US household debt nearly twice as high as annual wages and salaries: Inflating the consumer debt bubble with student loans and auto debt.

- 0 Comments

The latest consumer credit report surprised to the upside. What was the surprise? Americans are back to borrowing money they don’t have. Are they borrowing for investing or possibly purchasing a modest home? No. The latest data shows that Americans are once again going deep into student debt and auto debt. This is actually worse than borrowing for a home you can’t afford. A car will begin losing its value seconds after you drive it off the lot. Yet this is where Americans are pouring their money. So don’t be surprised if you see a pizza delivery person driving in a nicer car than you are. Since the 1980s, households have been supplementing the decline in their standard of living by going into deep debt. The last crisis was more of a debt bubble but it was more visible through the housing market crashing and burning. Housing was only the vector where debt was attached to. Starting in the early 1980s, households started borrowing more money than their actual wages and salaries. At a time when pensions were going extinct in favor of the Wall Street casino, Americans simply filled the gap of weaker wages with debt. So it should come as no surprise that today, US household debt is nearly twice as high as annual wages and salaries.

Spending money that you don’t have

Access to debt seems to be the thing keeping the economy going. Debt for homes, cars, wild banking finance, education, and credit cards. When the bubble started imploding in 2007 through 2009, the Fed stepped in to bail out their financial colleagues. Profits on Wall Street have never looked so good. Yet austerity has rained down on most American families. Have you noticed those auto deals coming in the mail? Noticing all those new credit card offers? We are simply recreating the debt bubble of the past. But since Americans are now being priced out of the housing market by Wall Street it is important to look at what debt sectors are booming.

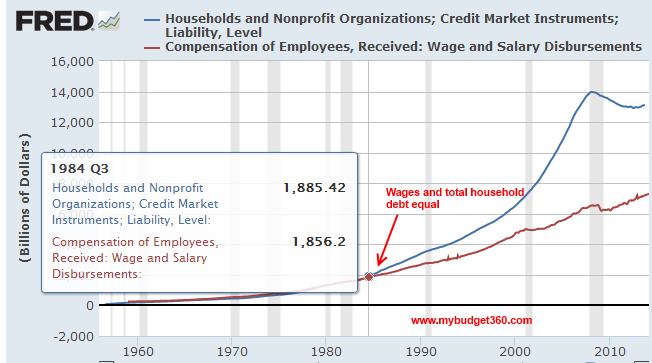

One of the most telling charts is looking at household debt compared to how much in wages and salaries are paid out:

Back in the early 1980s total household debt was virtually the same as total wages paid out. In fact, this trend goes back to the 1940s at the birth of the US middle class. We can almost pinpoint the birth of the US middle class at 1945 and its slow demise beginning in 1984:

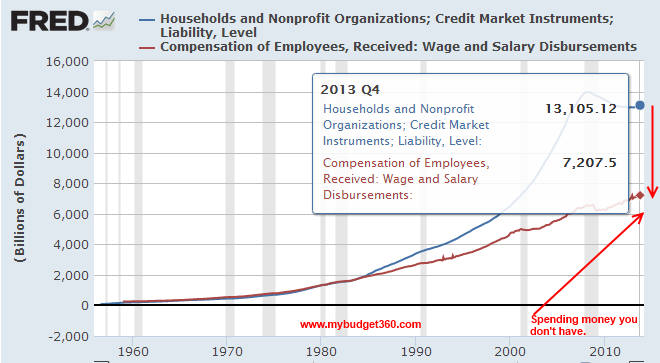

This is a very telling chart. The reason many Americans did not feel the sudden shift and decline in their standard of living was access to debt. The latest data shows that total wages paid out were close to $7.2 trillion yet total household debt is at $13.1 trillion. We are absolutely spending more than we earn.

Spending on cars and college

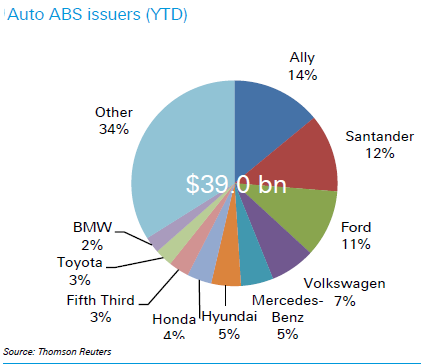

While Americans struggle to keep pace with the powerful eroding power of inflation, many are going into debt for cars and college. Take a look at auto debt just for the current year:

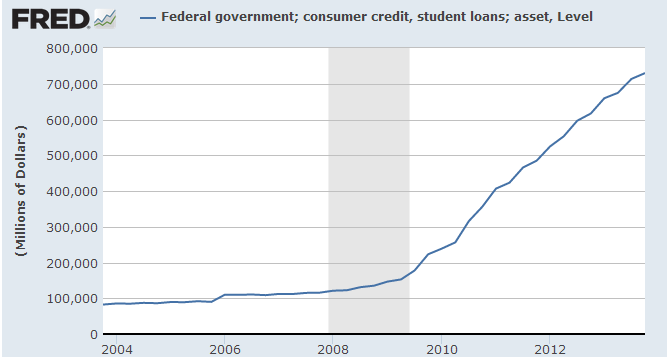

$39 billion in auto debt has been issued out this year. Combine this figure with student debt:

You begin to realize that Americans are so tapped out that instead of buying homes (a market dominated by investors now) many Americans are trying to keep up the pretense of a middle class lifestyle by having nice cars and getting degrees.

It is becoming apparent that now that the finance class in the US has pilfered all they can, it is time to give the public a taste of debt simply so they can inflate another bubble that will only leave them poorer once it pops. It is no accident that in the last jobs report, 800K people simply dropped out of the labor force. The unemployment rate fell because we are measuring fewer people. We still have 47 million Americans on food stamps. Wages are not going up. So when you go to the mall and see people shopping and filling up their cars with goodies, just remember that the typical American has zero dollars saved up for retirement. Keep on fiddling people. We truly are a consumption based nation. So much so that we have exported everything including our middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â