The Future of U.S. Housing – Projections of Household Formation, Loan Modification Data, 500,000 Option ARMs Still Active, and a Decade of Stagnation.

- 6 Comment

Take what you knew about projecting housing for the last fifty years and throw it out the window. The big problem with using models post-World War II is that they base growth on a baby boomer population that was the largest affluent middle class cohort known to the world. That model is now disappearing. Some point back to the Great Depression but forget to mention that life expectancies in the first half of the 1900s weren’t that fantastic. So you had a population that was constantly churning and emptying out homes that many had paid down. Yet after World War II the Levittown model of housing took hold with suburban life being the driving force of future home building. When linked up to cheap oil and 30 year fixed mortgages this seemed to be a good balance for entry into the middle class. Those days are seemingly no longer here.

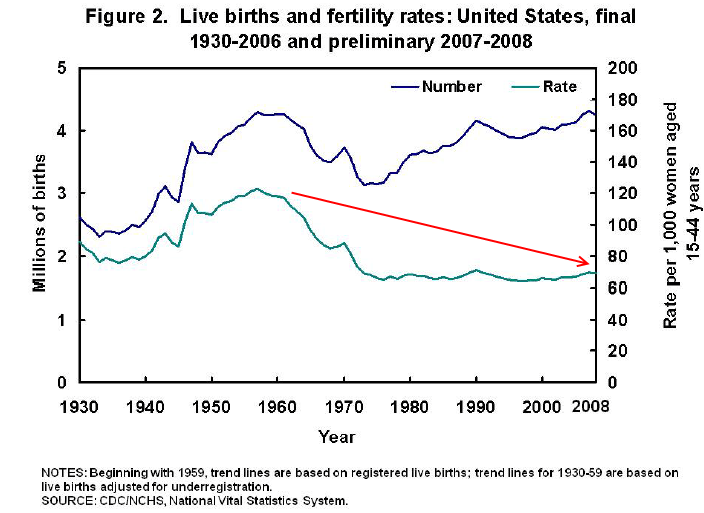

This isn’t to say that our best days are behind us. But if you base excellence on massive consumption, you will be hard pressed to adapt in the new world. For example, today our birth rate is near replacement levels:

One of the biggest pushes to buy a home was based on the “household formation†stages. But many Americans are now delaying this stage. Part of it has to do with shifting values but another cause is more practical. People don’t want to start a family in a horrible economy:

“(WaPo) That same survey found that women with low incomes were particularly likely to report postponing having a child. Nine percent of those earning less than $25,000 annually postponed having a child, while only 2 percent of those earning more than $75,000 did so.

“Certainly younger folks have the ‘luxury’ of delaying their childbearing in an attempt to hold out for better economic conditions, while older people may feel the press of the biological clock prevents too much of a delay,” said Gretchen Livingston, a senior researcher at Pew.â€

This is understandable. But another more hidden reason has to do with the near religious idea that housing is always a great investment. You have an entirely new generation of Americans who will never believe the hollow mantra that real estate only goes up. There have even been articles talking about the new American Dream revolving around renting. Times and motivations change.

Is There Such a Thing as Too Much Homeownership?

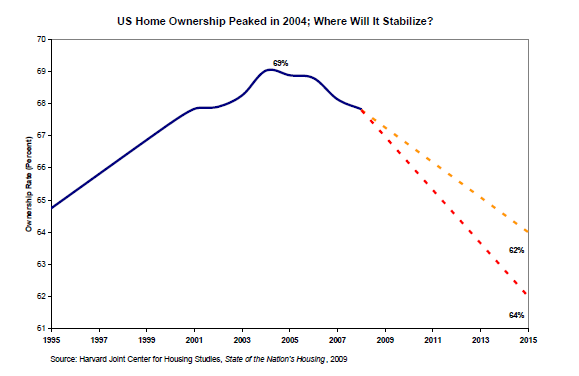

We found out that owning a home should be based on economic fundamentals. For so long have we lived in this Wall Street bubble machine that people have forgotten what sound lending involved. People fret about “high interest rates†shattering the housing market but back in the early 1980s people were still buying homes with double-digit mortgage rates. Why? Because prices still made sense and people came in with a down payment. Today, we still have a market artificially being pumped up by the Federal Reserve. Wall Street would like you to believe that things are so complex that only a Ph.D. can understand what is going on and therefore we warrant complex securities. Nonsense. We had over 150,000,000 Americans in 1950 and somehow boring banking and lending seemed to work. And we certainly didn’t have a financial crisis like the one we just had that was the worst since the Great Depression. We reached the apex of homeownership in this bubble and are quickly reversing course:

Source:Â The Urban Land Institute

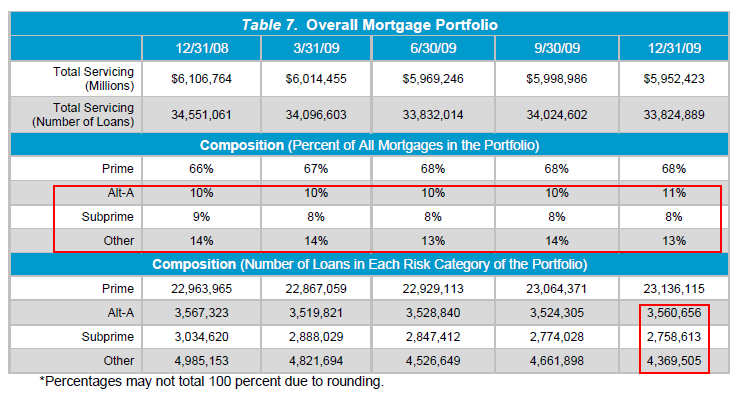

69 percent was the absolute upper-bound range. And keep in mind what it took to get there. This involved using every toxic mortgage product imaginable and actually creating rampant accepted fraud where people didn’t even verify incomes. In fact, we had a period where you could structure a housing deal where you received money (i.e., cash back deals, 125% LTV products). Wall Street knew this was the case and fueled the fire over and over so they could structure deals to keep the casino card game going. Why? Every person that wanted a home with good credit and income had one. The next group was basically anyone that wanted a home irrespective of income and credit. The birth of subprime, Alt-A, and other junk. And these toxic products still linger on bank balance sheets even while they announce record profits:

Source:Â OCC/OTS

Just look at the amount of active loans. Nearly 20 percent of active loans fall in the Alt-A and subprime category. The “other†category also has questionable loans. So total that up and you have roughly 10 million active mortgages that fall in this risky category. We have yet to work through this. Banks keep announcing solid profits and putting on a smile for the public but behind closed doors they are keeping their money tight and are churning profits internally for their corporatocracy. The last thing they are doing is placing a bet on the American people even though they have taken $13 trillion in bailouts and handouts.

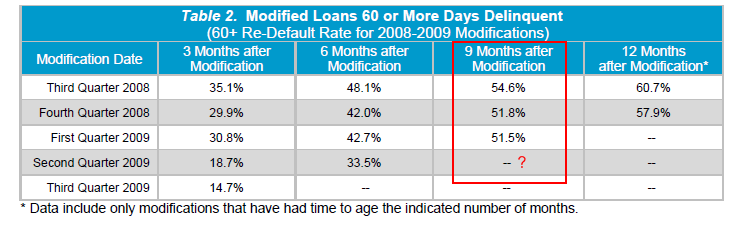

For all the hype regarding loan modifications most are failing only after a few months:

After 9 months nearly half of modified loans re-default. And this is what you would expect when 17 percent of the population is underemployed. How are they going to pay their mortgage? The problem of course stems from the inability to pay at nearly any cost. That is why we have lost over 1 million households since the recession started. People are moving in with friends, families, and consolidating households. This too is another reason why new home formation will be lagging in the next few years.

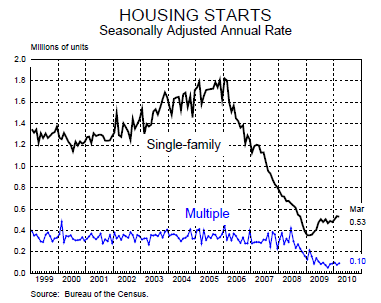

All you need to do is look at those who have their ear to the ground, home builders:

That minor bump is merely the reflective reaction of cheap money trying to do something. Yet you can see for yourself above that homebuilders are not optimistic about building to meet new demand. And why should they? A large part of the current sales are occurring with existing home sale inventory. We have plenty of that to last us for years.

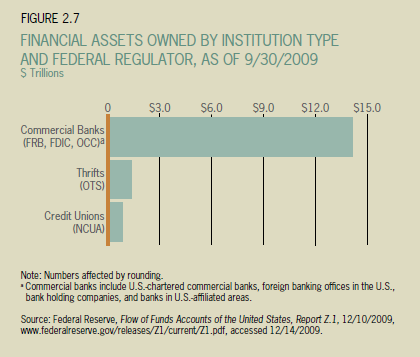

The massive concentration of all this debt is put into the hands of a few big banks:

Source:Â SIGTARP

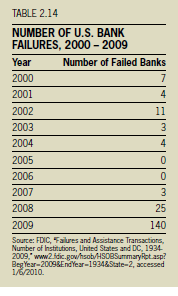

The top six banks in the U.S. control 60 percent of all banking wealth. This in a market where 8,000 banks exist. But that number is dwindling but only because those banks that are able to fail are doing so:

And this year is quickly outpacing 2009. So banks are failing yet the too big to fail are turning giant profits even as we have shown, still have the bulk of toxic loans on their books. At a certain point this has to break and as we saw with the case against Goldman Sachs, even the mere mention of shedding light on banking balance sheets is enough to cause a market tremble. Why? Everyone still understands that toxic debt is still alive and well.

What About Short Sales and Option ARMS?

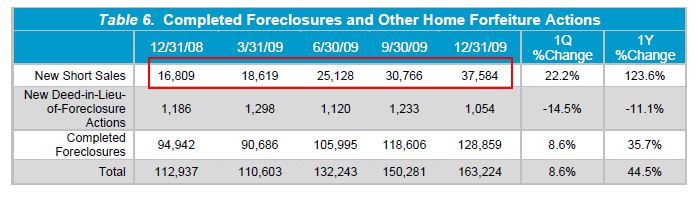

There is this hype regarding short sales and how they’ll be a big factor in today’s market. I highly doubt that. Will we see more? Of course. But not enough to shift the dynamic of the housing correction. All this will do is push more inventory out:

37,000 completed short sales in the last reported quarter. Measure that with 128,000 actual completed foreclosures. Foreclosures still dominate the market. Until that foreclosure number settles down, the housing market will be in a complete state of flux.

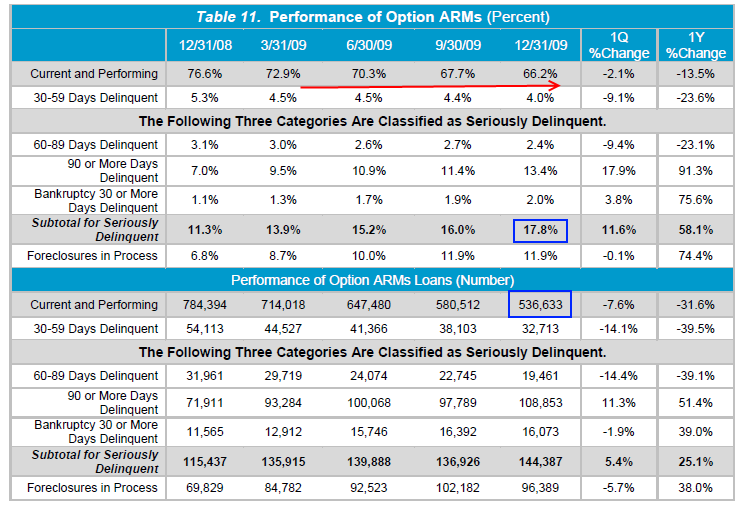

The broccoli of the housing dinner plate, option ARMs is still alive and well. It is still sitting there, waiting to be eaten after the steak is devoured. Most of the over 536,000 option ARMs are in housing battered states like California and Florida. Maybe this is why national attention has fallen by the wayside for this topic but these states should care because it is another shoe to drop. And the data on these loans gets worse and worse:

34 percent of option ARMs are non-performing. This is astronomical given that most won’t hit their recast periods until 2010 and 2012. The data gets worse as time goes along. There is little reason to believe that these will turn out to be good deals. You’ll notice above how the number has quickly fallen. Part of this is because of foreclosures but another reason involves banks shifting these loans into “other†categories like interest only loans but that doesn’t make them any better. It buys more time.

Where Next?

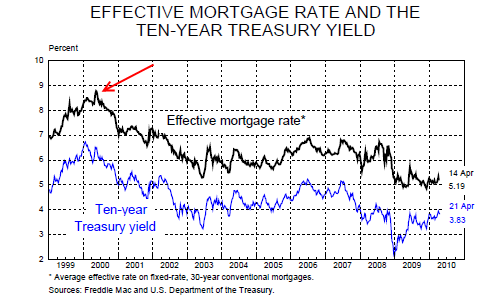

Mortgages rates will rise and this seems to be an obvious reality that few even factor in:

Current rates are absurdly low because of the Federal Reserve monetizing debt. They recently completed buying up $1.25 trillion in mortgage backed securities. Why did they have to buy? Because no one else would buy this debt at this artificially low rate. Even as early as 2000 the 30 year mortgage rate was close to 8.5 percent. With current rates near 5 percent, people fail to understand how big a move back to 8.5 percent would be (the 40 year historical average is 9 percent).

How big is this difference? For a $300,000 mortgage it works out like this:

@ 5% PI Â Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â $1,610

@8.5% PIÂ Â Â Â Â Â =Â Â Â Â Â Â Â Â Â $2,306 (a 43 percent increase)

With household budgets running tight, this is a massive jump. Current rates are unsustainable and by definition something that is unsustainable will change.

Next, you have many baby boomers remaining put because they have now had to reevaluate retirement options. This was thought to be a new boom for vacation resort areas where many new condos went up. Yet that vision isn’t coming to pass. Right now, the market seems to be pushing sales by one person losing their home and another one picking that home up for a price that was unthinkable just a few years ago. Yet all that does is churn current inventory. No new home building and move up buying is stagnant.

The trend is rather clear. Housing is in for a long and hard struggle. Things are being held together with a thin string right now. With so many balls in the air, it is hard to envision what breaks the current back of the system. Wall Street hasn’t had any serious reform so there is no reason to believe that things are now somehow better. In fact, the too big to fail have now gotten even bigger. They are earning profits from merely stock market voodoo. The real economy is still languishing and current home data tells us that story in vivid color.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

OTR Tire Guy said:

Unfortunately, most people who want a home are trying to buy outside of their means, even now.

I try to warn my friends about how much it actually costs, per month to live, and own a home, to no avail. The American Dream is more like an American Delusion.

We are at the point where interest rates have to rise. This is going to be a nightmare, regardless of whether Wall Street reports earnings this quarter.

Call me a bear, but this situation is untenable, on a number of fronts.

April 20th, 2010 at 6:06 am -

Forty2 said:

Well, I’ve been a housing bear for years, but today I signed a P&S contract for a small REO house in an affluent town in NE Mass. For the price (129K) I couldn’t buy a shitty 70s condo here. Nobody wanted it because it’s tiny and an odd layout. Works for me as a single middle-aged guy w/no kids. It needs a little work but compared to the disasters I’ve looked at over the past two months it amounts to very little.

When the price of buying vs renting finally tilted in favor of buying, I bit. $700 or so a month vs. $1050? Not a hard decision, and it’s mine.

April 20th, 2010 at 6:04 pm -

Nigel j Watson said:

great post! As I said when I passed it on to my groups:

My Budget is one of the better (as in accurate) financial blogs around. This is one of the clearest dissections yet of just how mortal a wound this latest orgasm of Wall Street avarice has been to the average American’s major lifetime “investment.”

While the government piddles around “saving” homes with its asinine mortgage modification measures (lacking either the courage or the votes to demand the banksters, finally, do the right thing by marking down the inflated values in their secret and toxic inventories), the steadily rising % of long-term unemployment defeats any and all such half-hearted attempts from the other end of the equation: the homeowner’s ability to pay. No wonder these “saved” mortgages are showing a 60%+ recidivism. D’uh. Or, if your prefer, Homer’s D’oh!

All of this merely kicks the can down the road while all the crooks in their gleaming cubes wait anxiously for the economy they purposely raped to “come back,” thereby allowing them to cover up their crimes with revivified profit streams.

Their wait, and our own, will be in vain. They have overplucked this time.

April 21st, 2010 at 6:41 am -

Scott said:

I have to put your money some where and stocks are a complete scam so I put my money in hosuing and have done especially well over the last 5 years

April 21st, 2010 at 8:34 pm -

Toby Bo said:

Your point that home sales are connected to life stages is right.The housing bubble also produced the opposite where home sales enabled a life stage.I read a blog from Celebration,Florida where the family lived there just one year until they flunked out of the middle class.

The bubble gave the image of wealth that lead to weddings and houses.The materialism of the bubble had different flavors that intoxicated both genders.I joke that Celebration kids catch up with ice cream trucks on their Segways.If real estate had a sound it would be the steamed milk nozzle.

April 22nd, 2010 at 8:56 am -

TarNFeathers said:

Americans need to learn this phrase:

It’s F-ing Over!!

1/3 down…at least another 1/3 to go!

April 22nd, 2010 at 2:44 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!