The tax consequences of a shrinking middle class – Nearly half of Americans do not pay income taxes because they earn too little or are flat out on Social Security.

- 10 Comment

Recently the topic of taxes has been put on center stage again. Aside from the political bickering the data shows us an even more disturbing trend. The middle class is demonstrably shrinking at a time that the government is spending money it doesn’t have while the Fed is digitally printing money to save its allied banks. The reason nearly half of Americans pay no federal taxes, this is different from other taxes (i.e., payroll, sales, etc) is that nearly half of Americans make too little money. This might come as a surprise to many given that we are the wealthiest nation on the face of the planet. However, we need only remember that we have the highest percentage of Americans on food stamps in a generation with nearly 46.5 million receiving this aid. Yet part of the data also reflects our aging population. After all, since 1 out of 3 Americans have zero in savings many retire relying completely on Social Security for their income.

The tax data

Let us break down the figures for income taxes:

Source: Tax Policy Center Credit: Lam Thuy Vo / NPR

First, what you’ll notice is that 23 percent do not pay income taxes because they simply make too little. Again, this does not mean that they do not pay payroll taxes (i.e., Social Security and Medicare) which all Americans earning any money must. How low is this? For a family of four it would need to be under $26,400. Given that the average per capita earnings for Americans is $25,000 it should come as no surprise that many fall under this category.

Then you have older Americans on Social Security. Since many rely on this as their major source of income and the typical payment is roughly $1,000 a month, not much you can tax here. Then you have benefits for the working poor that allow additional deductions such as the earned income tax credit. In this case, a family of two parents and two children earning $45,775 would have paid no income taxes. Again, they are still paying payroll taxes. Given the median household income is $50,000 you would expect this figure to put many in the non-income tax paying category.

Yet the overall issue of course is that we are spending more than we make and somehow trying to ignore the fact that we are crushing the middle class. The middle class has shrunk over the last 40 years by 10 percent:

Source:Â CNN Money

What was even more troubling is that nearly half of Americans pass away with zero to their name:

“(NBER) We find that a substantial fraction of persons die with virtually no financial assets – 46.1 percent with less than $10,000 – and many of these households also have no housing wealth and rely almost entirely on Social Security benefits for support.â€

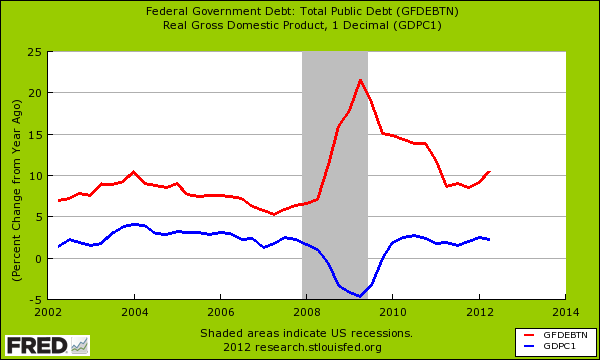

The heavy reliance on Social Security, food stamps, Medicare, and other programs shows how precariously close our economic system is to a depression. We have 46.5 million Americans that would likely have a hard time buying food if it were not for these programs. Does this even remotely sound like an economic recovery to you? The spending keeps going up yet the economic growth isn’t necessarily coming:

You’ll notice that out debt growth is far outpacing out GDP growth. It is unfortunate that mired in all the rhetoric there is little substantive debate regarding helping the middle class. We have a system that is largely controlled by a millionaire Congress that is far removed from Main Street. The fact that many Americans are confused about the tax equation isn’t surprising given the low level of financial literacy in our country. Much of what is out there is set to confuse and keep turmoil in the system. If you haven’t notice, our economic inequality is at levels last seen since the Great Depression.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

clarence swinney said:

VOTE DEMOCRATIC BECAUSE

WWII Draft—R opposed

S&L—R destroyed

Fairness Doctrine-R destroyed

Revenue Sharing-R destroyed

Increase Spending-80%-Reagan did

Increase Spending 92%–Bush II did

Increase Debt 189%–Reagan did

Increase Debt 112%–Bush II did

Invade a small island nation-Reagan did

Invade an innocent poor unarmed nation-Bush II did

Invade one of poorest unarmed nations—Bush II did

President and 11 staffers told 935 Lies to lead us into war-Bush II did

Created 31,000 jobs per month—Bush II did

Since WWII –D created twice as many jobs as R

Select an anti Christ Mormon as candidate for president—R didWant Success? then vote Democrats into office

Want Peace? Then vote Democrats into office

want jobs? Then vote Democrats into officeSeptember 20th, 2012 at 2:16 pm -

clarence swinney said:

1980-2009

20 years 3 R presidents—18 years R Senate—12 years-R House- 6 years Total Control

took 600B budget to 3500B (less wjc itsy)–1000B Debt to 10,000B—surplus to 1400B Deficit–

99,0000 jobs per month compared to Carter + Clinton 222,000—initiated our involvement in 10 foreign conflicts—costing billions and loss of many thousands of loves—Smashed S&L Industry—Housing Industry-Banking Industry from Local to Wall Street Control—Great Recession—50,000 plants were closed 2000-2010– unjust dumb invasions of two poor, unarmed nations to remove leadership and place ours in power creating animosity throughout the Muslim world.Folks! We must get good Leadership and it cannot be neo-con Republicanism

We have the wealth + income to pay off our debt and create millions of new jobs.

It will take tax policies like 1945-1980 that paid off WWII Debt.

We can do it. Romney and Republican control of House/Senate will never do it. Republicans are owned by Wall Street wealth.September 21st, 2012 at 1:43 pm -

Ryan said:

Keep up the posts. I’ve been reading them all and your nailing it. One thing I would encourage you to write more about proactive steps people should take during our country’s financial free-fall. What types of investments do you recommend? We see the storm coming, how do you prepare? How do we position ourselves?

Anyway, thanks for writing these posts.

September 21st, 2012 at 11:55 pm -

Dan said:

Dear MyBudget 360,

The actual amount of income that a family of 4 can have and pay no income tax is higher because of child tax credits. I am assuming in your example that you mean 2 parents and 2 kids. Well, for every child that is under 17 Y.O., you would get $1,000 refundable credit. Therefore, a family could make $26,200 + 19,000 = $45,200 in gross income and pay no income tax.

How did I get to that number. I used your number which is just standard and personal exemptions. Then I assumed $2,000 in child tax credit. The credits pay for the income tax of the 10% income tax bracket (1,700 tax on 17,000 in gross income). Then with the $300 in credits left I chipped away at the 15% bracket ($300 / 15% = $2000). So $19,000 more can be earned and no “INCOME TAX” in the USA.

There you have it folks…$45,200. That is why so many people don’t pay income tax. I didn’t in 2010. Was I on Gov’t assisstance…no. I made about $55K. It was an odd year, but I didn’t pay any income tax. I paid self-employment tax though.

BTW, I am a CPA who specializes in Tax.

September 22nd, 2012 at 6:25 am -

hoser said:

Taxes are a scam anywhy. Our tax dollars feed the IMF under the guise of the US Treasury. Geithner works/answers to Christina Lagarde. http://www.truthattack.org/jml/index.php

September 22nd, 2012 at 2:12 pm -

JungianINTP said:

Which ideology – always working

behind the scenes while employing

Big LIES – seeks to collapse the

system of the meritocratic/

moralistic/capitalistic West?

Virtually every analyst expounding

on the HOW of this financial decline

gravely/mistakenly believes it’s all

attributable to happenstance or mis-

management or utter stupidity,

rather than what, in fact, it is:

the movers and shakers’ conspiri-

torial machinations tha advancing

that ideology; i.e., capitalism isn’t

failing but shuddering under the

weight of

socialism’s/communism’s/feminism’s

ever-expanding

WELFARISM!, which de-insentivizes

the productive and creates a MORAL

HAZARD for the unproductive to feel

comfortable in their “poverty.”

It’s all been planned–it’s by design,

not happenstance nor mismanagement

nor stupidity (( Marxists’ utter stupidity

notwithstanding )).

September 22nd, 2012 at 3:25 pm -

clarence swinney said:

STOP SELLING OUR GOVERNMENT

IT IS A SHAME THAT OUR SENATOR WAS A FRESHMAN AND HAD 1.3M IN HIS CAMPAIGN PIGGY BANK ONLY A FEW MONTHS AFTER BEING ELECTED

Max Baucus—Chair Senate Finance Comm—70% poll for Public option–

Bill hit his comm— first act—removed public option for debate

shocked me—I trusted him. Zap. Report=he had $1,900,00 in his campaign kitty from health care industry..The millions spent by thousands of Lobbyists expect favors. Buy them.

We need a Washington revolution and kick all out

Obama lost me with Gay Marriage. Totally disgusted. I am in a position I trust no one in Washington. I know few are very good but $$$$$$$$$$$$$$$$$$ BUYS ANYONE

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ OUT OF GOVERNMENT—— QUICK

NYT had superb article on Wall Street employees going into many many many government jobs in Congress and White House

They left for a much lower paying job.

Conclusion—Wall Street biggies are placing them in positions to make decisions for Wall Street.

Pay under table or? Many have done this. Worked in Wash for few years then back to Wall street into a higher paying jobThis is sad sad. RULES MUST CHANGE

NO $$$$$$$$$$$$$$$$$$$$$$$$ IN WASHINGTON

NYT had article on Interconnectivity between Board Of Directors in WSA firms

You vote for my pay+pension I vote for yours

sickening5 big banks own 50% of deposits in 7000 banks and 10 own 80%

Restate Glass Steagall—separate Casinos from local banks

County Banking Systems—local wealth kept local to create more local wealth and jobs

WASHINGTON SOLUTIONS (Congress + White House)

Requires overturning Corp is a person

1. fed fund election—6 mos-3 primary 3 general—free equal tv time—debate a week=12=adequate to evaluate candidates NO $$ =O

2. Since they will not need campaign funds Ban them from receiving anything of a financial value this closes K St.

3. Progressive Flat Tax by group—We have the income to pay our way-do it

We rank #2 as lowest taxed in OECD nations. We have an income of $14,00 billion yet taxSeptember 25th, 2012 at 1:40 pm -

clarence swinney said:

why do not Democrats promo this? can you help?

FEDERAL EXPENDITURES(billions)

FISCAL YEAR

2001—1850 (end of Clinton last Budget 9-30-01)

2009—3510 (end of Bush last budget 9-30-09)

2010—3430

2011—3810

2012—3720 (est)

2013—3800 (budgeted) (end of Obama last budget 9-30-13)President Bush

1850 to 3510= (+90%)President Obama

3510 to 3800= (+8.6%)

Sources:omb.gov

usgovernmentspending.com

President Obama Exec. Order 13589-â€Promoting Efficient Spendingâ€

has paid off on goal of 8 Billion reduction by end of his term.September 27th, 2012 at 8:07 am -

clarence swinney said:

BIG SPENDER OBAMA

FEDERAL EXPENDITURES(billions)

FISCAL YEAR

2001—1850 (end of Clinton last Budget 9-30-01)

2009—3510 (end of Bush last budget 9-30-09)

2010—3430

2011—3810

2012—3720 (est)

2013—3800 (budgeted) (end of Obama last budget 9-30-13)President Bush

1850 to 3510= (+90%)President Obama

3510 to 3800= (+8.6%)

Sources:omb.gov

usgovernmentspending.com

President Obama Exec. Order 13589-â€Promoting Efficient Spendingâ€

has paid off on goal of 8 Billion reduction by end of his term.September 30th, 2012 at 8:22 am -

clarence swinney said:

INEQUALITY YES expanded repeat but oh oh so important for the Middle Class

Net Wealth-2010

1%=35%

5%=635

10%=77%

80%=11%

Financial Wealth

1%=42%

5%=72%

10%=85%

80%=5%

OECD rank–4th on inequality–3rd as Least Taxed–2nd as Least tax on corporations

Reagan began redistribution upwards with his 60% tax cut for top incomes.

Ask any friend to guess how much we pay in federal-state-local taxes as a percent of gdp.

No one I asked ever said under 50%. It is 27%. 27%.In Fiscal 2012 federal tax revenue was 2450Billion. We borrowed 1100 Billion.

Our national income is 14,000 Billion. 2450 is a Tax Rate of 17.6%Since 1980, we borrowed 15,000 Billion which let the rich off the hook to retain and grow their wealth.

They pay most of individual income tax but little of income in payroll tax. The big question is how much of Total Income do they pay not the Adjusted Gross Income which has their deductions.Mitt Romney is proposing a 20% tax cut which means more borrowing like Bush who gave top 5% 48% of his tax cuts and borrowed 6100 Billion(5800 on 9-30-1 to 11.900 on 9-30-09) or doubled our debt in 8 years.

We have the Income to balance our budget but we must tax the top10% to do it.

Clarence Swinney political historian Lifeaholics of America –burlington nc

author-Lifeaholic—Success by working for a Life not just a Living.October 21st, 2012 at 7:29 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!