Gas Prices going up and Bailing out a Hedge Fund: Why the Average American is Getting Bailout Fatigue. TALF a bailout for Corporations under guise of Lending for Average Americans.

- 1 Comment

Most Americans are having a challenging time digesting the bitter fruit of all the financial news coming from Wall Street and D.C. It is hard for many to wrap their brains around what is going on. In fact, today Ben Bernanke just stated that AIG was operating like a hedge fund. Which of course begs the question if we are bailing out AIG, are we then bailing out a hedge fund and does that open the door to other beleaguered funds? This would cause some major dislocation in our philosophy of what initially was to be a credit market bailout to help homeowners. That was the initial seed and has morphed into a beast rivaling an economic Frankenstein. Now, we are simply bailing out institutions that are hand selected by Wall Street and Washington D.C.

Today there was an interesting exchange between Ben Bernanke and Senator Bernie Sanders:

“(Reuters) My question to you is, will you tell the American people to whom you lent $2.2 trillion of their dollars?” Sanders asked, referring to the size of the Fed’s balance sheet.

Bernanke responded that the Fed explains the various lending programs on its website, and details the terms and collateral requirements.

When Sanders pressed on whether he would name the firms that borrowed from the Fed, the central bank chairman replied, “No,” and started to say that doing so risked stigmatizing banks and discouraging them from borrowing from the central bank.

“Isn’t that too bad,” Sanders interrupted, cutting off Bernanke’s answer. “They took the money but they don’t want to be public about the fact that they received it.”

He said businesses in his state were in trouble and needed loans, but were not permitted to borrow from the Fed.

“Do you have to be a large, greedy, reckless financial institution to apply for this money?” he asked.”

And Senator Sanders hit at what I believe is the true reason there is a loss of confidence in the markets. There really is no clear cut logic to what is happening. First, we are expected to handout trillions of dollars to questionable banks and institutions and then we are expected to forget about the money and who it went to because it might hurt their feelings? It is truly a spectacle rivaling a circus or something you would find in an emerging market. Sanders will be pushing legislation to reveal which institutions have borrowed from the Fed to the tune of $2.2 trillion. The argument is these institutions will be hit once there dirty deeds are revealed. As if these institutions can trade any lower. It is a poor excuse to keep the gig going and praying a new sucker rally will appear and many of these banks would then have a chance to unload 30 years of reckless debt.

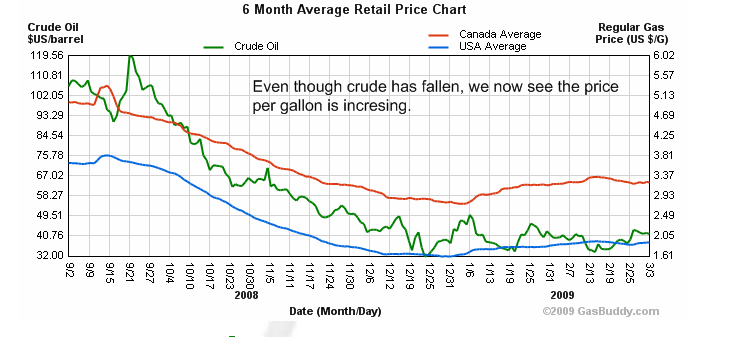

And most Americans are not seeing any day to day benefits even as prices come crashing down on many items. Let us look at gas for your car:

Since the bottom, a barrel of oil has increased by 13 percent while the average gallon per gas has jumped by 20 percent. So what is happening is refiners have cut back at $40 a barrel for oil and supply and demand have adjusted to keep gas prices up. So this supposed relief is a drop in the bucket for most Americans.

Another disturbing move is the so-called TALF program which is supposed to increase credit for consumers:

“March 3 (Bloomberg) — The Federal Reserve and U.S. Treasury eliminated executive-compensation limits for sponsors of asset- backed securities accepted under a new $1 trillion program, indicating the rules may have hampered efforts to start the plan.

The rules won’t apply to the Term Asset-Backed Securities Loan Facility because of the government’s “desire to encourage market participants to stimulate credit formation and utilize the facility,” the New York Fed said in a question-and-answer document on its Web site today. The government also signaled it will use the program to support additional credit markets.”

Did you get that? They had to give more compensation for more executives to take money from American taxpayers! What a sick joke. And we are talking about another $1 trillion here. If we really want to increase lending, which of course is questionable as to how much debt we already have, why not setup a function where Americans can request credit directly from the Fed? We can setup a Fed credit card. You mean to tell me they can’t set something up like that and flood the market with $1 trillion in credit? If rag tag credit card companies and mortgage brokers filled with high school graduates can flood the streets in ghettos and prime neighborhoods, how is it that our Ph.D filled Fed and U.S. Treasury can’t devise a more sophisticated plan to get credit out on the streets?   Instead, we are going to filter this money through an already fractured system and by the time all is said and done, there may only be $200 billion left for consumers.  Highway robbery here.

And this is even more of a bailout for troubled institutions than relief to average Americans. What they’ll be able to do is exchange junk consumer loans and student loans for example, for government capital. Then whether they lend it out or not is up to them. Same crap as the TARP. That is why if they want to lend the money do it now and do it from the Fed and U.S. Treasury. This is a bad idea but is better than the premise of the current TALF. This would seem logical and given what has been going on, would probably not make it past any legislative body because most things that are occurring beg for an ounce of common sense. But you need to remember the Fed and U.S. Treasury are merely puppets to the banking powers in our country mostly seated in Wall Street. If they are truly concerned about giving credit out, you mean to tell me these geniuses can’t create some credit card application for Americans to fill out? Heck, even slumlords do this and are profitable!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

susan r said:

Isnt it something that when our gas prices drop and get better, the people on Wallstreet are pulling their hair out? Even Opec says they want to see gas prices go UP so that they can make more money. Something just does not make sense. When our gas prices dropped to $2.00 a gallon, they said the economy was not doing good at all. But when the gas prices go back up, they say the US is pulling out of the recession. Go figure?

June 8th, 2009 at 7:48 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!