The four horsemen of the middle class apocalypse – what does it say that we as a nation bailed out the financially wealthy too big to fail banks yet failed to bail out the middle class?

- 9 Comment

What made the U.S. the envy of the world was the belief that if you worked hard enough and had the right kind of grit and intelligence that you would be able to enjoy the fruits of your labor. This is what built the solid middle class after World War II. The majority of people finally had the chance to purchase a home without going into dramatic debt, to send a child to a quality public schools, and for the most part enjoy in the rising quality of life for most Americans. The last category has been lost in the last few decades. While incomes for the bottom 80 percent of Americans have gone stagnant income growth for those in the top 1 percent has skyrocketed. The tools and amount of capital needed to prosper are largely out of the reach of the middle class and only the modern day oligarchy can afford to send their kids to $50,000 a year private schools without sweating it. Does the public have at the top of their priority list a desire to keep the middle class solvent? We bailed out the too big to fail banks under the premise that they were instrumental for our economy but the same has not been offered to the middle class. Why is that?

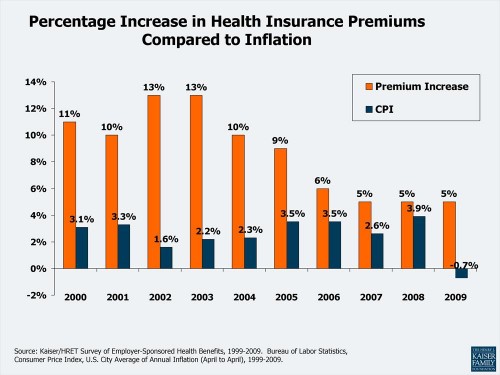

Horseman #1 – Rising healthcare costs

Source:Â Kaiser Family

The cost of healthcare is far outstripping the rate of overall inflation. This is not exactly a recipe for success with 75 million baby boomers entering retirement. The fact that we spend more per capita on human wellbeing than any nation in the world yet produce poorer results than other industrialized nations should tell us something about our system. The rhetoric coming from D.C. and Wall Street is troubling because it once again only protects the small group of people that have amassed most of the wealth in the country. The rest of America is left to fend for itself or continue to payout larger and larger premiums with really no equal rise in quality.

The per capita annual income in the United States is $25,000. How much can someone at this level afford in terms of health coverage? Not much to be honest. According to a recent Census study the number of Americans without health insurance is up to over 45,000,000+. I’m certain that number is now higher given that the study was conducted at the beginning of the recession.

Horseman #2 – Cost of college

Source:Â BusinessWeek

The rising cost of college and lack of income growth has pushed many students into massive amounts of debt. Many older Americans like to talk about the days when they went to college and paid for their schooling with a part-time job. No part-time job is going to pay for $50,000 a year in tuition (or even $20,000 at many public schools) when the average per capita income is $25,000:

Since 2000, in real terms college costs are now up by 23%

Since 2000, in real terms real pay for college graduates is down by 11%

This I find extremely troubling. While the cost of going to college has risen by 23 percent over the last decade actual real pay for college graduates has fallen by 11 percent. Can it be that higher education itself is in a bubble? This is very likely.

Education is vital to having a vibrant and competitive middle class. Yet Wall Street has allowed the banking system once again to turn this institution into a commodity meant to be traded and raided. This is why we have many paper-mill institutions predatorily going after students and condemning them to lives of debt serfdom with a worthless piece of paper. The working class is shrinking faster and faster as most of our manufacturing is outsourced so many are forced into becoming educated or face low pay service sector work. In a debt based society many of these people simply go back to school thinking they will pick up a skill in a new “hot†job field. Many simply come out with degrees and debt that put them into a deeper hole. Many would have been better off going to a community college or trade school but many of these for-profit schools get to students first before they can go to these more affordable options (at least for now as states hemorrhage funding).

If we really value educating the population and having an intelligent middle class, then why allow this banking and government backed circus to continue?

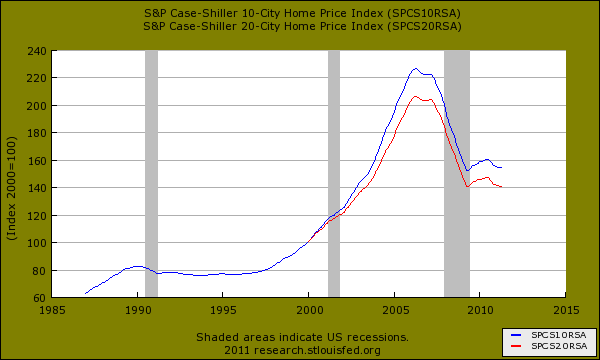

Horseman #3 – Price and volatility of housing

With all the volatility around in the world Americans at least were able to count on housing as a safe investment. That was before investment banks got their hands on the mortgage backed securities market and turned it into another wild casino with the aid of the both political parties. Nationwide since the Great Depression in the 1930s home prices in the United States never saw an annual price decline. So something seriously went wrong when home prices today are now down by over 30 percent from their peak levels reached half a decade ago!

A home suddenly turned into a commodity that could be traded on or even used as another credit card. Maybe it could be used to compound the problem by taking a HELOC to go to one of those paper-mill colleges. What a mess and that is why having a strong consumer protection agency was so important but what we are getting is a stripped down shell. While there are tens of thousands of lobbyists protecting investment banks, where is the protection for the middle class? Of course the oligarchs will say that a hands off approach is necessary and who really wants a nanny state? Of course that is what they say but these are the people with the most protection and support from the government.

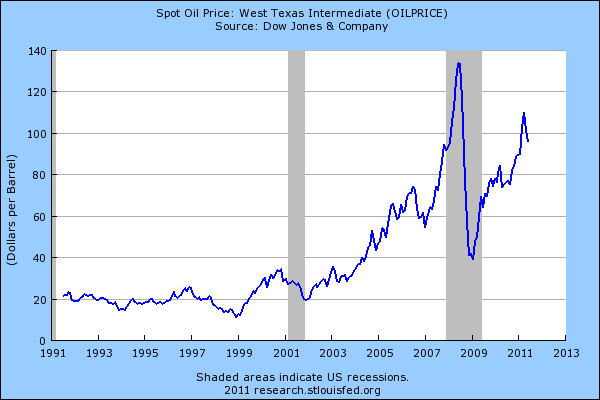

Horseman #4 – Fuel and energy

Finally the last horseman of the middle class apocalypse is energy costs. Our nation is built on a cheap energy model. It has a hard time sustaining solid growth once it goes over $30 a barrel. We use petrol in our plastics, fertilizers, cars, planes, and so many other things that once the price goes up the entire chain changes. Now look at the above chart. In 2000 the cost of a barrel of oil was $27 while today it is closer to $100 (more than tripled in this last decade). Yet incomes and according to government data, inflation has been rather quite over this time. The cost of college and healthcare has gone up even faster.

This is the new world we are living in. There is little desire or regard for the middle class from the oligarch machine. A big portion of their wealth is derived from robbing the lower classes (i.e., gambling on housing, swindling people into worthless paper, and charging people outrageous amounts of money for medicine that may or may not produce statistically different results). They also have convinced many that they are simply temporarily embarrassed millionaires waiting for their turn to get rich quick if only the government got their hands off their money (of course 1 out of 3 Americans has zero dollars saved up). We are living in a time where the middle class is being asked to cut back to bail out the banking machine of Wall Street while at the same time being asked to tighten its belts. Sure sounds like we are doing what is right for the middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

truthbetold said:

We the sheeple are toast if we continue to be complicit with this gutting that we are taking without so much as a baaaaaah

July 22nd, 2011 at 7:07 am -

Ken Brodeur said:

Solutions to the “Middle Class Apocalypse”

Kill the horseman by…

1. Negate healthcare costs by eating organic whole foods. Use a hospital ONLY for a surgeons expertise and doctors for advise. Make yourself familiar with Antoine Beachamp and holistic natural medicine. Hypocrites is attributed the saying, “let your food be your medicine and your medicine be your food”.

2. Educate yourself. We live in a most wondrous time. The internet IS the supreme college. Forget Harvard and short term profits, it is simply a reflection of usury, extortion and elitism. Research on the internet. Yearly average cost of education on the net, $400.

3, Stop paying your mortgage to banks. Especially if you are underwater. More and more lawsuits and lawyers are combining to take on the banks. Lawyers are starting to smell the scent of money and are seriously taking sides with the middle-class. Example, you have a $2000 monthly mortgage payment. Arrange for a retainer with a good lawyer for $1000 a month and join the fight against bank fraud. Net gain $1000 a month you can put into preparing to move should you loose the lawsuit and solid, non paper assets you retain on your property such as silver and gold.

4. Invest in alternate energy sources, such as solar, alternative fuels, such as alcohol burners and maybe even get a still. Join the fight to legalize hemp production in the US, it grows fast and everywhere in the world except the arctic regions and would be the perfect biofuel. Breaking the energy monopoly will be your most important and greatest effort but it can be accomplished. Go to step 2. for know-how.

Combined, these steps will bring the international financial elite to their knees and in line with the basic laws of the US constitution.

July 22nd, 2011 at 11:15 am -

Raj said:

The middle class is to blame for this by failing to vote out the people who do nothing for them and buying the sound bytes.

Politicians disunite the middle class by hot button issues and manipulate them.

The middle class has got fat, lazy and stupid when it comes to being informed about their well being and not realizing they are the teeneger given a credit card and no job increase.

Well the credit limit has been reached, after having the enriched the aristocracy (rich) , it’s time to pay the piper and guess who’s getting stuck with the bill?

It’s ironic that we laugh at poor countries where the poor are strong armed into voting for corrupt governments – and they are illiterate.

We have the freedom to vote for who we want, all our basic needs and information at our fingertips… and yet still we allow ourselves to be manipulated into putting the very people in power who will stiff us in a heartbeat due to corporate contributions.

who are the stupid people? The ones in illiterate countries or us?

You decide.

July 23rd, 2011 at 9:58 pm -

Rusty Brown in Canada said:

“…should you loose the lawsuit…”

Absolutely amazing how many people don’t seem to know the difference between “loose” and “lose”!

July 24th, 2011 at 2:43 pm -

Bud Wood said:

Seems that Ken Brodeur has the right idea. I eat mostly organic food plus sea vegetables (seaweed) and vitamins, etc. Being older, I did strive 4 years (actually 5) of college which was pretty good. I am fortunate to have a small house with no mortgage.

My challenge is to get off the energy grid – – that may take some doing.In any event, each of us can have a better life when we cut the cord that binds us to the system. It’s somewhat difficult to do, but any journey starts with small steps. I’ve taken quite a few in the right direction. At least, I’ve totally exited from voting because democracy is the biggest problem.

July 24th, 2011 at 9:19 pm -

Alchemisteve said:

Do you think this is all a grand accident?

The four horsemen were loosed by design.

Why?

To reduce the middle class to the lumpenproletariat.

You should add to your list of solutions:

5. Attend Tea Party rallies and vote for their candidates

to return to Constitutional government.

6. Remember the 4 Gs: Gold, Guns, Groceries and God.

7. Educate your friends and family.July 25th, 2011 at 9:19 pm -

FrankBlank said:

@ raj who wrote

…we laugh at poor countries where the poor are strong armed into voting for corrupt governments – and they are illiterate.

We have the freedom to vote for who we want, all our basic needs and information at our fingertips… and yet still we allow ourselves to be manipulated into putting the very people in power who will stiff us in a heartbeat due to corporate contributions.

who are the stupid people? The ones in illiterate countries or us?

——————we are the same. Read Chinua Achebe, “Things Fall Apart” . It’s about Nigeria in the 60’s and pretty much applies to a lot of our situation now.

July 29th, 2011 at 5:51 pm -

Hillary said:

It is discouraging when we the people have to bare the expense of bailing out major banks while no one can help bail us out.

June 19th, 2012 at 8:49 am -

T said:

Learn to spell, will you? It’s BEAR the expense of….. NOT BARE the expense of….. When bare is used as a verb, it means to take your clothes off, or to expose something.

BEAR as a verb means to take on as a burden, such as ‘bear the expense of, OK?

Americans no longer know how to spell; and it MATTERS- it makes reading difficult otherwise.

July 8th, 2012 at 8:43 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!