Following the Failed Japanese Economic Playbook: 10 Charts Comparing the Japanese Lost Decade to the United States.

- 2 Comment

Even as early as last year, anyone trying to compare the circumstances of the United States with the lost decade in Japan appeared to be out of line with mainstream economist and the media. Yet if this financial crisis has taught us anything, it is that the experts can be wrong by a wide margin. Given our recent economic circumstances, Japan style stagnation is looking more and more likely. Even the media is now using the phrase “zombie banks” in reference to banks that were kept artificially alive during the Japanese lost decade. Noble Prize-winning economist Paul Krugman had this to say recently in Beijing:

“(Telegraph) We’re doing half-measures that help the economy limp along without fully recovering, and we’re having measures that help the banks survive without really thriving. We’re doing what the Japanese did in the nineties.”

Mr Krugman said that the recent stress test results had bought the Obama administration some time, but that questions remained as to whether banks have enough capital to fulfill their role in the wider economy.”

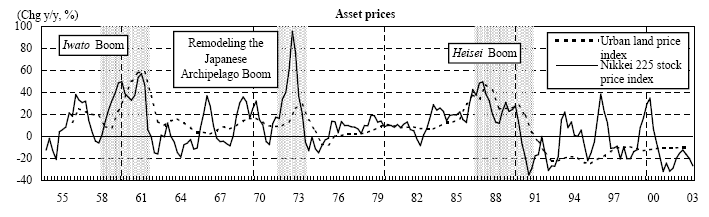

So why is Japan suddenly being used as a comparison? First, it is important to understand what happened in Japan in the first place. Japan like the U.S. has been fond of boom and bust markets. First, let us take a look at some of these bubbles:

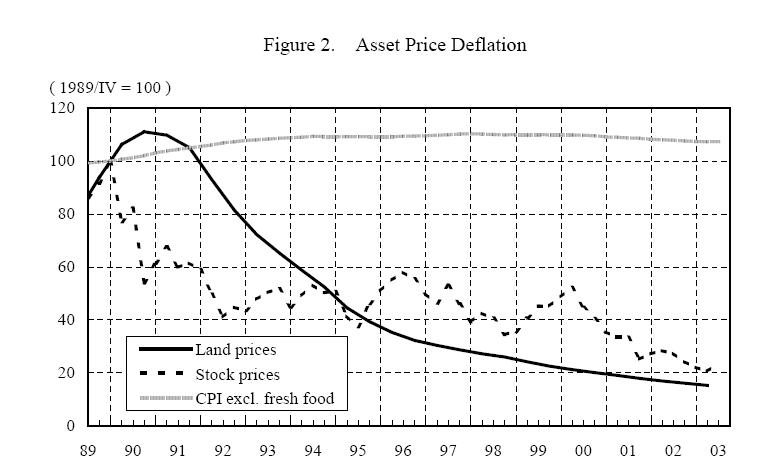

The 1980s witnessed an enormous boom for Japan. The Nikkei boomed and so did real estate. If anything, they had a double bubble just like we did with the 1990s technology bubble followed by the 2000s real estate bubble. Japan’s bubble was fueled by euphoria that current prices were justified because of future earnings potential but of course, the pace was completely unrelated to fundamentals and like all bubbles, burst. This is where we follow Japan down the same path. Japan’s banking system made enormous amounts of bad loans on over priced real estate. Instead of taking over banks temporarily, wiping out shareholders, giving bondholders a haircut, and finding a true value of the assets the government decided to zombify the banking system. That is, it didn’t take banks into receivership and take the painful short-term medicine but kept pumping money into them hoping that someday, they would come back. What occurred?

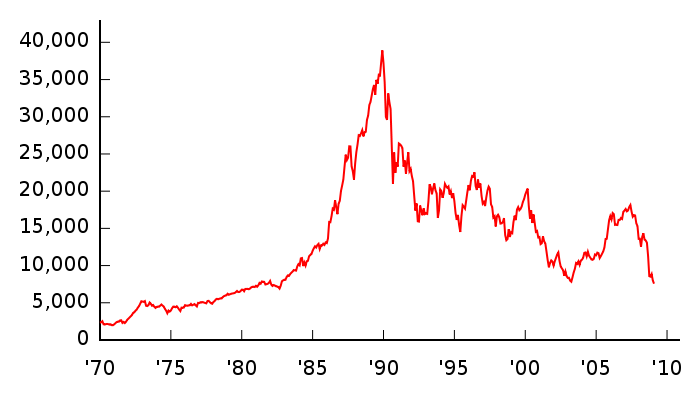

Two lost decades. As you can see from the chart above, both asset prices and stock prices have been steadily collapsing for nearly 20 years. The Nikkei peaked at 38,915 on December 29, 1989. Today it stands at 9,324, a drop of 76% over 20 years:

It is important to note that Japan not only injected money into their failing banking system, but spent trillions in fiscal stimulus. Of course, much of this was largely fueled by cheap money through dropping interest rates:

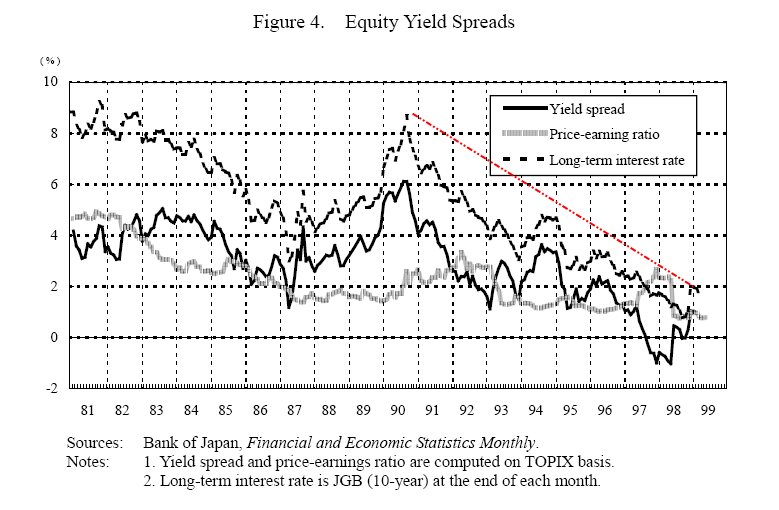

Japan took rates to zero and was the first country to experiment with quantitative easing which clearly did not work. That is why with all this market volatility, it is surprising to see the U.S. Treasury and Federal Reserve repeat the same mistakes. If you look at the above chart, and expand it out keeping rates low, it does not necessitate a healthy economy in the end. What it does is protects the elite of the banking system. And that is the irony, the overall banking sector has done horribly in Japan even with all the handouts but like our system, banking executives in Japan also did well during this time:

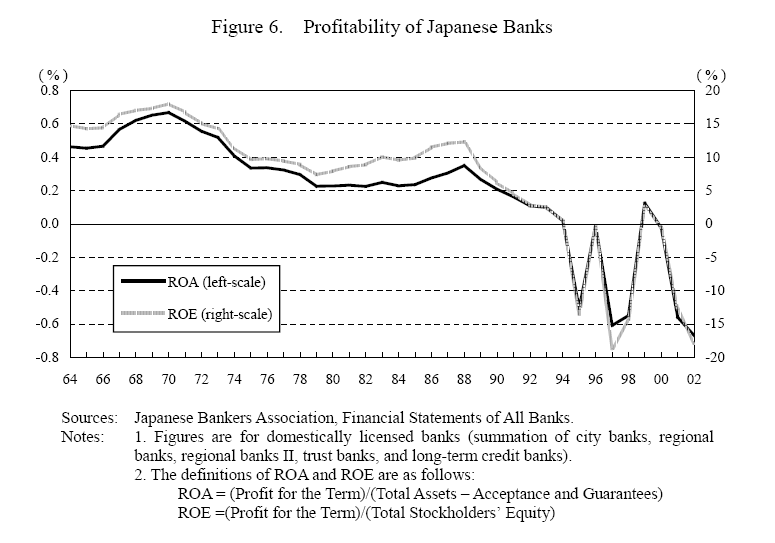

It is amazing that the S&P 500 ran up nearly 40% in two months given all the current news. First, we need to remember that nearly 25,000,000 Americans are either unemployed or underemployed. That is a significant drain to the health of our economy. And the recent optimism in the banking sector is completely unfounded. The American banking system by technical definition is insolvent. The only reason they are turning any kind of profit is because of artificial injections of money through massive bailouts. The current banking model is designed for high flying real estate and fast trading of toxic securities and derivatives. With that model shutting down, banks really have no sustainable model. Japan faced similar issues. That is why if you look at the above chart, for nearly 20 years Japanese banks have been struggling to find their footing. Aside from the current misplaced optimism, banks are still in horrible shape. What has occurred is our current policy is right out of Japan’s playbook. If history is any guide, let us count the similarities:

(1)Â Stock market bubble – pops

(2)Â Real estate bubble – pops

(3)Â Massive injections of capital into banks – no nationalization

(4)Â Enormous fiscal stimulus

(5)Â Banks keep toxic assets on books

(6)Â Record low interest rates – can’t go lower than 0 can you?

The parallels are unmistakable. Another important similarity is giving money to banks does not mean they will lend:

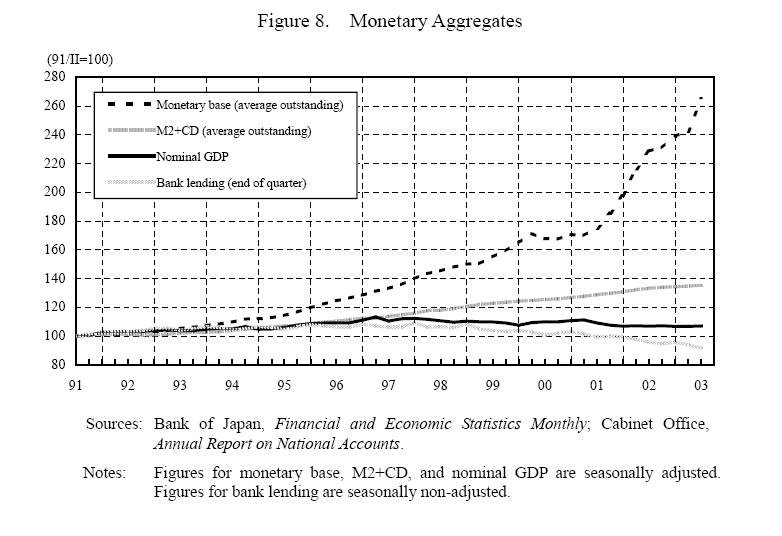

This chart sums it up. There is an increase in M2 yet bank lending steadily declines for over a decade. Of course, the Japanese banking officials came out to the public stating that injecting capital into banks would cause lending but the above proves otherwise. And this is happening in the U.S.:

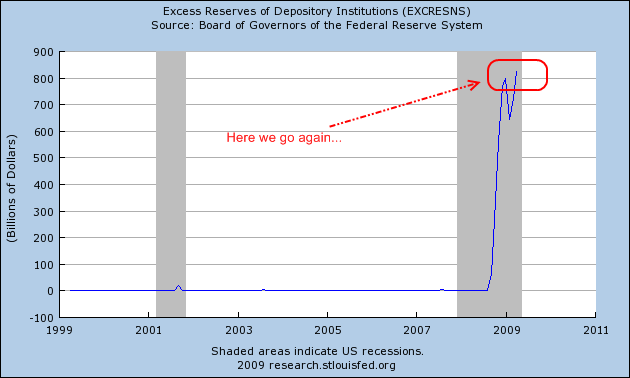

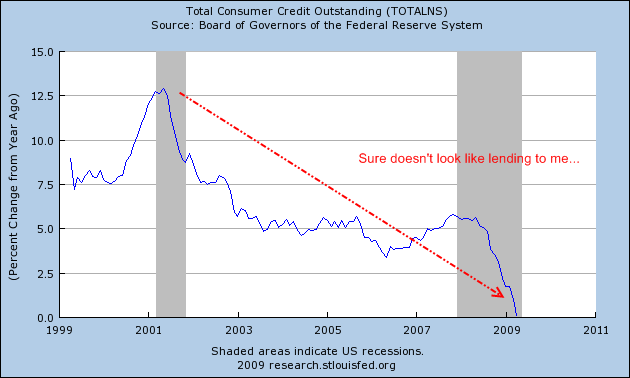

We can take the above chart to the 1950s and you will not see banks holding any excess reserves that will show up on the chart. All of a sudden the chart pops, banks are hoarding money. Why? They are flat broke! You would think that with trillions injected into banks, they would start lending to the public. Well if we just look at Japan, we already know that lending is not going to happen:

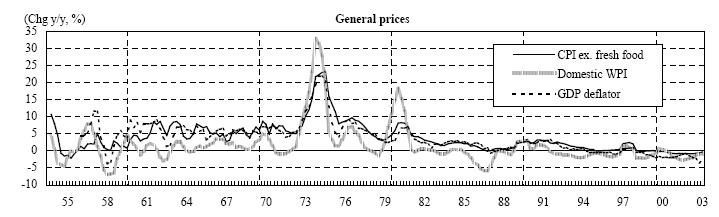

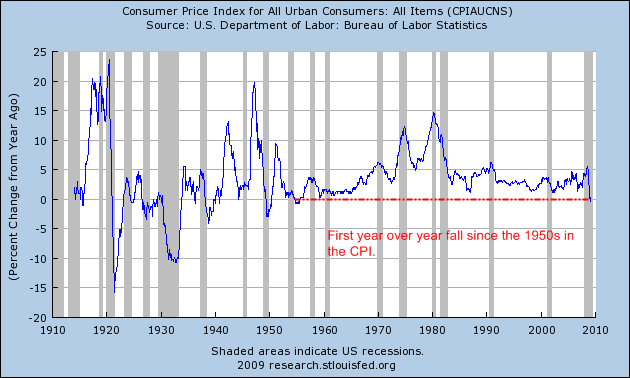

What is occurring is failed banks are being subsidized by the taxpayer. The bailouts will stagnate our economy for at least a decade while we keep feeding the Hungry, Hungry Hippo banks. Oh, and another thing that I forgot is we are seeing a fall in general prices:

Exhibit A:Â Japan

Exhibit B:Â U.S.

Now we are looking at the prospect of deflation. Looking at this data and reasons it seems like we are doing everything Japan did. I saw someone argue that the Japanese had more savings and that is the difference. Well, yes. In fact, that only makes it worse for us since we have less of a buffer.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

factsnews said:

Another awesome article! Were on the same path as Japan. Do you think our government doesn’t know this? It seems like they are leading us on a path to self-destruction. Please visit my website for more details.

PS- I almost put 2+2=5!

May 13th, 2009 at 2:35 pm -

Inflation said:

While I agree that we are staring deflation in the face I do believe that the FED will stop at nothing to try and prevent that. Eventually there will be so much money thrown at this that there will be nowhere for prices to go but up.

May 15th, 2009 at 2:24 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!