The great deleveraging event – household debt has fallen 4 percent since recession hit. Household debt has fallen dramatically from the peak when household debt aligned itself with annual GDP.

- 1 Comment

The debt bubble bursting has jammed the bottom line of American households. Debt and money are synonymous for many households in our current economy. The ability to spend, or buying capacity, is looked at in the same light as savings from many in the financial sector. This is why data recently released shows the balance sheet issues faced by many typical households are more dire than once imagined. Since the recession hit US households have seen their debt fall by 4 percent, an amount of $584 billion. This is good news right? Well yes but the reality of this “good news†is that two-thirds of this debt reduction came from home loan foreclosures and default on other debt. To put it more simply Americans have decreased their debt load simply because they were unable to pay off inflated assets. On the flip side the financial sector has been handed a blank check for the ill-advised lending and predatory bets they made but US households do not have access to the unlimited piggybank at the Federal Reserve.

The big deleveraging event

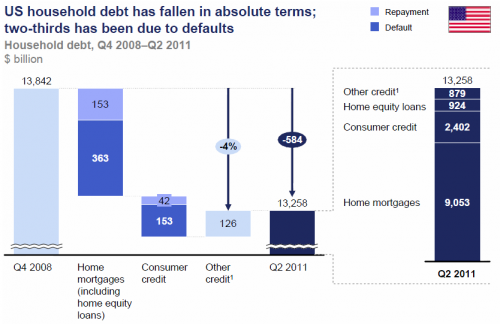

McKinsey has an interesting chart showing this contraction in debt:

Source:Â McKinsey, Zero Hedge

How do you read the chart above? Well $363 billion of the debt reduction has come from people defaulting on home mortgages. Another $153 billion has come from families defaulting on consumer debt. At one point revolving debt (credit cards) hit nearly $1 trillion but now it is back down in the $700 billion range.

The chart also highlights how painful the housing bubble bust has been for the typical US household. Even in Q2 of 2011 over $9 trillion in household debt is associated with home mortgages. So the housing market falling by over 30 percent from its peak has wiped out large amounts of perceived equity yet the debt still remains. Many are unable to pay on an asset that is worth even less but for most Americans their home is their biggest financial asset.

The other item is with consumer credit. This is made up largely by auto loans, student loans, and credit cards. As we have mentioned, revolving credit has contracted strongly since the recession hit. But student loans are surging hand in hand with the higher education bubble. The shift from one bubble to another is unfortunate and this is likely to bring future problems for many Americans. With student loan debt, there is a very challenging process of deleveraging since the debt is locked onto students for ages. Walking away is nearly impossible and even bankruptcy does very little when it comes to discharging this debt.

Large group of strategic defaulters

Many have made the conscious choice to walk away from underwater mortgages:

“(Zero Hedge) Up to 35 percent of US mortgage defaults, it is estimated, are the result of strategic decisions by borrowers to walk away from homes that have negative equity, or those in which the mortgage exceeds the value of the property. This option is more available in the United States than in other countries, because in 11 of the 50 states—including hard-hit Arizona and California—mortgages are nonrecourse loans. This means that lenders cannot pursue other assets or income of borrowers who default. Even in recourse states, US banks historically have rarely pursued nonhousing assets of borrowers who default.â€

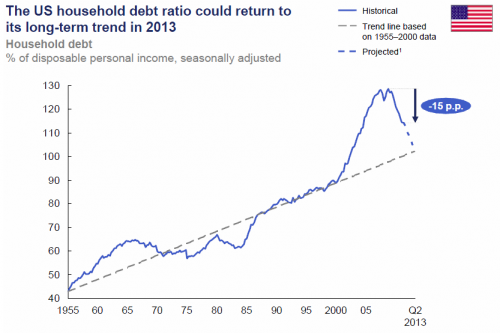

Of course we see that this has been a larger move in big bubble states like Nevada and California. Â This process of deleveraging is also putting household debt ratios back in line:

Source:Â McKinsey, Zero Hedge

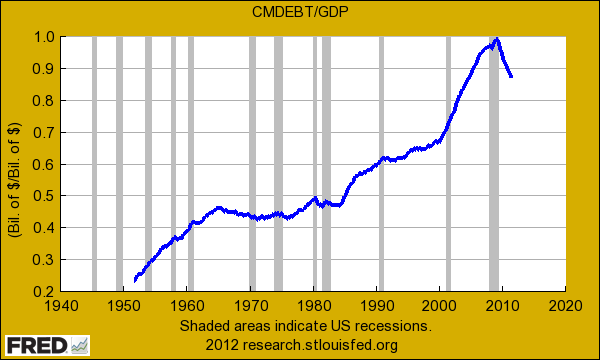

This is one way to look at it. But we can also look at household debt in relation to GDP:

From this perspective, household debt is still perilously close to being one-to-one with annual GDP. From these charts we realize that the brunt of the debt bubble bursting has been shouldered by the American household. The financial sector has up-leveraged with trillion dollar bailouts from the Federal Reserve and accommodating colleagues in Congress. It is never a positive sign that most of the deleveraging is coming from people simply defaulting and not paying commitments back. Sounds like they are taking their cue from the financial sector.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

cash said:

I fail to see how defaulting on any debt lowers debt.

Most, if not all, mortgages have a bond adn a note. Thr bond secures the note with the property. The link ends there. If a mortgagot defaults on the note he loses the property. But the note remains. Any amount remaining after the sale of the foreclosed property remains owed by the mortgagor. Forclosure does not amount to debt forgiveness. The “underwater” mortgages are a problem because the mortgagee (the bank) will continue to look fot, and is entitled to, full paymeant of the note plus interest on the remaining balance.

January 29th, 2012 at 11:01 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!