When it costs more to be poor – Fed and government shifting inflation onto rent, medical care, and food. QE3 to widen the gap between the poor and the wealthy.

- 9 Comment

Inflation has been picking up since the recession ended in 2009. The problem with the CPI increasing year over year with no rise in household incomes is that the standard of living for most Americans erodes every year that incomes do not keep up. Household incomes are back to levels last seen in the mid-1990s while the cost of necessities has gone up. This brings us to our article today that examines the nuts and bolts of what constitutes the Consumer Price Index (CPI). The CPI attempts to measure the changes in price for consumer goods and services. Overall it did a very poor job of measuring the housing bubble because of the owner’s equivalent of rent metric. Today, it is understating inflation because of the excess spending on “wants†that occurred in the 2000s has now shifted to spending on “needs†but is being dragged down by the amount of family spending on needed goods. We will dig deep into this data but suffice it to say that the Fed is creating inflation in items most Americans actually need to live their daily lives and the burden on the poor is actually increasing.

Do not believe the talk that inflation is nonexistent

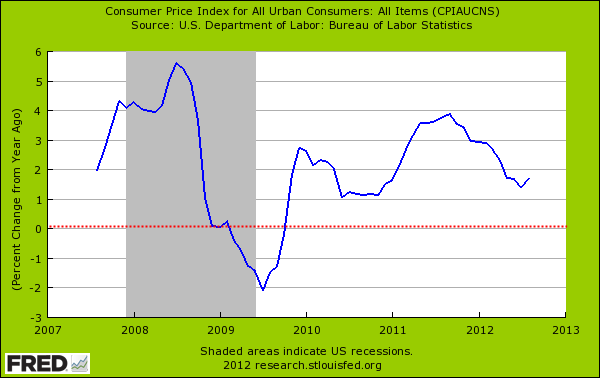

Even a one percent rate of inflation is troubling if incomes are stagnant or falling. Since the recession has ended inflation has occurred even as measured by the CPI:

Over this same timeframe, household incomes have remained stagnant and household net worth has fallen close to 40 percent. Yet there is something more troubling in the actual data. The inflation rate is actually being understated because Americans have shifted consumption from non-essential goods to actually seeing inflation in things that they actually need. In the 2000s spending on wasteful items was rampant and much of it came because of the easy access to debt. Yet with 100 million credit cards being yanked out of the system, this spending has fallen dramatically. So where exactly is the inflation occurring?

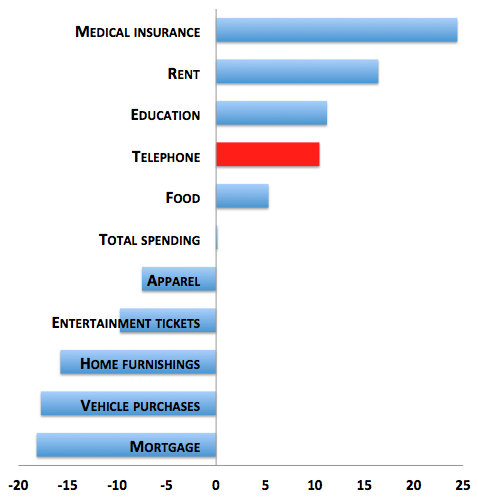

Change in Family Spending: 2007 – 2011

Source: Â The Atlantic

This is a very important chart to examine. What we find is that family spending has gone up on items that are daily needs. The biggest change has occurred on medical insurance and rents. The cost of rents going up has come thanks to the financial system allowing million of properties to be held off the market thus allowing prices to be pushed up as the population grows. The price of rents going up isn’t a sign that incomes are going up but a troubling fact that Americans have to allocate more of their funding to housing. Of course, this is hitting working, middle class, and younger Americans hardest who actually do not own a home.

Next you have the bubble in higher education raging. Students are taking on incredible levels of debt to support their educational pursuits. No other generation has had to face so much debt with such a minefield of scam artist institutions that basically have millionaire presidents and are one step above a paper mill. Yet thanks to easy government loans and banking lobbyist in cahoots with these institutions, the ultimate bill is passed on to taxpayers and those taking on the loans. It is sophisticated way to launder money under the guise of helping Americans. The quality checks are removed like selling a car for cheaper because it has no seat belts or brakes. It also waters down degrees from quality institutions as more subpar degrees flood the market.

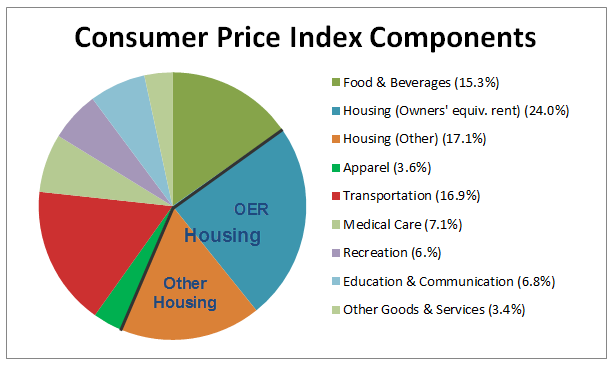

Finally you have an increase in the price of telephone service and foods. The only item that has increased that might be considered a luxury is in the telephone category. Yet food is an absolute necessity. If we break down the CPI weighting we find the following:

Food and housing are the biggest line items. However because mortgage spending has fallen thanks to the Federal Reserve and Americans spending less on home furnishing and vehicle purchases the CPI is not reflecting the big changes occurring. A 15+ percent increase in rent from 2007 to 2011 with no increase in income is sizeable. Yet the items where family spending has fallen is largely elective. So when we look at family spending and then look at the CPI, you can understand why the increase in inflation seems modest yet most Americans are feeling the pinch to their wallets much tighter.

This is why the Federal Reserve through QE 3 and massive amounts of mortgage backed security purchases is essentially robbing from Peter to pay Paul. The end result is that you have shifted more of a burden to renters to essentially take off a bit of steam from home owners. Now you have major private equity investors buying properties and hiking rental prices since they are able to borrow money cheaply. In all reality you have shifted a larger burden on those least likely to have the means to afford it. This is why we have seen the middle class shrink in the last few decades and the ranks of the poor grow even larger. With over 46 million Americans on food stamps we really are becoming a split nation. And again, refer to the chart above on family spending. With the rise in the cost of food you are squeezing the lowest rung even further. Yet this is the setup of the current system. The Fed is picking winners at the expense of others. This is what occurs when you have manipulated money creation and coddling the banking sector versus actual real growth in the economy. When you see those headlines about inflation figures keep all this data in mind.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

9 Comments on this post

Trackbacks

-

PacRim Jim said:

QE = quantitative easing into poverty, disorder, and socialism.

If the money wasted in the various QEs had been spent on infrastructure, the entire infrastructure of the U.S. could have been rebuilt, while providing millions of jobs.

Instead, trillions vanished into unknown pockets, to be repaid with interest by our children and grandchildren.A quiet death knell for freedom, but a death knell nevertheless.

September 30th, 2012 at 12:06 pm -

DaveA said:

It does cost more to be poor, but that cost is borne by other people not yet poor enough to qualify for Medicaid, Section 8 housing, Obama phones, and food stamps. Furthermore, these benefits (unlike your wages and savings) must keep up with inflation, or the beneficiaries will riot in the streets.

September 30th, 2012 at 5:07 pm -

RUSS SMITH said:

Hi!, Patrons Of My Budget 360 Et Al:

Everythng mentioned in this article should be viewed only as pre-hostory date looking forward to the massive tax increases not measued by the CPI coming on New Years’ Day; when the Bush Tax Cuts expire. Then the new data sheets will be formed with their new pie charts but I didn’t see taxes in the pie inside this article did you? I don’t know about anyone else but reality tells me to pay for everything charged withou leaving anything off of my personal costs pie charts but I’m known for over immagining things plus being a little pevish like Chicken Little. Anybody want to volunteer to pay off my credit card debts & thank GOD I don’t have any too expensive to handle student loans to feed either. These articles are like trying to trade the futures’ markets with prices stuck in time and prices we’re going to pay in the future won’t be stuck in time either, because they will even change on us while we sleep. You see there’s no mercy available to the Middle Class either, because the government that feeds off OUR collective saleries/wallets is compltely broke. It use to be we were lined up for some relief on our vhicle license tags payments but now they go a few notches each year along with the aging of OUR vehicles. They say inflation is tame but my wallet says it’s robbing all of US more now than ever before and some analysts are saying inflation is just starting with decades yet to go to the finish line whatever that means? If OUR political parties know nothing else, they sure know how to allow the Federal Reserve to pump more money out of thin air to raise OUR collective prices day by day don’t they? Next thing you know they’ll charge us to get into the voting booths; just like some businesses have pay toilets? Stand by for Taxmageddon right after the New Year & watch your pie charts add a few more colors etc.

RUSS SMITH, CALIFORNIA (One Of The Broke States)

resmith@wcisp.comSeptember 30th, 2012 at 8:45 pm -

Hillary said:

It comes as no surprise to me. I have seen it happen in real time. I was in Florida awhile ago and the inflation there was through the roof. IT has become less evident the father north I have moved.

October 2nd, 2012 at 9:00 am -

mike said:

Jim, I agreed with all of your post instead of the bits about “socialism.” Investing in infrastructure and providing jobs in the process IS socialism, as you’re asking for the money to be spent on public services for the benefit of everyone. Using socialism as a dirty word only weakens the argument that money should be spent anywhere but at the behest of the top 1 percent. Surely any reader of this blog knows how capital has gone predominantly to the upmost echelons of society at the expense of 99 percent of the country; let’s not adopt their memes too.

October 3rd, 2012 at 11:28 am -

mike said:

And Dave, the “Obama phone” was a right wing meme. It was actually started by Bush II in ’08.

http://thinkprogress.org/election/2012/09/27/924011/the-truth-about-the-obama-phone/?mobile=nc

October 3rd, 2012 at 11:30 am -

clarence swinney said:

Sorry–a repeat but so darn important

BALANCE THAT BUDGET

1945 to 1980 we taxed wealth and estates to pay off WWII debt.

Now, we need the same to Pay off the “Republican†debt.

We have an income of 14,000B.

2013 budget calls for 2900B in revenue and 900B in deficit.

A shame that a nation with 14,000B income borrows 900B on a 3800B Budget.

We rank #4 on Inequality in OECD nations and above only Chile and Mexico as Least taxed.

In Federal-State and Local taxes we tax 27% of our GDP..

Since 1980, our tax rates have been cut to favor the wealthy.

Top 50% take 86% of individual income and pay a 12.5% Tax Rate

70,000,000 take 14% and all pay the full payroll tax.

The top 400 are billionaires. Some pay no payroll tax.

Most pay less than 1%.We MUST go back to taxing Estates and Wealth at higher rates.

One family has more wealth than 90% of families.We can balance our budget and pay off our debt which will give the middle class a larger share of our wealth and an improved standard of living. clarence swinney

October 3rd, 2012 at 1:02 pm -

clarence swinney said:

TAX FINANCE

The Tea Party is saying that taxes on land and financial assets punish the “Job Creatorsâ€.

The wealthy claim they need to be pampered with tax preferences to invest and employ labor, while the 90% need to be kicked and prodded to work harder and get paid lower wages.

These falsehoods are seen easily as false by looking at 1945-1980 when individual and corporate taxes were highest in history yet we had highest growth in history.

Reagan started the transfer upward of income and wealth with his 60% tax cut for the top rate plus his spend/borrow fiscal policies. He spent more in 8 than prior 50 years. He increased debt by 189%.

How can the rich justify the Fed printing $13Trillion to bail our bankers and scream were it to do the same for federal-grants-in aid to states and cities to vitalize our economy by creating millions of jobs

Think about helping 90% not the top 10%.

Our cities and states need revenue. Reagan axed Revenue Sharing which would be vital today.

Bush II tried to outdo Reagan on Spend/Borrow with 92% increase in Spending and 112% increase in Debt giving us a Great Recession and 2,700,000 jobs outsourced to just China. Plus destroying our Housing Industry. Plus created two awful unneeded wars. Invade two unarmed, destitute nations.

Shame on us is what history will read. Clarence disgusted swinneyOctober 8th, 2012 at 12:31 pm -

clarence swinney said:

just tired today

Cynicism about our government

Some are blinded by ideology and pursue policies that are not for the common good.

For example, send entire industries to foreign nations to make a few more bucks without thinking of long term effect on our economy and people. The board accomplishments of our government far over shadow the weaknesses.

Government addresses our serious economic, social, environmental problems

and alleviates much of our human suffering .

I am tired of the Inequality where my teachers get laid off while corporations and banks make record profits after we bailed them out.

It is time to reunite the people to demand a fair shake. We had great growth of middle class 1945-1980

where a worker could afford a nice home, educate his children, care for his sick, and look forward to a happy retirement.

Which leadership can do it? Do you see one?October 9th, 2012 at 8:18 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!