The average American is broke and buying things they cannot afford with debt again. Debt based consumer financing again filling the gap of a shrinking middle class.

- 2 Comment

At a family Thanksgiving get together we typically have a usual crowd showing up to celebrate the year that has passed. For many, this is the only time we see each other. A familiar face was not there. We asked what happened and apparently he had to work on Thanksgiving Day because stores are now pushing the shopping addiction into another day. Mind you that Americans for the most part are broke. It isn’t enough that we have Black Friday and cyber Monday to get people to spend outrageous sums of money on things they really don’t need via faux holidays. So it is no surprise that auto sales are on a sharp upswing from the lows of the recession. However, much of this is coming with people getting into massive auto loan debt. Those zero percent down deals are back again. All of this is happening while household incomes retreat to inflation adjusted lows that were last experienced in the late 1980s. Auto debt, credit card debt, and student debt are all on the rise again.

Going into debt to keep the pretense of a middle class up

I avoid Black Friday and that probably doesn’t come as a surprise. There is little joy in going into a bumper-to-bumper packed parking lot only to dodge angry parents ready to rip out your face like a zombie on The Walking Dead for that special toy. So they are doing it for the kids you may say. That might be one way of looking at it but many are also buying cars they cannot afford:

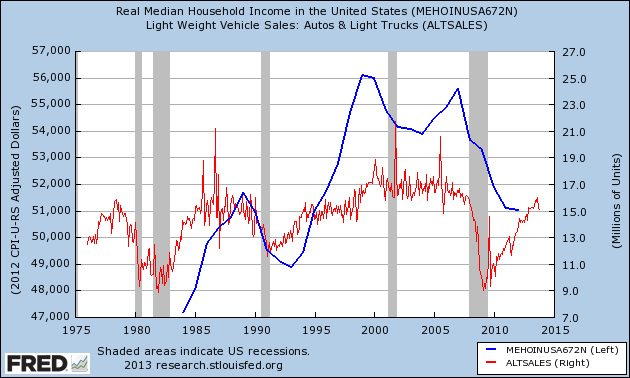

This chart does a good job of summing up the current situation. There has been no real income growth for nearly an entire generation. Yet car sales are up dramatically from the lows of the recession. How can households with no income growth afford cars that cost $25,000 to $30,000? They can’t but they are financing it:

2010 Auto loan debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $700 billion

2013 Auto loan debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $840 billion

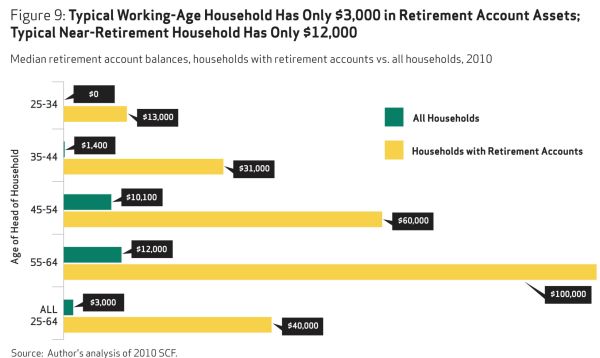

This is how you finance a broke American middle class. Sure, auto sales are up but they are up on $140 billion of additional auto financing. Do you think this is a smart idea when the typical American has nothing saved up for retirement?

“The typical working-age household only has $3,000 socked away for retirement! More troubling, of those that bothered saving, the median amount saved is $40,000. Essentially one year of expenses for your average American household.â€

The insanity of Black Friday is symptom of a mindless addiction to spending and taking on debt to keep the system going. Our banks are addicted to debt. Our government is addicted to debt to the point of putting us into a soft default mode.

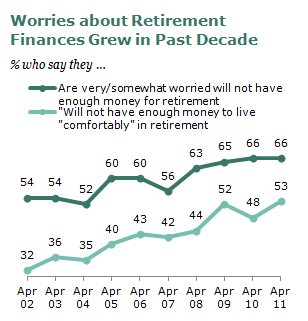

All this additional debt is merely a way to keep up the pretense that the middle class is still alive and well in the US. In reality the middle class is shrinking at a very fast rate. The majority of Americans are worried about their financial health in retirement:

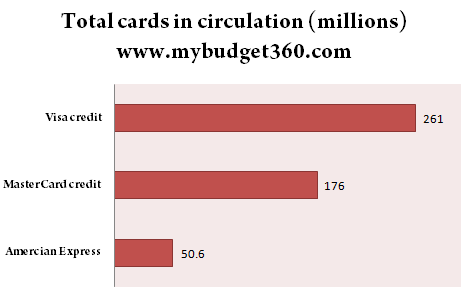

Yet you have hoards of people going to stores and spending on credit cards as if it were the last sale ever! This is the cognitive dissonance that gets us into trouble. Banks are all the more willing to lend this money out and transfer risk elsewhere whether it be through inflation or simply storing it away on the Fed’s enormous balance sheet. Ultimately, it won’t be their problem when things go bust again. You can’t have major debt growth with no real income growth. Many Americans simply put themselves into an endless debt trap to have simple materialistic items. Nothing wrong with buying things if you have the money. Yet we have a system where having no money is not a problem! The typical American credit card holder has 3 credit cards but almost no retirement savings!

Just watching the news about people being stuck with stun guns or boxing it out for some trinket is madness. But it also highlights the underlying psychological pressure people are facing. Many wrongly think they are getting a “deal†by putting up with the hoards. It is a tiny win on the consumer hamster wheel. Many are living day to day and getting that one gift becomes the battle to win instead of trying to figure out why our banks and government have neglected the country to the point where the one day for gathering for family has now become a pre-meal for shopping with money you don’t have.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

Joe said:

Depressing stats, but no matter how much you have or haven’t saved, Start Now! Government benefits will only get smaller in the future …..

December 1st, 2013 at 1:56 pm -

cindy said:

The other day,a local reporter interviewed woman and asked her how much she was going to spend for gifts.She replied she has been saving since June and she planned to spend $200.00 .She also spent 125.00 to decorate her house.Also,she mentioned how tough it was to pay her bills to

begin with….

I’m planning to donate to local charity and put up some Christmas lights and watch PBS Christmas shows and that’s it..December 2nd, 2013 at 4:00 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!