Does inflation even matter? The growing secrecy of the CPI and how average Americans face budget squeezes through financial maneuvering and the chained CPI.

- 0 Comments

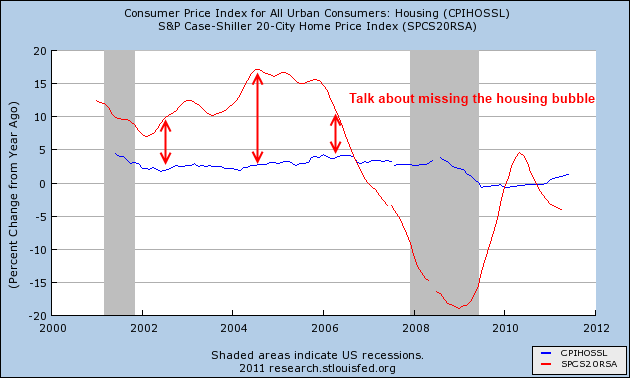

Things seem to be progressively getting worse for the middle class as most of the debt ceiling talks revolve on sticking it to working Americans as if they were financially able to handle any more austerity moving forward. While the too big to fail banks swim around in pools of bailout money like Scrooge McDuck both sides seek to squeeze more pennies out of working class Americans. One way that the middle class has been hammered over the past few decades comes from the way we measure inflation. The CPI measure through the Bureau of Labor and Statistics does not even examine actual home ownership carrying costs and uses a very open method of calculating home costs by using an owner’s equivalent of rent. This is why during the most obvious housing bubble in history home prices seemed to be increasing at a moderate pace according to the CPI while the more accurate Case Shiller Index was registering annual increases of 15 percent or more. This is important because so much rides on accurately measuring inflation in our country and more is trying to be done to stifle information that reflects the real changes to our overall economy.

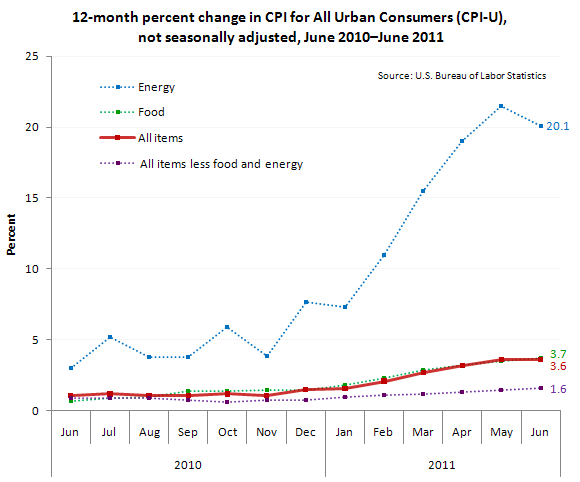

Inflation growing slowly if we exclude food and energy

I always find it amazing how some pundits like to remove food and energy from measuring the CPI yet so much spending goes into these two items. This is also important since stagnant paychecks don’t go as far in covering these monthly budget needs. As we go forward we start getting a more inaccurate perception of inflation. For example, housing is the biggest item in the CPI because most Americans spend the largest amount of money on housing per month. So with that said, you would expect an accurate reflection in the CPI for housing. But if we look at the CPI housing measure versus the Case Shiller Index we realize a serious problem is occurring:

This is such an important item to look at because so much rides on this measurement. The Federal Reserve based much of their low rate Fed Funds policy on the notion that no inflation was occurring in housing that was out of the norm. It was clear that even early in the 2000s home prices were already far outstripping the overall CPI measure. We can say that this was merely a once in a lifetime bubble and we have now learned our lesson. But even with the full acknowledgment of the bubble, nothing has been done to fix the measure! In fact, there is now a push to use a “chained CPI†that will make inflation seem even lower moving forward:

“(WSJ) One proposal in the budget talks that is getting a serious look from all sides would switch the government’s way of measuring inflation and delivering a big impact on tax, spending, and entitlement programs.

How big? It could save roughly $300 billion over 10 years. That big.

The idea of using this different measure of inflation, known as a “chained†Consumer Price Index, has won support from numerous deficit-reduction commissions as well as many liberal and conservative economists.â€

It should be no surprise that both political parties are onboard on this move since they are simply looking at ways to simply chop at the middle class while protecting the financial elite. All of a sudden these people have conservative attitudes toward finance yet were funneling trillions of dollars to banks with no abandon.

If you wonder where the savings are coming from just go to the Social Security website for one place:

“(SSA) There will be no increase in Social Security benefits payable in January 2011, nor will there be an increase in SSI payments.â€

So instead of reforming the financial system in this country that is the root cause of this mess we are going to balance these enormous budget deficits on the backs of seniors and their Social Security payments by understating inflation? What in the world are we coming to? This is starting to feel more and more like a low wage banking corporatist nation:

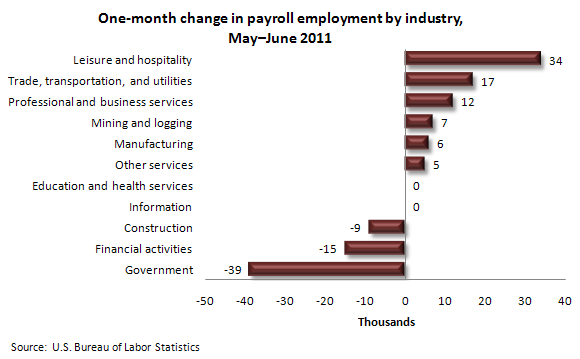

There should be little surprise that the top employment field in the latest month of data shows that “leisure and hospitality†was the top hiring sector. In other words our top sector is temporary with low employment security. How does this bode well for the middle class that now has to contend with more technocrat methods of measuring inflation?

Global markets are smarter then that and that is why we have seen raging price jumps in virtually all commodities. Part of this has to do with a declining dollar, perceived market risk, and simply global markets catching on to this game of hiding inflation.

The Federal Reserve is playing an interesting hand here. First, they do want to create inflation because that will make our monumental debts cheaper in the long-run. At the same time, they don’t want this inflation to appear in official government data because this would force more payments out in a variety of programs including Social Security. So the name of the game is internally fry through dollars while telling the public that inflation is nonexistent. This is the kind of loose accounting the Federal Reserve does to keep its banking friends happy.

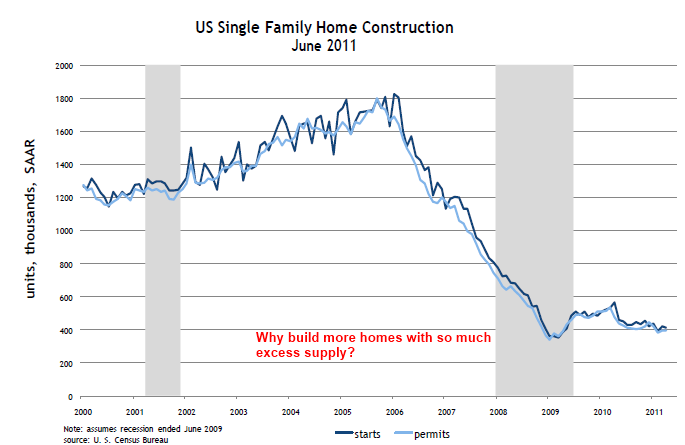

Yet we know the reality and that is that the middle class is shrinking. This is why a sector like housing that has busted has yet to recover:

There is no demand for new homes since we have a massive backlog of homes to sell. The market collapsed in 2006 and has been in the trough since 2009. If there were demand builders would be out there but the above chart shows no sign of this. Yet we do see the price of food, energy, healthcare, and college screaming up. The fact that the government realizes they can save $300 billion over 10 years on the backs of working and middle class Americans by understating inflation is troubling. At the same time, there is no push for reform or clawbacks or anything resembling reforming the financial system coming from Wall Street or the government. All this theatrics is merely to determine how much pain the middle class is going to get. Don’t be surprised if you hear pundits and officials telling you that no inflation exists.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!