Fiscal Stimulus: Does Government Investment help the Economy. Examining the Impact of Monetary and Fiscal Stimulus.

- 0 Comments

The economic difficulties facing our country have for the first time, made the Federal Reserve and U.S. Treasury seem powerless in regards to starting the economic engine once again. For nearly 100 years, the school of thought was that monetary policy was the driving force for everything. If inflation was picking up, all you needed to do was raise rates and it would slow the economy down. If the economy started slowing down dramatically like we are currently facing, all you needed to do was lower rates to add liquidity into the system.

The flaw with that thinking is that first, you assume government measures of inflation or economic activity are correct. First regarding inflation, we had a decade long asset bubble fueled by easy credit and the government completely missed out on this because of the way inflation is measured, they look at a data point called owner’s equivalent of rent. That is, how much would it cost to rent your current place? This missed many data points since homeownership came close to reaching 70 percent at the peak and many people had exotic loans which many times understated the actual price of the home cost by as much 50 percent. That is, you might have an adjustable rate mortgage paying $1,500 a month but the true 30-year fixed monthly cost would run you closer to $3,000.

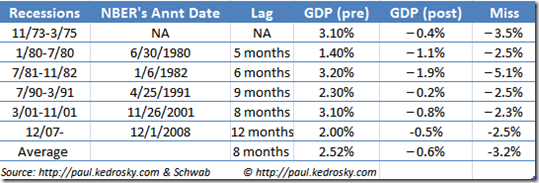

Second, the government was late to the game in calling the recession. First, many relied on the National Bureau of Economic Research to call the recession. They were 12 months late here:

As the above points out, the NBER isn’t exactly precise on calling recessions and frankly, their job is more of a historical one. We also had critics using the outdated model of calling a recession by looking at two negative quarters of GDP growth. Of course this didn’t happen because in the first half of 2008, the government sent out those stimulus checks which barely kept us in the positive. So by that measure, we weren’t technically in a recession. Yet those rebate checks were part of fiscal stimulus and you see how weak of an impact that had on the economy. And don’t think this was chump change. $167 billion and look how it helped our economy. When you have $49 trillion in combined debt, $167 billion is a drop in the bucket.

As I’ve argued before, the Federal Reserve and U.S. Treasury are determined to destroy the U.S. dollar. There policies are still clinging to a thought that believes monetary policy is the way to go. Only recently, have they opened up their rhetoric to support fiscal stimulus. After $8 trillion now committed to various bailouts, they are finally realizing that monetary policy is not the way. $8 trillion is 57% of our annual GDP.

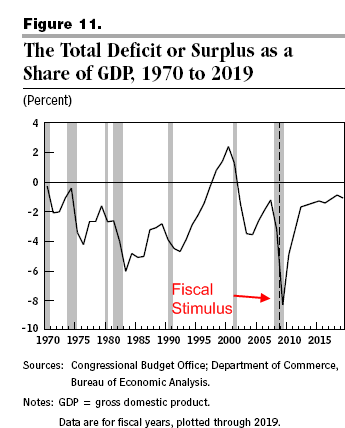

Yet this isn’t to say fiscal stimulus is the solution either. Think about how that tiny fiscal stimulus of $167 billion worked out. All it did was kept GDP slightly positive and spurred some consumer spending. In the scheme of things, this may be slightly better since at least those on main street get some more money instead of those on Wall Street but this did little to help the economic situation. The government is now proposing a nearly $1 trillion stimulus package. First, let us look at how large this really is:

This is going to push our total deficit close to 10 percent of our annual GDP. That is the largest amount since World War II. Think about that for one second. We are fighting this economic battle like the Axis Powers. The chart above is optimistic that this fiscal stimulus will be enough to boost the economy. Yet the real question is will it? If $8 trillion committed to bailouts with nearly $3 trillion shelled out hasn’t helped, why are we to expect that $1 trillion in fiscal stimulus is going to stop this recession?

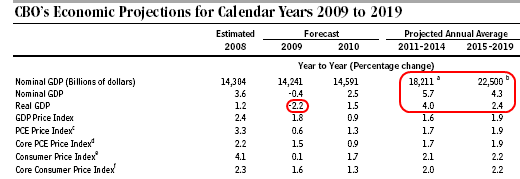

This argument tends to get politicized, one side favoring monetary policy and the other fiscal. I think most Americans favor something that works. We already know monetary policy doesn’t work because of corrupt and misguided plutocrats at the Federal Reserve. Yet the Congressional Budget Office may be too optimistic on how quickly we will be up to stable growth in our GDP:

I’m not faulting the CBO here since they are simply putting out their forecast. Yet why are we to think that things will already stabilize in 2010? Last year we saw that 2.5 million people lost their jobs and this trend doesn’t seem to be abating. The incoming administration is looking to add 3 million jobs which will simply replace those lost in 2008. Yet is that reason enough for growth? The fact of the matter is we are incredibly deep in debt. These historical actions tell us the government is at a point where this has to work.

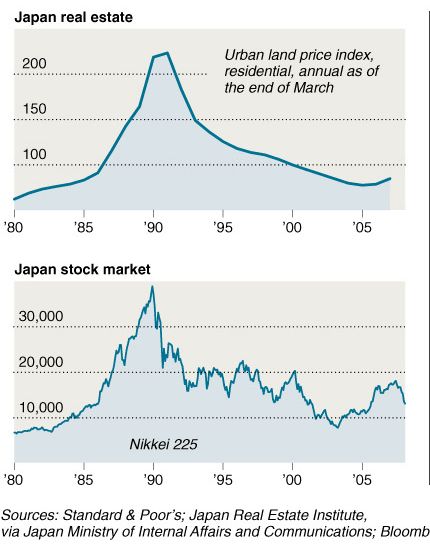

Yet if we look at places like Japan and their lost decade (two), they had a stagnant economy for nearly 2 decades. They followed the same path we are, monetary policy failed (Bank of Japan dropping rates to near zero), capital injections into banks, infrastructure programs, and all this happened on the back of a stock market and real estate bubble. Yet Japan is a saving country. We are a debt spending country. The only way we can keep going is if the world is willing to fund our spending. Now with the Federal Reserve and U.S. Treasury trying to destroy the dollar, why would you as a foreign country want to invest in something you knew was systematically trying to be de-valued? At a certain point, foreigners will stop because they either are broke or simply do not want to be put in a losing investment.

Take a look at Japan:

The bubble in Japan went full force from 1987 to 1990 and then popped. Keep in mind the above chart doesn’t show all the monetary and fiscal stimulus injected into the system when the bubble popped. Even with that, the stock market and real estate declined (is declining) since 1990. That is why I’m not as optimistic as the CBO that we’ll be back and running at full steam by 2010, certainly by 2011.

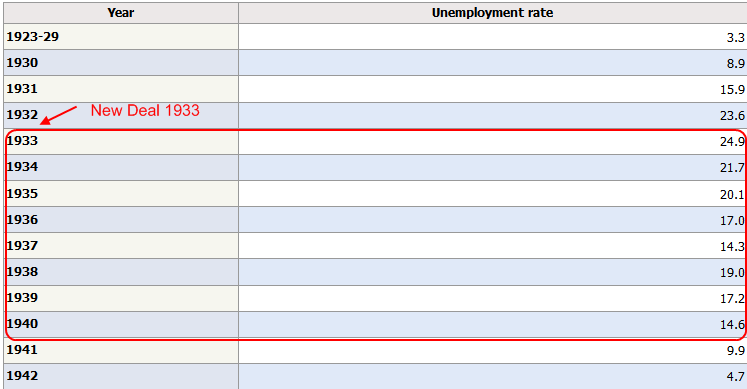

People are pointing to the Great Depression and the New Deal as example of fiscal stimulus pulling us out of economic funks. I’m not sure I agree 100% with this. There are good things that came out of this like the FDIC, Glass-Steagall, financial regulations, and programs to help the poor. Yet when I look at the data, it seems that fiscal stimulus only blunted the pain of any economic downturn for the average family instead of actually pulling an economy out of the dumps:

I think the average working person does not concern themselves with micro and macro economic forces, the Federal Reserve, or monetary policy. I can count on one hand how many times the Federal Reserve has been mentioned on mainstream television. Yet the unemployment rate is something the average American does feel. This hits home probably the hardest. The above chart highlights unemployment during the Great Depression. As you can see, even after the New Deal, unemployment stayed above 20 percent for 3 more years, and never dropped below 14 percent until we entered World War II.

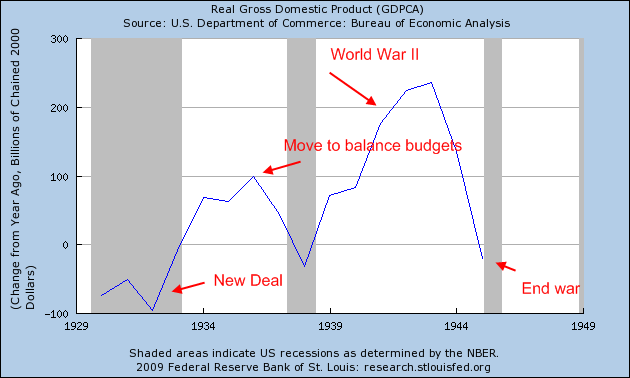

The dip in 1938 was a push to balance the budget which sent the nation back into recession. So it would seem, that fiscal stimulus was the only game in town for a very long time here. That is problematic. What we can agree on is the unemployment rate did improve. I’m sure many workers actually appreciated working instead of looking for handouts even if it was government work. Having a few bucks for food gave people a sense of dignity instead of soup lines. Yet the above doesn’t show that this spurred a sustainable economic model of growth. Yet we have to be fair as well since GDP did grow during this time:

So what are a few things we can learn from above? First, GDP did improve under the New Deal. Yet how much of the growth was based with government programs? A lot. In fact, the recession in the later 1930s showed how much. The government started cutting back and trying to balance its budget and you can see what happened. Next, World War II turned on the rocket burners for GDP. After the war, GDP slammed on the breaks.

We are in a tough spot. The danger we face is the major reliance on government for jobs in the upcoming years. Japan serves as a recent model of massive government intervention (with no major war). The Great Depression shows us that fiscal stimulus isn’t always a panacea. I think most Americans want a country that has sustainable growth, that values hard work/production, and has a future for our younger generations. Yet we have currently become a country that wants quick fixes. We have never seen a housing and credit bubble like the one we just had that has wiped off $50 trillion in wealth globally. To think that one year is going to change everything is naïve. We have spent beyond our means and the piper must be paid.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!