How to get out of Debt: Can it be the American Consumer is Contributing to Deflation by Paying off Debt?

- 1 Comment

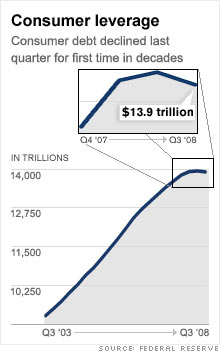

The Federal Reserve flow of funds report was issued this week and for the first time since 1951, when records started being kept household debt has actually declined. The larger meaning of this? Many Americans simply cannot take on anymore debt. What it also means is that many Americans are more reluctant to take on more debt onto their balance sheets. That is an important shift in consumer psychology. Even if the government tries to encourage spending by giving banks and lenders easy access to money this does not necessitate that people actually use the money or use the money to spend.

The retail sales numbers came out today and once again they have declined for the 5th straight month. People are simply not spending as much. That is why when I talked about 10 reasons we will have a minor depression, I noted that retail sales will play a big factor in determining a point where we may hit a bottom to our current economic problems. Until we get employment and retail sales back up, we will not be out of the slump.

Take a look at this chart showing consumer debt topping out:

*Source:Â CNN.com

Even though the drop of 0.8% is tiny, it does signify a shift in what is going on but more importantly it is another factor showing us that we are clearly in a deflationary environment. The Federal Reserve and U.S. Treasury are doing all they can to avoid deflation because deflation unlike inflation, causes people to pull back on their spending more furiously. Think of the Great Depression. Why would you purchase a home today when you know it will be cheaper tomorrow? Why would you go out and buy a car today when next year it may be significantly cheaper? That is the consumer psychology making the rounds right now.

With inflation, there may be an incentive to purchase now. As perverse as the housing bubble was, if you were to believe housing prices always went up you had an incentive to buy today. If you felt the home would be more expensive next year, you’d go out and spend today. As bad as inflation is, it is more manageable at least from a monetary perspective. If inflation gets out of control, they can simply raise rates. With deflation? They have very little in their arsenal to combat it. That is why the effective rate on the market is near zero already. That is why the government is not only the lender of last resort now, but it will also be the spender of first resort. The data in this recent report tells us people are not spending and actually paying down current debts.

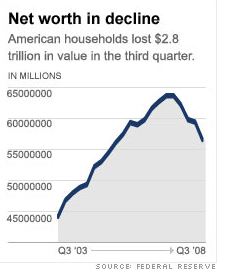

Part of this also comes from U.S. households losing $2.8 trillion in the third quarter in their net worth:

That is a painful decline. This is a drop of 4.7% and the largest decline in the 57-year history of the report. It also marks the fourth straight quarter of declines. You also have to keep in mind that this report does not include October, November, and December which have been even tougher months. Where did the markets end on September?:

Dow:Â Â Â Â Â Â Â Â Â Â Â Â Â 10,850

Nasdaq:Â Â Â Â Â Â Â Â Â Â 2,091

S & P 500:Â Â Â Â Â 1,166

What you can expect is the net worth of many Americans will show significant declines again for the fourth quarter of 2008. I would also suspect that given the debt destruction by people defaulting on mortgages and credit cards, that you will see debt decline once again.

So what can you do in this climate? If we are to remain in deflation for a short period, the best thing you can do is pay down any debts you may have. This should be a primary target. In fact, you should go after credit card debt first. Why carry a balance of 15 percent or higher when a savings account is only yielding 2 percent? Pay down that 15 percent and you’ll at least know that you are “earning” a 15 percent return right now in this market which is practically unheard of.

The balance sheet of many Americans may look weaker but there are things you can do. If you are planning on buying a home or a car, don’t. These two sectors are deflating at incredible rates and all economic fundamental data is pointing to further declines. What do you think automakers are going to do next year? They are going to have inventory overload and will look at ways to moving the items. In economics the best way to move something is through price. Lowering the price.

I wish I could say the same about the U.S. government but we are going to be in debt for some time. It doesn’t look like in the short term we are going to do anything to address our massive debt. Given the current employment situation and fragility of the credit markets, I just don’t see anyone advocating a balanced budget approach. But that doesn’t mean you shouldn’t try to get your house in order. You should. Even people that make $46,000 for their household can find ways to save. It takes flexibility and adaptation but it can be done. Hopefully this gives you a few ideas on how you can prepare.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Tatiana said:

Anna Schwartz, the doyenne of US mrtsnaoiem and life-time student (with Milton Friedman) of the Great Depression. It cannot deal with the underlying fear that lots of firms are going bankrupt. The banks and the hedge funds have not fully acknowledged who is in trouble. That is the critical issue, she adds.Lenders are hoarding the cash, shunning peers as if all were sub-prime lepers. Spreads on three-month Euribor and Libor the interbank rates used to price contracts and Club Med mortgages are stuck at 80 basis points even after the latest blitz. The monetary screw has tightened by default.York professor Peter Spencer, chief economist for the ITEM Club, says the global authorities have just weeks to get this right, or trigger disaster. The central banks are rapidly losing control. By not cutting interest rates nearly far enough or fast enough, they are allowing the money markets to dictate policy. We are long past worrying about moral hazard, he says. They still have another couple of months before this starts imploding. Things are very unstable and can move incredibly fast. I don’t think the central banks are going to make a major policy error, but if they do, this could make 1929 look like a walk in the park, he adds.The Bank of England knows the risk. Markets director Paul Tucker says the crisis has moved beyond the collapse of mortgage securities, and is now eating into the bedrock of banking capital. We must try to avoid the vicious circle in which tighter liquidity conditions, lower asset values, impaired capital resources, reduced credit supply, and slower aggregate demand feed back on each other, he says.New York’s Federal Reserve chief Tim Geithner echoed the words, warning of an adverse self-reinforcing dynamic , banker-speak for a downward spiral. The Fed has broken decades of practice by inviting all US depositary banks to its lending window, bringing dodgy mortgage securities as collateral.Quietly, insiders are perusing an obscure paper by Fed staffers David Small and Jim Clouse. It explores what can be done under the Federal Reserve Act when all else fails.Section 13 (3) allows the Fed to take emergency action when banks become unwilling or very reluctant to provide credit . A vote by five governors can in exigent circumstances authorise the bank to lend money to anybody, and take upon itself the credit risk. This clause has not been evoked since the Slump.Yet still the central banks shrink from seriously grasping the rate-cut nettle. Understandably so. They are caught between the Scylla of the debt crunch and the Charybdis of inflation. It is not yet certain which is the more powerful force.America’s headline CPI screamed to 4.3 per cent in November. This may be a rogue figure, the tail effects of an oil, commodity, and food price spike. If so, the Fed missed its chance months ago to prepare the markets for such a case. It is now stymied.This has eerie echoes of Japan in late-1990, when inflation rose to 4 per cent on a mini price-surge across Asia. As the Bank of Japan fretted about an inflation scare, the country’s financial system tipped into the abyss.

March 10th, 2012 at 1:07 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!