I am Inflation, Destroyer of Worlds: Poor and Middle Class Get Smashed by Inflation.

- 2 Comment

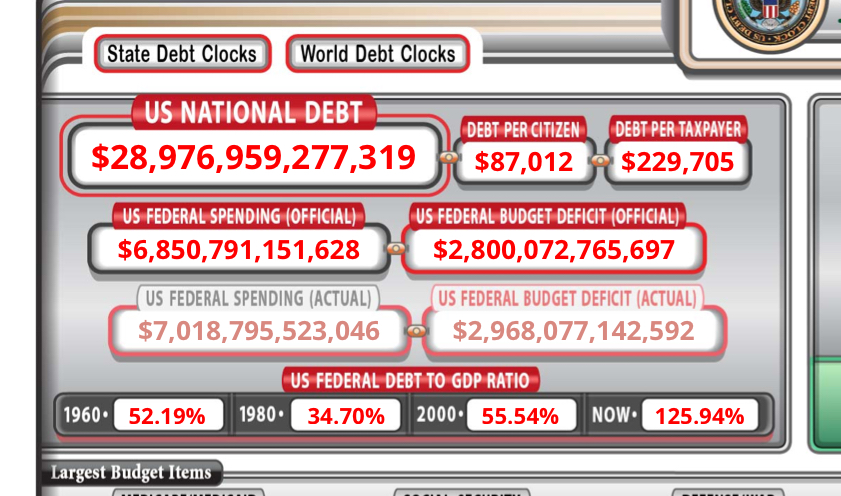

Inflation, inflation, and inflation. People tend to think that inflation merely means higher prices. Yet the type of inflation we are dealing with is extremely problematic. Inflation is running at a multi-decade high clip at 6.2% annualized and it may be even worse since the way we measure inflation is an imperfect science. Inflation punishes the poor, middle class, and savers. You wonder why the stock market, crypto, and real estate are all at record high levels? People with assets are chasing yield and younger Americans are disenfranchised and want to swing their YOLO bets on Crypto since many believe this is the only way to become financially independent. All of this reeks of an unsustainable period in economics but we are in a perpetual bubble world. Our national debt is inching closer to $29 trillion which seems comical and the Fed balance sheet is at record levels. So the notion that they will willingly let rates go up does not seem like an option. So Jane saver who has her money at Bank of America is earning close to 0% in her savings account which is actually losing purchasing power each year. Inflation is a destroyer of worlds and here are the winners and losers.

Winners – Debt Holders

One group that wins with inflation are those with debt at locked in rates. How do they win? Your debt does not increase and is fixed at a rate that arguably has to be lower than the inflation rate. So winners in this area are the US government since our national debt is at a very low rate so we still have the ability to borrow long at a low rate yet have the ability to inflate our way out. Does this seem like a magician’s act? It does but that is the environment we are in. Here is our balance sheet:

The winners are also older households like Baby Boomers since they hold low rate mortgages and you have an inflating bubble so the underlying asset is going up while their debt is locked in at low rates. All of this is artificial and of course is manufactured to choose winners and losers. This is why many young Americans are trying to find ways to beat inflation.

Losers – poor, middle class, and savers

Of course inflation does cause harm to other people like the poor, middle class, and savers. For the poor, many are living paycheck to paycheck. In the US, 1 out of 3 Americans are living paycheck to paycheck. So for this group, wages are simply not keeping up with the cost of goods going up every month. So one pound of steak goes from $6 to $10 but your wages stay stagnant. What do you do? You shift down to say chicken or no meat protein or other alternatives. This is all happening in real time. The reality is, the US has largely ignored the poor for a generation and are simply viewed as hamsters in the economic engine. It is no surprise that we are seeing “anti-work” movements and people simply opting out of the system in various ways.

The middle class loses in different ways. Say you are saving money in a CD or more “secure” options that once were a viable option. But right now those are paying zero to one percent and with inflation running at 6%, you are losing money unless you are getting at least 6%. So what do you do? You need to take on more risky bets. This can be with higher priced stocks, crypto, or real estate if you can afford it. For many it seems like the Red Queen’s race – running faster and faster just to stay in the same spot.

Why is inflation the destroyer of worlds? Because you need to place your bets or your money will erode over time. The idea of saving is almost nonsensical in a high inflation rate world. You are losing your purchasing power more aggressively each day. Deflation is even worse since it forces people to pause their spending which in turn causes a vicious cycle downward. In a consumption based economy like our own, you want a bit of inflation, say 2 to 3 percent just to keep people spending and encouraging people to consume more. But right now there is so much easy money floating around and hence our high inflation rate.

The Wealthy Get Wealthier

The pandemic has been great for the top 1 percent. They own half of all assets in the US and guess what went up since the pandemic hit? Stocks are at record highs, real estate is at a record high, and pretty much anything that they own is up. So this group had some of the best asset performance during a global pandemic. Yet this group is a small portion of our population and what is breaking down is the idea of a stable middle class in the US. A lot of it now seems like predatory capitalism in the West and top down aggressive authoritarianism in the East. Both do not seem like sustainable systems so we need to get back on track and focus on building a stable middle class: good jobs for many, affordable education, healthcare that works for most, and a focused America first strategic agenda versus this nonsense “Red vs Blue” tribalism that is being exploited by paid bots and nefarious state players.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Homer O Goodall said:

I’ve been destroyed by inflation. My employer now gives me 1900 a month, but many times the bills outstrips it.

November 20th, 2021 at 7:15 pm -

Jay said:

Inflation is getting out of control and not sure how we are going to handle it.

September 14th, 2022 at 10:38 pm