Generation R – Millennials are largely living at home or opting to rent. What happens when homeownership is less accessible to younger Americans?

- 3 Comment

There is a big challenge when someone comes of age during an economic crisis. Millennials, the children of baby boomers born between 1982 and 2000 have largely grown into an economy that was fully in shambles. This is a generation that grew up with parents talking about the middle class as if it were a foregone conclusion. Their parent’s went to school when it was affordable, came of age when jobs were plentiful, and housing costs were reasonable relative to incomes. Those days are largely gone. While some in the real estate industry scratch their heads as to why homeownership for younger Americans is so low, they should spend some time analyzing the cross-currents that are hitting this cohort. The older Millennials are well into their first home buying years yet their homeownership rates are far below those of previous generations. It was thought that once the Great Recession ended in 2009 that somehow these people would be back at it and buying homes. Yet growing up during a time of massive uncertainty leaves a psychological impact on how you view your future goals. Many are opting not to buy homes and many others simply cannot afford to leave home. The apt title for this cohort is Generation R, as in a new generation of renters.

Does the American Dream carry the same weight for Millennials?

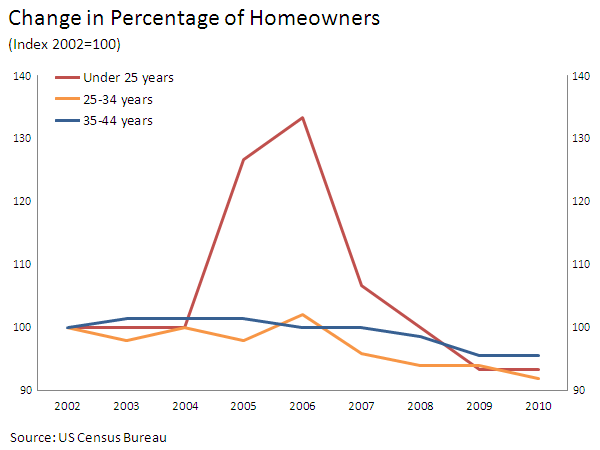

When we look at homeownership data broken out by age groups, we find that many younger Americans bought during the apex of the housing bubble. Many went into massive debt to purchase a home when they were already carrying high levels of student debt. As the housing bubble burst, many who were junior in their careers, were at times the first to be let go. Also, since they bought at the peak, they were severely underwater and many were unable to carry their mortgage payments.

There is a growing amount of data suggesting that homeownership will be very different for future cohorts of Americans, particularly the young:

“(Century Foundation) According to Census data, less than half of those aged 25–34 years old are homeowners today, the lowest percentage since 1999. Despite a brief upsurge in young homeowners signing subprime leases during the heady days of the mid-2000s, on net nearly all of the 11 million unit household growth of the last ten years occurred among older households, while Millennials—children of the Baby Boomers born between 1982 and 2000—are now overwhelmingly choosing to rent or move home with their parents. That’s problematic because first-time buyers are critical to the health of the housing market, which depends on new blood to finance older sellers’ movement into the higher ranges of the market. It’s also a major contributing factor in the continued weakness of the construction sector: single-family housing starts for February were down 12.5 percent from the same time two years ago, while renter-friendly housing was up 197.5 percent.â€

This is incredibly important information. The middle class was largely developed around the mythology of owning a home. Most Americans contain all of their net worth in the equity of their home. Yet today, home prices are largely out of the reach of younger Americans with lower salaries. Take a look at the above chart. You can see that homeownership for younger Americans peaked during the height of the housing bubble. Since then, it has fully retreated.

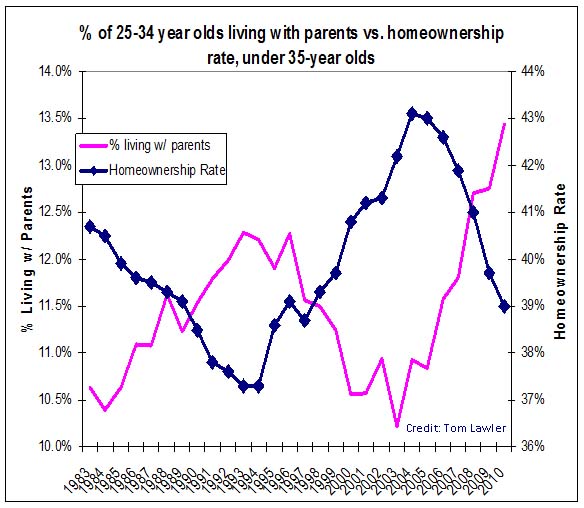

That is one source of information. The impact of the housing bubble popping on Millennials can be seen even more dramatically when we look at those now living at home with parents:

There is a near perfect correlation here. As the bubble burst many younger Americans were forced to move in with their parents or many simply never left the nest. This is largely driven by financial forces versus any sudden shift in wanting to live with mom and dad. The problem is that mom and dad are also struggling with their retirement planning. Since the Great Recession ended the large buying in the housing industry has come from investors. The growth in renting households has been dramatic.

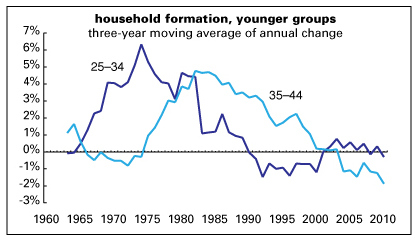

You can see the problem for the housing industry with household formation:

This weak growth in household formation is largely due to younger households living at home or simply linking up with roommates under one roof. It also helps to explain why construction and home building continues to be weak. Investors in many cases are buying up existing inventory simply to rent out to households. It will be interesting to see whether motivations for home buying shift for Millennials. I would argue that we would first need to see a shift in wages and jobs before seeing a surge in home buying. Generation R is the new trend here and many are redefining the definition of the American Dream when it comes to homeownership.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Leslie Anne said:

“I would argue that we would first need to see a shift in wages and jobs before seeing a surge in home buying.”

Watch HGTV sometime. It’s not a shift in wages-n-jobs that is needed. What’s needed is a shift in expectations.

June 19th, 2014 at 4:48 am -

tyler said:

No one should buy a home under the age of 60.

A. Home prices are way too high as the government continues to pump money into the system

B. You never really own a home. The government owns the home and charges you rent to live there. At any time the government can raise your taxes or screw up your sewer system.

C. You have less legal protections then a renter. It takes months and a trail to evict a renter. A home owner in most states can be evicted without trial for a single late payment.

D. homes force you to remain in one area unable to go fin better paying jobs elsewhere

E. If you view home ownership as an investment why do you have to take out debt to get it?

F. the cost of renting factoring in everything is almost half per sq foot as owning.

Rent for life. Change places as you need it. Move where the jobs are. Or buy a home and be poor then cry to the government for more tarp money.

June 20th, 2014 at 4:16 pm -

Steve Ostertag said:

Millennials have been “Europeanized”. They are unwilling to “blow their hearts out for freedom’s sake and run themselves into the ground” to chase the dollar. They work in non-profits so their Marx-ed up (false) consciences are not disturbed because to them realization of profit is worse than genocide. Meanwhile, who are buying up the homes? Immigrants, especially those assimilation resistant types who DO run themselves into the ground for freedom’s sake and affix identity markers to their vehicles from Mexican tricolors to Polish Eagles to Sikh Khandas.

June 30th, 2014 at 12:03 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!