Inflation conundrum, price increases without wage growth are unsustainable: Central banks around the globe aim at inflationary targets but have a hard time inflating wages.

- 0 Comments

Inflation has a slow corrosive power that few people ever see. We all realize that rust will occur on exposed metal through a slow process of oxidation. One rain will not do this. It takes time. Little by little the destruction occurs. I’m always thrown aback when I hear some people say something like they bought a house in 1970 for $25,000 and of course, this fact seems incredible when homes are selling for $200,000 today. The logical conclusion is that buying a home is a fantastic deal. What they don’t bother doing is adjusting prices for inflation. Wages were also a lot less back then. What about opportunity costs on other investments? Central Banks understand that few people bother with the inflationary math and simply live by a doctrine that views price hikes as something that is built into our economic system. Yet this constant push for higher prices is brought on by the policies taken by our financial system. For example, take housing today. Housing values in the last year have increased by double-digits across the U.S. This is a good thing, right? Well not when you look at why this is occurring. Large financial institutions have found loopholes in the system to access cheap capital and have now decided to crowd out regular home buyers in the market. A chase for yield has resulted but all this has done for regular households is cemented a system where more disposable income is going to housing, either in rents or housing payments. Price increases without wage growth are flat out unsustainable and that is the conundrum we find ourselves in today.

Fed policy helped banks, not U.S. households

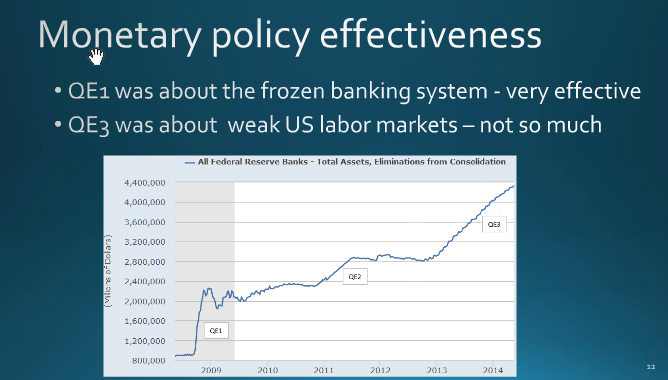

Actions taken by the Fed including QE1 and the more recent actions of QE have resulted in a rebirth for the banking system, with all the crony aspects intact. For example, Jamie Dimon CEO at JP Morgan Chase recently received a 74 percent raise. The typical U.S. household has seen absolutely no wage growth for nearly two decades after adjusting for inflation. This is the fundamental problem with how the bailouts were undertaken and continue to result in inflation that is eating away at every penny Americans have. Access to the trappings of a middle class lifestyle now require outrageous levels of debt including student debt for higher education access.

Take a look at the Fed’s balance sheet:

Do you see any realistic tapering here? Of course not. The Fed like other global central banks are laser focused on inflating the previous system with all the malfeasance that brought on the first debt crisis. QE has done very little for our labor markets. New jobs are showing up in the low wage economy but how useful is that? I doubt most Americans are receiving 74 percent pay hikes for being part of a financial system that brought us to the brink of Great Depression 2.0.

Income and housing

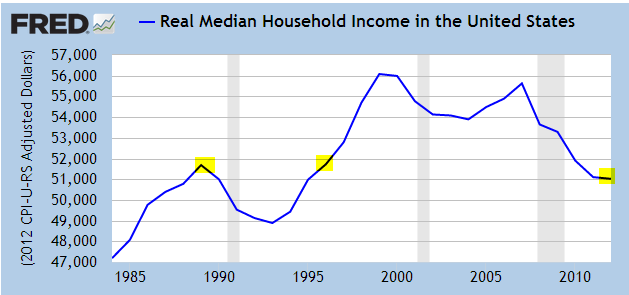

Income is the lubricant that keeps our system going. If we look at household wages, inflation has ravaged any growth here:

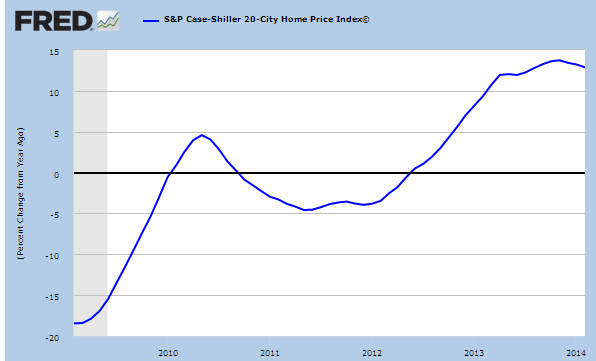

Real household incomes are back to where they were a generation ago. This is precisely why most Americans do not feel that this is a recovery. The reality is, more and more income is being devoured by the costs of daily living. Housing surged up last year but this is because the banking system has created perverse incentives for large investors to crowd out regular buyers in the residential housing market. Keep the income chart in mind when you look at this chart for housing values:

Housing values are up by double-digits in the last year. So what you have is simply more money going into the housing market. The Fed and banks own this new market so in an odd way, banks are simply eating up more income in this new version of a rentier class.

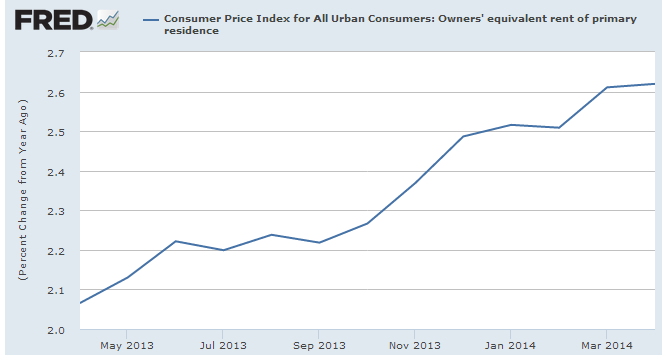

The BLS CPI measure is largely missing out on the big jump in housing prices. But it is now trickling down as investors jack up rents on the low supply of housing:

Rents are going up but incomes are not. So all you have is more money being sucked away by the banking sector. What kind of bailout was this? This was a bailout system that only entrenched the financial sector deeper into their ways. The middle class? Let them eat cake and have a taste of austerity. This is why we are facing a massive retirement disaster as Americans have ill prepared for their future.

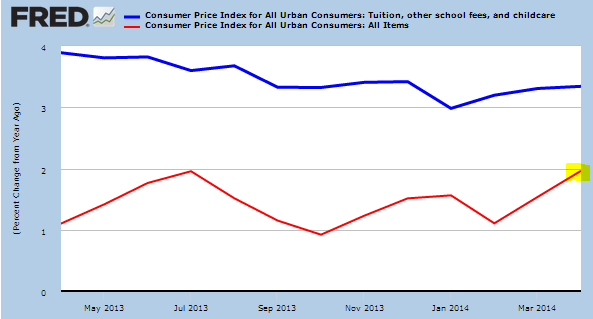

Central banks would like to have a 2 percent annual inflation target and it looks like they are hitting it as long as you measure it in a way that is convenient to your end goal:

Didn’t the Case Shiller chart show home prices rising by double-digits? Of course. Yet the BLS CPI only measures the owners’ equivalent of rent (OER) which completely lags the real housing market by years at a time and in the past crisis, completely missed the housing bubble. Housing either in rent or mortgage payments is the biggest expense for American households. Yet we are not getting a clear picture of price increases here.

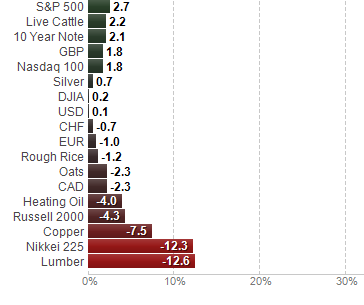

This path is fully unsustainable as Japan has recently witnessed with their multiple QE adventures that have resulted in two lost decades. It worked for a short burst and created a rally in the markets last year but how is the Nikkei doing this year?

*Year-to-date performance

The Nikkei average is now down by 12 percent for the year. We are simply trying to solve a debt based crisis with more debt while maintaining the same banking system that led us into this deep hole in the first place. What can possibly go wrong?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â