Housing in a time of rising mortgage rates: A big jump in mortgage rates is here to stay for these reasons.

- 2 Comment

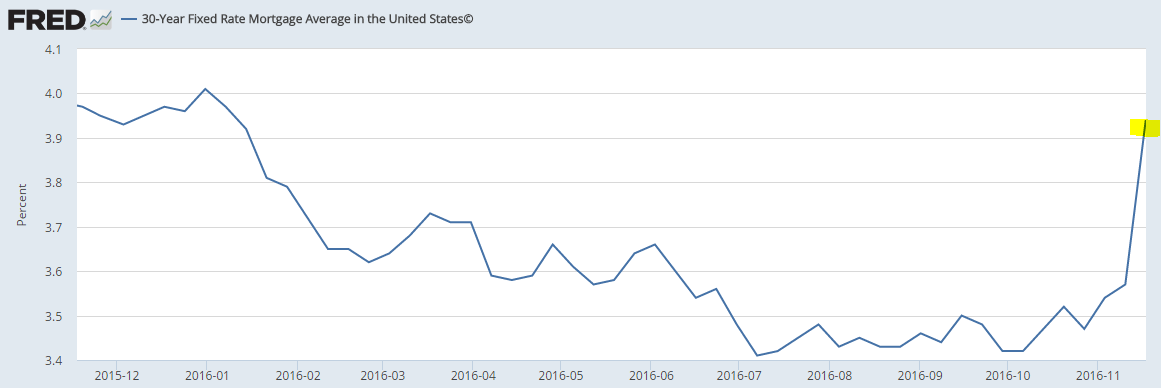

In the midst of everything that is going on, the bond market took a big hit to the tune of $1 trillion. What this means is that mortgage rates tied to Treasury bonds had a massive move, the largest in many years. The 30-year fixed rate mortgage rate jumped to nearly 4 percent, the highest rate in a year. The trend looks to continue as the expectation of inflation is now expected to happen. There are a variety of reasons as to why this will happen and we will go into this later in the article. But this jump in the mortgage market happened during a time that the homeownership rate is already low because people are too broke to afford homes at inflated prices. This is a problem because people are already walking on a financial edge. The housing market just got more expensive for regular people.

Bond market movements

The bond market moved because the new entering administration is talking about cutting taxes but also unleashing a massive infrastructure spending plan. Of course with nearly $20 trillion in public debt, that might cause a problem including inflation. So the bond markets reacted in a clear direction.

Take a look at this chart:

This is a market that is expecting inflation. The market already got exhausted with the Fed in terms of Fed taper lies and simply using lip service to calm the markets so the financial system could extract money from the people working in the economy.

It is absolutely no surprise that mortgage rates went up as if they were reaching for heaven:

That is a dramatic reaction. The bond market is usually calm but this reaction is one where the market is now expecting inflation to hit. The housing market has become expensive because people are broke. Half of Americans are living paycheck to paycheck and the mainstream media is simply disconnected from how most of Americans are living. You rarely hear about median household income or how people budget because the media just doesn’t care. They conveniently leave out this data even though this is the way most people live. People eagerly wait for their paychecks so they can pay their bills.

Another reason higher rates are here to stay is that the incoming administration was very vocal about going after the Fed. This is what they promised. The incoming administration mentioned how the Fed manipulated rates basically to support Wall Street. So it’ll be interesting to see if they take any action on this in the next couple of years. So far, the bond markets are betting on this.

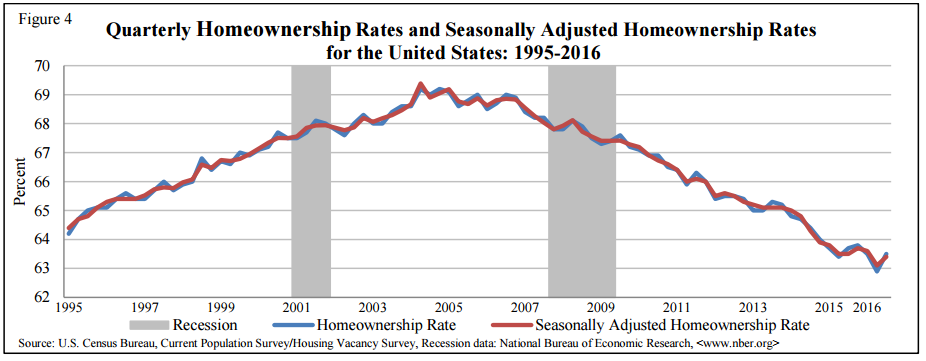

The homeownership rate is likely to trend lower again because mortgage rates just made it more expensive to buy a home:

The homeownership rate is now down to a generational low. Millennials are living at home because they earn very little in their jobs and simply have too much student debt, over $1.4 trillion. That is simply not a recipe for future buying especially from younger people.

Bottom line is people are just too broke to buy homes and this rise in mortgage rates is going to make it more expensive.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Stephen Verchinski said:

Banksters win again. We have seniors now going to see medicare disappeared and health care costs skyroceting. Thank you dems and repubs.

November 20th, 2016 at 2:31 pm -

Tony Deleo said:

Don’t forget the “apathetic” public for sitting around and watching!

December 3rd, 2016 at 10:58 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â