Housing: Google Maps, Redfin, and Zillow: How Information Fueled the Housing Bubble and is changing the Real Estate Industry

- 1 Comment

Information is true power. The idea that only certain experts can explain economic phenomena is falling by the wayside. What has occurred over the past few years is a rapid shift in how people digest their information. In the housing sector, information is absolutely vital. Not only is information important but having accurate information. You need to remember how homes sold in the “old” days to have a perspective of why things got so out of hand so quickly. Information was fuel for the housing bubble but on the flipside, will actually make the correction much slower.

In the past, any information regarding previous home sales was archaic and very hard to retrieve. Even if a prospective buyer was to get information on a home how did he know what recent comparable sales went for? In order for the previous sales price to make any sense in relation to the current price, the prospective buyer would need information for recent comps and homes on the market which were under lock and key via the Multiple Listing Service (MLS). The MLS was under lock and key and only available to those in the industry.

Say you found a home you wanted to buy. You place an offer on the place. The appraiser who does have access to the MLS would go into the system and find recent comps, typically three to give you an estimate on your current purchase. Having only 3 homes as a frame of reference is a small world yet as a buyer, most people only cared if they had the income to make the payments. If things fell together, the home would close escrow and all would be well. The public was rather blind to this and only had monthly or even quarterly reports on overall areas.

This has now radically changed. Ironically the technology that will make real estate more transparent has also played into the speculation that fueled the housing bubble. The ability for people to login and view previous homes sales and view how much “equity” their neighbors were building up was a key factor in the housing bubble. The information was accessible. Online tools were showing housing going up and up and it was all in front of you. The systems weren’t flawed because even tools like Zillow, which provide “Zestimates” use algorithms which take into consideration recent comps. Yet if everyone is in a mania the number is “accurate” but doesn’t reflect sustainable prices. That is also the danger of having access to this information.

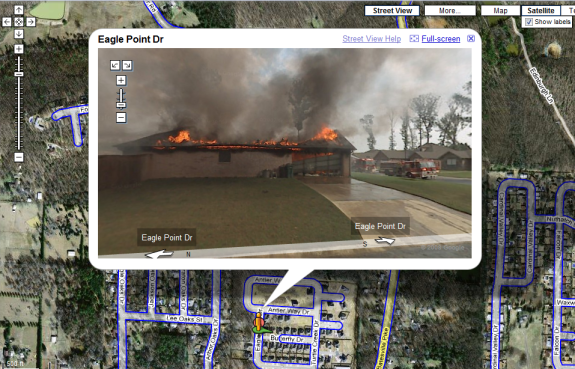

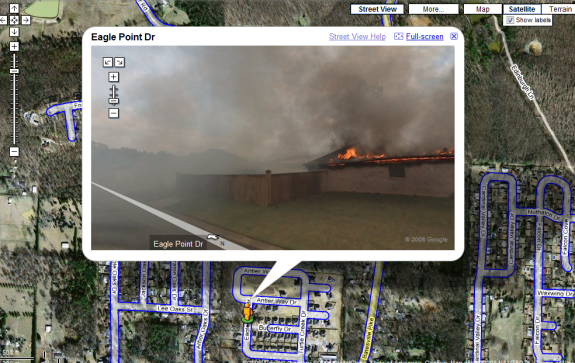

The consumer is getting incredibly empowered. If someone touts a home as being close to a school, how close is it? Is that pool really that big? Do neighbors have a dog? Is the home adjacent to a freeway? Instead of running down to the home and playing amateur sleuth, you now have access to the powerful maps of Google. This is technology that was once only in the realm of movie science fiction yet we now have it all for free at our fingertips. Google Maps also has an interesting street view feature that allows actual pictures from the ground in conjunction with the satellite imagery. You will always find fascinating things like this home that is literally on fire [hat tip The Big Picture]:

Now as a prospective buyer in a neighborhood, certainly pictures like this would raise some questions as to whether you would want to buy a home here. Do you really want to know how close a home is to a freeway?

*Source:Â Google Maps

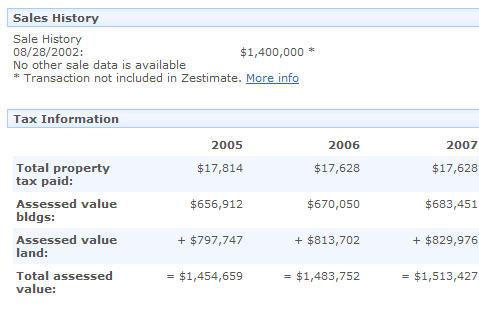

This kind of information is paramount in deciding whether to buy a home for quality of life purposes. But now, you can even query a home and find out the public sales history and prospective tax information. This has given the consumer insurmountable power:

*Source:Â Zillow

This information can give you a perspective of what you should pay for a home. Given that zip code median price information is easily accessible, you can figure out the overall appreciation/depreciation and run a quick analysis to see if the price makes sense. In a market where prices are falling, the power has shifted completely into the hands of buyers.

Keep in mind these same tools empowered sellers during the boom. All the data was pointing higher and higher and people looked at the information through a different lense. That is, instead of looking at a price and saying, “look at the price! If it was us that bought that home back then!” Now we get a response of, “look how quick prices are falling in this area. If we wait, we might be able to get it less than the purchase price.” The new technology is now going to actually slow the market more so than in typical past market cycles. Before, the correction would happen behind the scenes. Now, it will be painfully transparent to all.

In addition, services like Redfin and ZipRealty now offer discounts to buyers and sellers offering a new model of pricing for the industry.  The ability for consumers to be educated is at their hands.  The idea of “experts” is falling because experts at least through the eyes of many in our society got us here in this mess in the first place. People like Alan Greenspan who once touted the virtues of adjustable rate mortgages have actually gone back on their initial words. So experts can and will be wrong. The fact that all this information is available to you for free is amazing and should be utilized.  Even if you do go through a professional you’ll have a much stronger negotiating stand.  And knowledge is power when it comes to financial decisions.

Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Chris Finley said:

I agree that these new information tools empower the consumer, but I disagree that Redfin, Zillow and Google Street View maps “fueled the housing bubble.” The Housing Bubble was in full force and at its peak before these services even came online. Google Street View didn’t premiere until May 2007 and then only in a handful of cities. Zillow launched in February 2006. Redfin was only in the Seattle area at first. By the time it came to most people’s attention in a “60 Minutes” profile in May 2007, it had expanded to SF and Southern California and was just getting into the Boston area. The national housing bubble was already peaking before these technology even came into popular use, so I don’t see how they fueled the bubble. Greed fueled the housing bubble — not technology.

August 13th, 2008 at 3:24 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!