many more years. Florida has a similar makeup to California in that it went down the path of toxic mortgages that are now going to be setting on new terms at the most dire time in our fragile economy.

Even should the states receive $160 billion from the historical stimulus plan, that will only address this current fiscal year. As analyst estimate, we are expecting additional fiscal shortfalls in 2010 and 2011 which will be on par or even worse than the current situation. Is the federal government prepared to do another major fiscal program when this occurs?

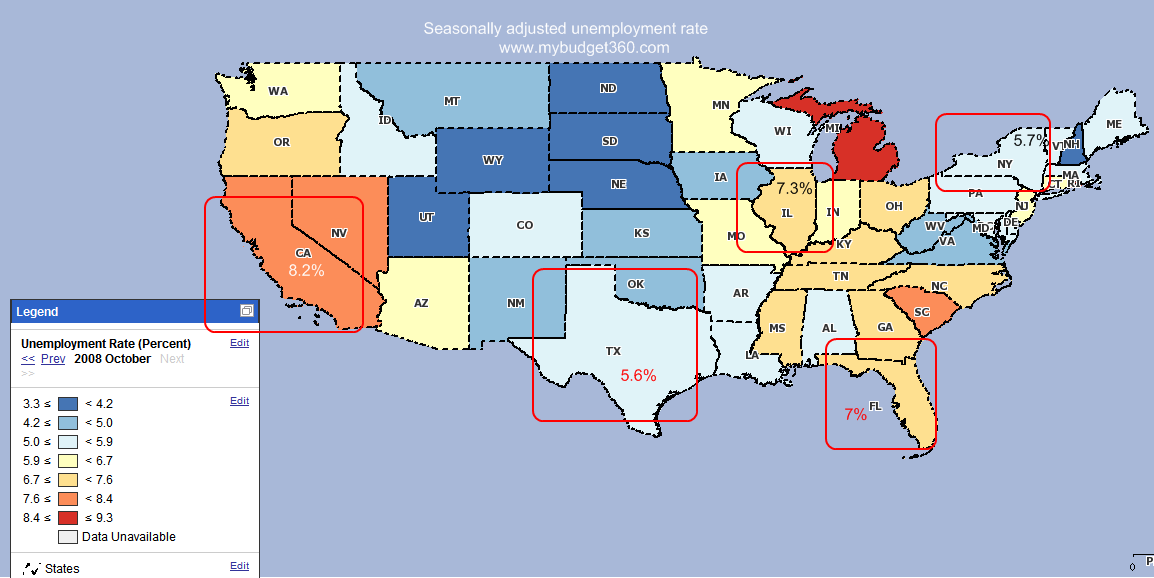

States with Highest GDP and Largest Population in Worst Shape

In a previous article I discussed that 40 percent of our country’s GDP comes from 5 states. Most of the population lives in these states as well but the important thing to note is that most of these states are also running with the deepest budget problems including California and Florida. Here is a look at employment situation in these states:

What people tend to forget is that these states have large consumers. So with retail sales falling off a cliff, how is this going to impact workers across state lines that ship merchandise to these locations? We are all connected. In fact, that is why $50 trillion in global wealth has evaporated since this financial crisis started.

Here are more estimates put out with the assumption that the economy improves in the second half of 2009:

Source:Â Center on Budget and Policy PrioritiesÂ

I really don’t see the stock market popping back up and we are now off 9% in only 6 sessions. This again reinforces the notion that market volatility is supremely high in unhealthy markets. Until market volatility stabilizes, we can expect more of the same. Keep in mind that many states rely on state income taxes which many people are gearing up for in the next few months and states are going to find the following:

(a)Â Drop in personal state income tax revenues

(b)Â Capital gains falling off a cliff

(c)Â Continued weak sales revenue

This is going to stun states on the downside. Expect states to have a fuller picture by the end of April. In addition, many states are already exhausting unemployment insurance so instead of money coming in, it is going out. This is a recipe for a long and prolonged recession which will be more like a minor depression.

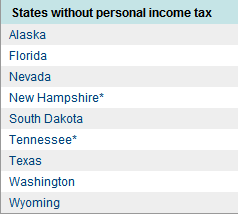

State Income Taxes

Some states have no personal income tax which on a plus side draws more employers but also puts a noose on services for their population. In challenging times these states have fewer revenue sources to draw upon. Here is a list of those states with no personal income tax:

*Source:Â CNN Money

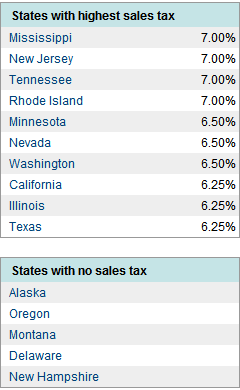

Then you have states with high sales taxes and these states normally bet on good times always remaining. These states will face major gaps as we now see that retail sales falling for 6 straight months and by big drops is going to choke off another revenue stream:

So here you’ll see a state like Texas with no personal income tax but a relatively high sales tax. With retail sales faltering even more resilient states will start feeling the pinch.

The bottom line is the places to find money are running out. We will need to cut back as a nation. We simply have no choice. Sure the U.S. Treasury and Fed can run the printing presses but this will do little good. The fiscal situation of most 50 states are deeply troubling. The aggregate of the 50 states is our country. You will need to prepare for a challenging few years. Simple things you can do is stay away from debt, think twice about common mainstream investing ideas, and save money. These are simple steps. Our government is still in that spending mode even though they are asking of you to be prudent.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!17 Comments on this post

Trackbacks

-

peter heinonen said:

get the CAFR ( comprehensive annual financial report) for each state with a supposed budget ‘shortfall’ and look in the investments section. there is no shortage.

January 15th, 2009 at 5:01 am -

linda said:

Interesting: Alaska has no personal income tax AND no sales tax and it’s one of the few states without a deficit? Wow, maybe we should elect Palin after all. Is that all attributable to oil?

January 15th, 2009 at 1:55 pm -

earl from texas said:

Maybe Texas should exercise its right to succeed from the rest of the nation.

January 15th, 2009 at 6:02 pm -

dave said:

Actually New York has the highest sales tax. It is 8.75% in Erie county, (Buffalo).

January 15th, 2009 at 7:06 pm -

Joyce said:

Yes. I’m not a crazy nutjob but maybe Texas secession is not a bad thought after all. It looks like liberalism has killed economies and I don’t want that virus to spread to Texas. Yes, I’d rather have Palin w/the funny accent and non-ivy league education as President then the “good speaker”…all those smart liberals, look what that great education did for you in California.

January 17th, 2009 at 2:09 am -

SB123 said:

I saw a color graphic 2 weeks ago showing that the bulk of the Bailout funds were going to 2 geographical areas (among other places): New York & San Francisco….which explains all the hatred towards Palin from the media.

Maybe in response to Act Blue, real Americans should Buy Red.

January 19th, 2009 at 4:39 pm -

RW said:

This is awesome. Thanks.

Having a deep interest in this I realize how difficult it is to put this together for all 50 states. So my critiques below are intended as helpful pointers to you.

RE: your numbers for Oregon and Washington.

A few framing points: Both Oregon and Washington have two-year budgets. This may effect numbers is some way. Here we tend to just view two years as a “fiscal year” more or less.

Here is a news article on Washington; it reports a $5.7 billion budget deficit in our new budget bi-annual. Your site shows only $509 million!

http://www.nwcn.com/business/stories/NW_020309WAB-state-budget-calculator-TP.1707dffc.html

Your site shows the $142 million deficit for Oregon. This article says the state economist says it’s going to grow by between $300 million to $600 million.

http://www.theworldlink.com/articles/2009/02/03/news/doc4988934c5cbac829917734.txt

February 4th, 2009 at 10:47 am -

Brodie said:

Just to clarify our sales tax in TX is actually 8.25%, not 6.25%, which apparently is “high” We just figure it in on anything we buy, (i.e: when buying a TV we think: it’s not $1000, it’s $1083)

From candy bars to televisions, it has worked out quite well for us plus the conservative base of being very employer friendly. Federal income tax is high enough, no one should have to pay a state income tax. It’s called budgeting well, and working with what you’ve got. Not throwing money down the hole (cough, California, cough).

We also have a sizable population as well as a sizable unemployed & uninsured population.North Texas in particular is slooowly feelings the effects of the recession (it’s not a depression and not anywhere near the Great Depression), but I still see people spending a lot of money. Especially when those refund checks come in!

March 28th, 2009 at 9:04 pm -

toyotawhizguy said:

dave said: “Actually New York has the highest sales tax. It is 8.75% in Erie county, (Buffalo).”

The “States with Highest Sales Tax” chart does not include any city /local /county sales taxes. New York State sales tax is only 4.00%. The other 4.75% is levied by your county.

October 16th, 2009 at 5:47 am -

Fitzcard said:

@ Brodie, Tx state sales tax is 6.25, however local government may tack on a 2% sales tax of it’s own if it’s voters want. Making it a total of 8.25%.

January 18th, 2010 at 3:40 pm -

Anita said:

Just wanted to let you know that the sales tax in Washington State is not %6.5 it is %9.5 that is a big difference! We are also getting hit with more taxes because they just gutted I-960 which required a 2/3 majority to pass more taxes. They voted against the will of the people. We have voted it in 3 times and they do away with it every time. Washington state is a mess. We are also running a much higher deficit than 509 million. I know that these numbers were from 2009. I wish I could find a list of what all the numbers are now in 2010.

March 11th, 2010 at 2:30 pm -

john said:

I think that everyone is missing the point. It doesnt matter if your tax is 6.25 or 8.25. What matters is that we have a bunch of idiots running OUR country and we are letting them run it into the ground. WE THE PEOPLE NEED TO STAND UP AND MAKE OUR VOICE HEARD. This is not a Obama problem. It is every politician who has sat in office for the last 10-15 years. We need to make changes in the government and the people need to be in charge of the change. They are getting away with basically murder and we just watch them do it.

July 3rd, 2010 at 12:10 am -

cabdriver said:

“Alaska has no personal income tax AND no sales tax and it’s one of the few states without a deficit? Wow, maybe we should elect Palin after all. Is that all attributable to oil?”

Mostly.

Alaska has a dividend economy, from the oil reserves. Every resident of the state receives a check for more than $1000, every year.

http://en.wikipedia.org/wiki/Alaska_Permanent_Fund

Some people would call that “socialism.”

There’s also the fact that Alaska, the largest state in the Union in terms of geography (as large as Texas and California combined) has only about 600,000 people residing there. If the oil dividend had to be split between 6 million people, it wouldn’t be nearly as much of a help to the local economy.

July 6th, 2010 at 8:27 pm -

cabdriver said:

So many people want California to fall- even though it’s one of the states that reliably generates more revenue for the Federal government than it takes- about 4 dollars into the Federal treasury for every 3 received.

Despite our economic stresses and strains, you poorfaces still haven’t managed to wipe off our grins.

Money ain’t everything.

Take it easy…

July 6th, 2010 at 9:03 pm -

Frank said:

Actually New York STATE sales tax in 4%. The higher sales tax is attributed to County/City taxes and many counties have that added to the State Sales tax

December 21st, 2010 at 8:18 am -

Julie said:

Please let Texas out on its own!! I am sick of hearing about it!! They will NEVER survive without all the Federal funding/ $$$$ they get from the gov’t. Stupid, stupid people…

March 5th, 2011 at 9:29 am -

butch howarth said:

cutting corporate taxes will put a burden on the working man. after we cut them to 0%,then what ? give them tax $. corporate wellfare is good ,but welfare for the working man is bad? wake up . if you keep electing republicans you’ll be working for pennies.they have cut taxes for the rich and corp. and now tell us the’re broke. no kidding. next they will come after your s.s., unemployment compensation, minimum wage and workmans comp..the republicans want to break the unions. if they do you can turn the clock back to 1920 ,when you worked until you died. wake up morons.

March 8th, 2011 at 3:21 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!