Foreclosure Decision Tree Analysis: Thought Process of Many in Foreclosure.

- 0 Comments

One of the most stressful events in life has to be losing a home. Not losing a home through a disaster but losing it through a foreclosure. The foreclosure process is a long drawn out drama that can put undue stress on a family’s financial bottom line. Home to most people means a place over your head and a place to set your roots. Only until this past decade did as a nation, did we collectively get caught up in transforming a home into a speculative commodity. Sure, we’ve had previous real estate bubbles in Florida, Boston, Los Angeles, or even Tokyo but nothing on a global scale like the one we are currently living in.

Foreclosure unlike many stressful events in life happens usually with the person facing the future foreclosure knowing fully that problems will happen much before the event itself. That is, it is a planned event although most people do not want it to occur. Usually the event unfolds due to the following reasons:

(a)Â Income loss

(b)Â Health issues

(c)Â Marital separation

(d)Â Intentional foreclosure

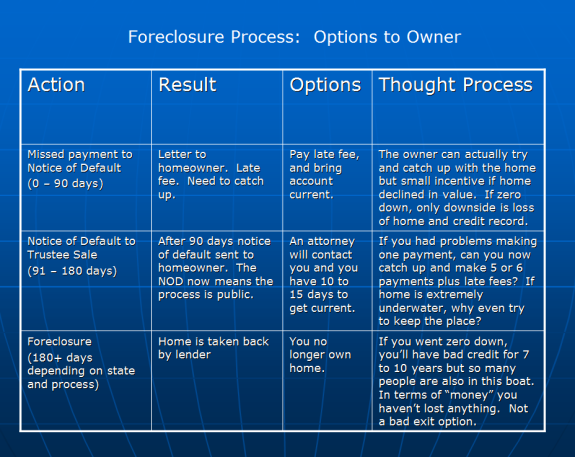

The first three options are usually the typical historical reasons for people to lose their home via foreclosure. The last option, that of the intentional foreclosure was an extreme rarity. Intentional foreclosure is losing a home on purpose. To give you a quick overview of a foreclosure, I put together a quick chart:

The entire process can last anywhere from 180 to 270 days. Currently, the process may last longer given the saturation that lenders are facing. The point should be made that foreclosure doesn’t happen instantaneously. Through the process, it is important to understand the decision tree analysis that many owners go through while facing the process.

Given the current housing climate, the first psychological response is one of denial. That is, “many homes are going down but I’m not one of them.” This is hard to combat. Yet given that the majority of homes did decline in this year it is highly likely that your home did fall in value somewhat. This is hard to reconcile in a time where we haven’t seen national median prices decline on a year over year basis since the Great Depression.

The first problems are noticed by the lenders when the owner misses their first payment. Yet the owner may know full well much before this time. Did a job loss occur? Is the home so underwater that they have consciously decided to stop making payments? Is the home set for a mortgage reset that will make the payment unsupportable? All these things play into the process.

At the point of the first missed payment, the owner will receive a letter from the lender. Normally, there is a minor late fee assessed to the payment. In the past, many homeowners that went in over their head had the ultimate option of simply putting their home on the market and unloading the property usually with a slight gain. That option for most Americans is now off the table. The owner thinks, “there is no point selling since I am underwater.” The owner can talk with the lender about a loan modification or a short sale but this will have to be an agreement that is beneficial to both. And the reason there has been such small progress in this area is the deal is rarely beneficial to both.

Let us run through a quick scenario for a home here in California:

Home Purchase price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $500,000

Current appraised value:Â Â Â Â $350,000

80/20 mortgage:

1st mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $400,000

2nd mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $100,000

Let us assume further that the first mortgage is an adjustable rate option mortgage. There are many in the state. It is safe to say that if the 2nd mortgage is held by a different lender from the 1st mortgage, that there will be no short sale. Why? Well a short sale would yield 0 for the second mortgage holder. There is no point going down this path. If anything, they would rather take their chances through a foreclosure. A loan modification would be near impossible assuming there is little incentive for the second note holder.

So as you can see, the process comes to a halt and the entire process above needs to unwind. As a homeowner, your thought process is “I am now underwater by $150,000 so why keep making payments.” In fact, with many of these loans the payment is actually going to go up and your home is going down. Talk about getting pulled from both sides.

Given that many buyers went with very little to no money down, the only real consequence here is bad credit for 7 to 10 years. Many in states like California speculated on homes and never really saw the home as a place to set roots but more as a commodity to be flipped in a few years.

That is why may of the lender and the government models are flawed. They don’t take into account that many homeowners have actually already allowed their homes to foreclose in their minds much before the actual process.  The only incentive for them to keep up with their payments is home appreciation which is not going to happen.  The major incentive is removed and there is very little collateral in terms of a down payment.  That is why down payments are so important. If you had to save 1 or 2 years diligently for a home, you’d be much more apt to fight for your home.  Studies show that having a negative equity position actually increases the chances of foreclosure.

The major reason for keeping homeowners put is really something out of the hands of the government or lenders.  You cannot mandate appreciation. This is doubly true when we just had a once in a generation housing bubble.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!