The hindrance of global debt – Spain accelerating to major bailouts and bond markets react. Eurozone stock markets in major decline.

- 0 Comments

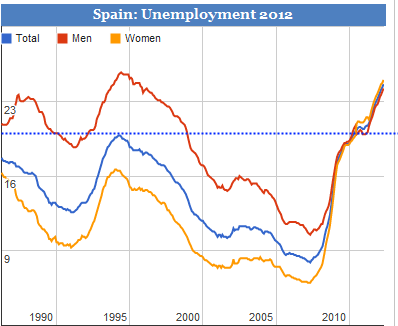

It is always a sign of desperation to ban short selling. Trying to put an artificial bottom usually backfires and we are seeing this hit in Spain. The situation is unsustainable and has taken the headlines away from Greece. Spain is a much bigger economy and they are deep in a recession with headline unemployment near 25 percent. Financial and government leaders continually attempt to solve a debt crisis with more debt. How is the debt going to be serviced with 25 percent of your workforce not working and incomes are being crushed? Does it even logically make sense to give Spain more loans when they are already unable to service their current debt? A household in this position is bankrupt and basically needs to restructure their entire balance sheet. The last thing they need is larger loans but that has been the proposals for the last few years. The contagion is spreading as now Italy is being caught up in the debt crisis.

Eurozone economies being crushed

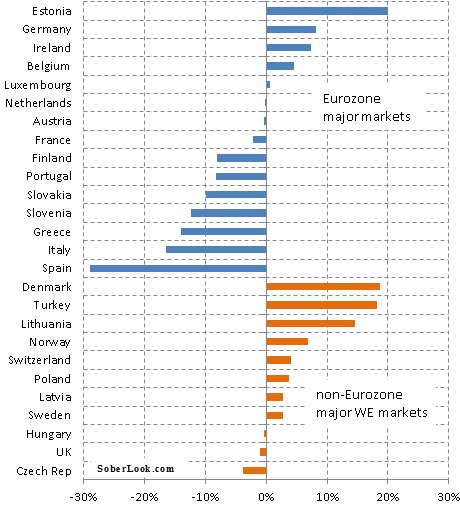

Eurozone equity markets are being hammered in 2012:

YTD equity returns in local currency

Interestingly enough non-Eurozone European markets are doing much better (i.e., Denmark, Turkey, Poland). If you look at Spain (down nearly 30%), Italy (down nearly 20%), and Greece (down approximately 15%) you begin to realize the extent of this global correction. The Eurozone is the biggest trading bloc in the world so it is naïve to think this will not have an impact on our own economy. Even China is feeling the deep correction as we see their market setup for a harder landing than once was imagined. The world is in a state of peak debt:

As of today there is some $45 trillion in public debt outstanding (over $180 trillion in all debt combined). Does anyone really believe this will ever be paid back? Or is this just some sort of long-con where current parties want to get their fix while pushing the real bill to generations down the road? If we look at Spain again, you need to remind yourself that the attempt to save the market is coming with more debt when the actual economy is doing this:

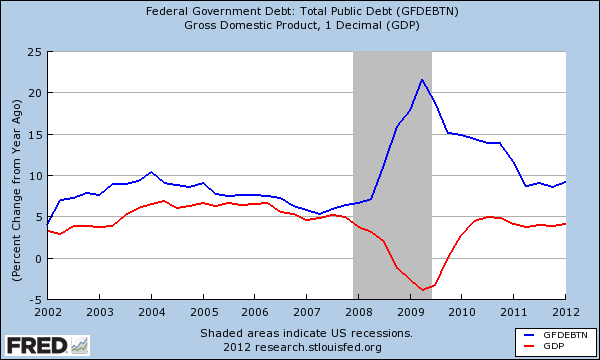

And this isn’t the only example of massive debt growth. The US is following a growth via debt model as well:

The growth of debt is far outpacing GDP growth. Keep in mind that 46 million Americans are on food stamps and many others are now receiving Social Security benefits. Our costs are soaring while the actual revenue going into the pool is decreasing. Very few people expected that the short term propositions that came out of Europe were going to really solve the issue. Major banks are simply fixing trades behind the scenes before major haircuts go into effect. The short sale ban really comes too late in the game since the bond markets are already pricing a default for Spain. Sovereign defaults are not uncommon but what is uncommon is that Spain is part of the Eurozone. The austerity measures are politically untenable for both Spain and Greece. If you look at the above charts you will see that Ireland is now growing (after a very painful restructuring). You need to cut lose the debt chains before trying to expand.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!