Income Based Repayment plan cementing inflated higher education costs for graduate school: How new IBR Pay as you Earn plan will be a big win for graduate students and keep college costs high. Student debt to hit $1.8 trillion in 2020.

- 1 Comment

It is interesting that the two segments in our economy mired in debt, housing and higher education, were largely inflated courtesy of easy access to debt. New rules on how students pay back their student debt including the Income Based Repayment plan ironically will keep prices inflated. The new program dubbed “Pay as you Earn†reduces the cap on loan payments from 15 to 10 percent of a borrower’s income and accelerates loan forgiveness from 25 to 20 years. As we will highlight, this will largely aid in keeping prices inflated especially in graduate schools since the government will provide a subsidy to this cohort. It is interesting that the fastest growing debt segment of the economy after the recession has come in student debt. Instead of looking at the issue comprehensively, it is likely that we will continue to push this bubble until it pops.

Income Based Repayment

One of the interesting changes with the IBR rules is that it will likely provide a large subsidy to those going to graduate school especially in certain disciplines. Take a look at the below example:

“(BusinessWeek) We have one example of someone who might look similar to an MBA student. He starts out with a starting salary of $90,000 and by the end of 20 years is making $243,360. Under the old IBR program, he’ll have paid $409,445 by year 25 and be forgiven $23,892 of his loan balance. Under the new IBR repayment plan he’ll pay less than half of that, or $202,299, and be forgiven $208,259 by year 20. The old IBR plan was punitive if you borrowed a lot of money, made you pay more over time and trapped you, so there were serious consequences to doing that. It was a downside and a pretty big risk, which is why you didn’t see people borrowing without regard to how much it will cost. The new plan essentially eliminates any downside or risk for that type of behavior, and cuts payments in half and then some.â€

In other words, the government is all the more willing to write-off the debt for many that are likely to have the ability to pay for it. In the mean time, in the private student loan market we have for-profits gouging students and the figures for student debt simply continue to grow.

How much student debt do we have floating out in the market?

What is amazing is that a plan like this will simply encourage people to borrow as much as possible since there are little consequences in the end. Sort of like low down payment loans for housing. If you find yourself in trouble, you can simply walk away or how things are playing out today, the government is likely to help banks to modify away and drag out the foreclosure process. In the end the public ends up paying for all of this since it erodes the purchasing power of others via inflation.

Take a look at this:

“My advice to people who are about to enter graduate school or get an MBA would be to borrow as much money as they possibly can through the federal student loan program. They shouldn’t use their own money, savings, or income to pay for it because the risks or the downside of this having real financial consequences for you, provided this program is in place, are almost zero. And to the extent that there are risks, they are well worth taking because the potential upside is pretty big on this.â€

Of course this is the kind of mindset that will come out of programs like this. Why not borrow $1 million if you will be capped at only paying 10 percent of your income? In the end this creates massive mispricing in the market. For example, if you are consuming $200,000 in graduate school education but paying hardly anything back, then of course this will encourage people to go into deep debt. Why not?

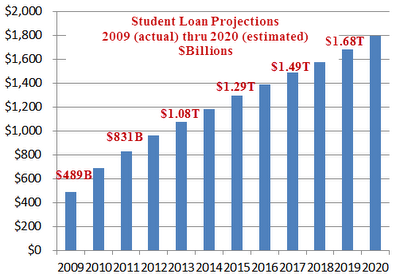

So it is no surprise that the amount of outstanding student loan debt has done this:

Source:Â Global Economic Analysis

At the current rate, student loan debt will hit $1.8 trillion in 2020. Does this seem feasible with all the other massive debt obligations we have as a nation?

How can it be in the last decade, the two largest bubbles have occurred in housing and higher education where banks, the Fed, and the government all worked together?

Ironically this program is called “Pay as you Earn†but in reality the end cost is going to be taken on by the rest of the nation. Why earn when you can simply go into massive debt?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

peter said:

WHAT A CON JOB. THE KIDS GRADUATING FROM COLLEGE TODAY ARE COMMING UP SHORT. GET GOVT. OUT OF SCHOOL AND GO BACK TO THE GOOD OLD DAYS IN-WHICH H.S. OFFERED A ACADEMIC COMMERCIAL OR GENERAL DEPLOMA. I CAN’T FIND A ELELCTRICIAN OR CARPENTER WITHOUT DIFFICULTY. YOU CAN MAKE A GOOD LIVING WITH A COMMERCIAL DEPLOMA FROM HIGH SCHOOL. TAKING A COMMERCIAL DEPLOMA I LEARNED HOW TO TYPE 125 WORDS A MINUTE I COULD DO ANY TYPE OF BOOKEEPING INCLUDING PREPARING FINANCIAL STATEMENTS, AND I NEW MORE ABOUT ECONOMICS THAN GUYS GRADUATING TODAY FROM YALE.

January 20th, 2013 at 7:54 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!