Home Equity Loans: $674 Billion in Total Loans. When The Household ATM Goes Out of Order. First, Second, Third, Fourth, and Even Fifth Mortgages.

- 3 Comment

Home equity was once seen as a cushion for a rainy day. People built up home equity as a means of paying off their home loan and saw it as a source of security. The days of the mortgage burning parties were all but lost in this housing bubble. The roots of the housing bubble mania started in 1979 and did not end until this decade. Our first taste of housing bubble glory came in the way of the S&L Crisis created by high flying loans in the 1980s. Yet we have never seen the home become a virtual cash ATM. Underwriting became so lax that getting $50,000 out of your home required a phone call and a few documents e-mailed to your Gmail account. That was it. Robbing a bank would yield less than simply raiding your own home equity.

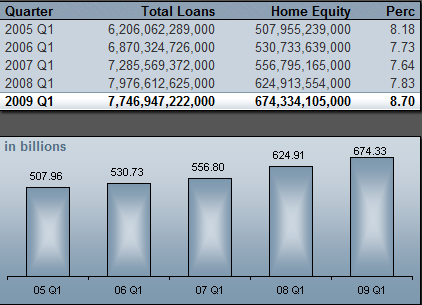

The problem with home equity lines of credit is they depended on a bubble. These products are at the margin of equity. Many are in junior lien positions so in the high likelihood of a foreclosure, the lender will be lucky to recover anything since they will most likely be paid last. What does that mean? Unlike a first lien where a lender will recover a good part of their capital even after taking losses, with home equity loans many lenders will get zilch. And incredibly home equity loans did not peak until Q1 of 2009:

Source:Â FDIC data via Bank Loan Performance

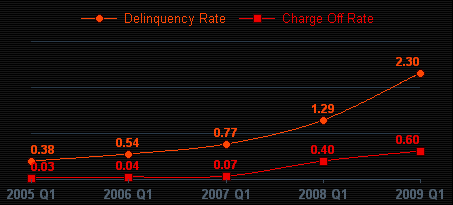

Now this is frankly absurd. The FDIC which covers trillions in deposits with a reserve that is most likely empty now, has allowed institutions to keep on making home equity loans in spite of the housing bubble popping and equity tanking. If anything, one easy method of protecting taxpayers from future losses is ensuring that the home equity loan machine stops at least until the housing market finds a bottom. And home equity loans are defaulting and the rate is spiking:

We are talking about $674 billion in loans here backed by what? Jacuzzis? Add-on game rooms? Modified kitchens with steel appliances? Some took out money to buy cars and take vacations. This money is spent. So the default rate going up is now putting $674 billion in loans at risk. And with negative equity, it isn’t like a homeowner can refinance and combine both their first and second mortgage into one. Now this may seem like a small problem given that we have $3 trillion in commercial real estate loans gearing up for massive problems in the following years. But make no mistake, home equity loans were an additional accelerant to the housing bubble fire.

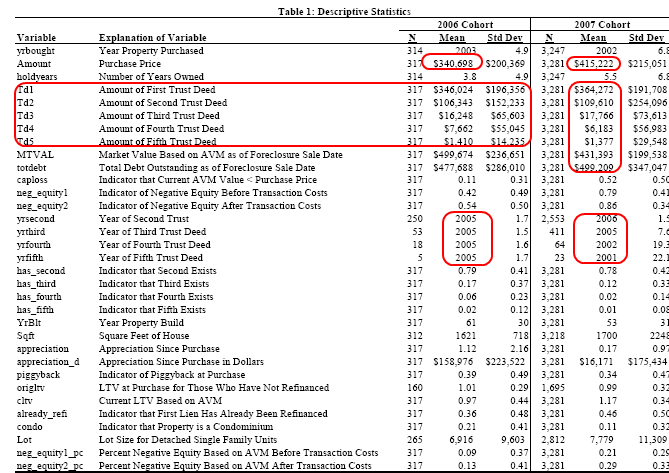

One of the misconceptions is that only people that bought during the peak are the few who are in trouble. This perception is rampant in California. Yet a recent study examined this and found that many people losing their homes via foreclosure were home equity happy and tapped out their equity with a yearly ritual. The housing bubble in California provided nearly a decade where homeowners were able to go back to the well for additional funds. Take a look at some of the findings by Michael LaCour-Little who is a professor at the California State University in Fullerton. What you’ll find is some people took out 2nd, 3rd, 4th, and even 5th mortgages!

What you’ll find in the sample is even though homes were purchased with a mean date of 2002 or 2003, many tapped out major amounts of equity by 2005. The average amount for second trust deeds was over $100,000. The data is fascinating because it highlights another problem in the system. A vast majority of these second mortgages are now underwater. Given that so many homes are underwater, it is highly likely that these home equity loans are now attached to properties that wouldn’t even cover the 1st mortgage.

In places like California with such an enormous bubble, 33 percent of all current mortgages are underwater. Needless to say banks are going to face billions in losses with home equity loans and the defaults are already showing up in the charts. The FDIC is scheduled to release Q2 data late this month so we’ll be looking for significant changes in this area. But given the report today by the MBA that some 13.2 percent of all mortgages are in foreclosure or are delinquent (a record), banks have a lot more losses to realize. The home ATM should be officially closed for remodeling.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

factsnews said:

If 2nd mortgages are underwater…

5th mortgages must be in the center of the Earth!

factsnews.wordpress.com

August 23rd, 2009 at 6:25 am -

JP Merzetti said:

Yes indeed,

One must wonder how much of the economic growth that happened AFTER the dotcom blowup at the beginning of the decade was a result of a generous house piggie bank.

If wages have basically flatlined for the majority over the past 3 decades, then much of the growth that did happen had nothing to do with rising wage incomes.When considering the perfect storm of future defaulted debt steaming down the mainline, perhaps its consequences will in some way amount to a curiously brutal revenge…waged by the majority of the masses against a system that has ravaged them.

“Consumer Society” although creating wealth for some lucky few, rather than feed the hand that bites it, may one day grow sharp enough teeth to reverse that trend.May 8th, 2011 at 11:25 pm -

Lady Dee said:

My husband and I are just now defaulting on a home equity loan on property in Arizona. We did not want to, but can see no other way around it.

My husband lost his job and retired early, in July 2010. (He lost his job in Jan. 2009, so we struggled for a while.) When he retired, Social Security linked our son’s Social Security payment to my husband’s. My son, a severely developmentally delayed person, got a raise. The raise was too much for him to qualify for social services with all the budget cuts in Arizona at that time. So, with his medical bills over $600/mo. and his income barely over $900/mo., we took our son to Oregon to get help for him there, as we have two adult children in Oregon. I had a job for $12.50/hr. in AZ (not much, but something) which included insurance benefits. I planned to go back to this job after our son was safely in a group home in Oregon.

It took too long (way past the 3 months that family leave lasts for), so I told my boss I wasn’t able to come back. We are staying in Oregon to be with our children. Our youngest son is just now getting settled in a decent living situation, with us right next door – 18 months later. We had to use much of our home equity to pay for COBRA as my husband has several chronic conditions. COBRA broke us. I retired early too in order to have enough income to live on. We simply cannot pay the loan. Our house is worth less than we owe and is also in need of repair.

It’s a huge catch-22. We had to leave to get help for our son who needs 24/7 care. In doing so, we lost a lot. We paid on our home equity loan for a good year and a half after we moved. We paid the water bill and the home owners association fees also. We used up our savings and our home equity. We now have no money left to pay anyone anything. But we have enough to live on each month if we don’t pay these bills. We feel bad about defaulting, but feel we did the best we could given the circumstances.

There have to be other people in similar situations where the money is gone (and not just by having been used on a Jacuzzi) and there is no more income to pay on the loan. The Great Recession had a boomerang effect, I think.

September 19th, 2012 at 3:25 pm