The Inflation Nightmare: How inflation is slowly consuming your income since 2000. The four horsemen of inflation include college tuition, medical care, housing, and stagnant wages.

- 3 Comment

Inflation has a slow destructive impact on your purchasing power. Most people don’t think twice about inflation. They just assume that the price of goods will go up because that is the way it has always been. Yet that is not true. The type of inflation we are seeing is debt supported inflation which has made the cost of normally affordable goods inaccessible for most Americans. It has also been a big reason for why retail is getting severely hit. Yet where does most of your money go? For most households it is housing and most Americans are too broke to afford a home. For younger Americans the biggest expense is college tuition. And inflation in tuition has gone completely out of control because debt has been disconnect from ability to pay (does this bring back memories of the housing bubble?). There is an inflation nightmare going on and you only have to look back to 2000.

The four horsemen of inflation

There are four major issues that are impacting inflation and hitting your pocketbook. You might not feel it immediately but when wages are stagnant, it does make a big impact. So it might be useful to look at the various segments that are hurting your pocketbook.

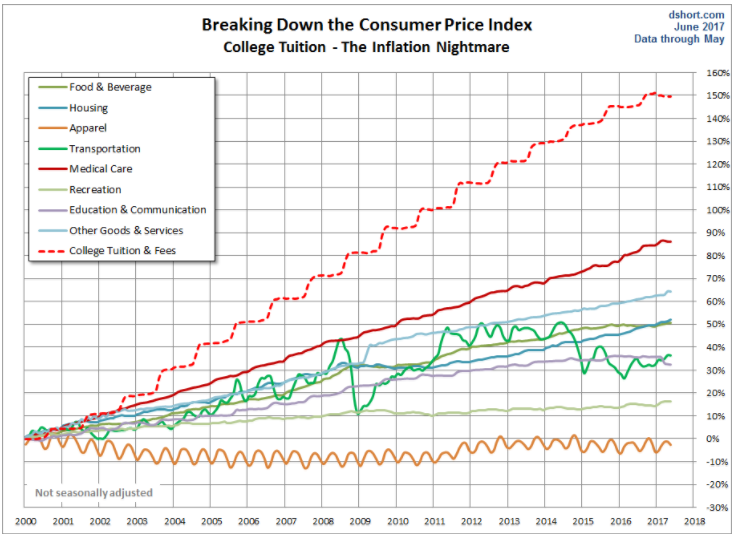

Inflation since 2000:

Let us walk through this stunning chart.

Point #1 – College Tuition     Â

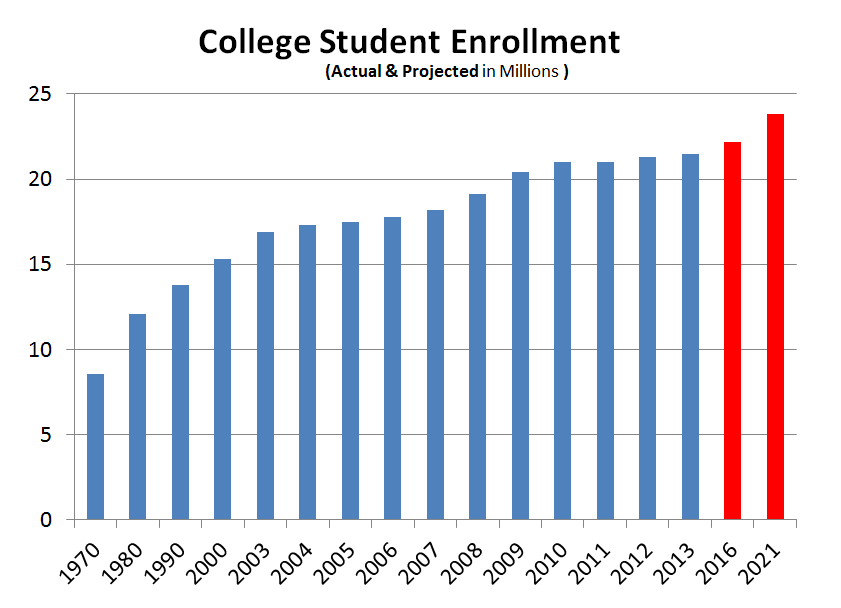

For young Americans that are starting out, college tuition is the biggest hurdle to long-term financial success. $1.4 trillion in student debt is floating out in the system. And we now have a record number of students enrolled and this is projected to grow:

So this is a critical point because we now are hearing countless stories of graduates saddled with debt and unable to find jobs that pay well. Is this is new problem? The problem of fresh graduates having a tough time early on isn’t a new problem per se but when you have such big debt, you need income to enter into your budget fast to service those student loans. That is the crux of the issue. And since student loans are made without looking at ability to pay colleges have increased prices to stratospheric levels (which shouldn’t be a shock).

If you look at the chart above, college tuition is up 150% since 2000. Not good.

Point #2 – Medical Care

Another big problem but one that largely impacts older Americans is healthcare. Just look at the chart above again. The cost of medical care is up nearly 90% since 2000. And this is going to impact more Americans since our population is aging dramatically:

Because of advances in technology more people are living into older age. That is a good thing. But it is also going to cost money.

Point #3 – Housing

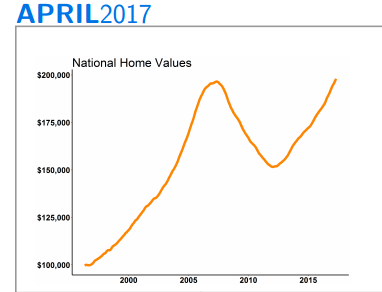

Housing is the largest expense item for Americans in the form of rent or mortgage payments. The way housing costs are calculated in the Consumer Price Index (CPI) is by looking at the owners’ equivalent of rent (OER). Unfortunately this is a poor measure because it looks at what a home would rent for even if you own it.

Housing costs are up 50% since 2000 yet this doesn’t show the full story of actual prices:

So wait, if the CPI is saying home prices are up by 50% yet Zillow shows that home values went from roughly $100,000 to currently standing at $198,000 (nearly a 100% increase) who is right here? Zillow is right since this is what it will cost you to buy a home. Now like student debt, the reason you can hike prices so high is because the financing behind it through mortgages is being tweaked. This includes the Fed heavily intervening in markets and causing these massive changes but in the end, Americans in large numbers are being priced out of housing because the underlying cost is zooming up.

Point #4 – Stagnant Wages

And finally the last item we will cover with inflation involves stagnant wages. Your purchasing power simply does not go as far anymore especially with your big ticket expenses. Housing costs are consuming a large part of your budget. If you are a college student tuition is back breaking. And if you are sick, one illness can put you in bankruptcy.

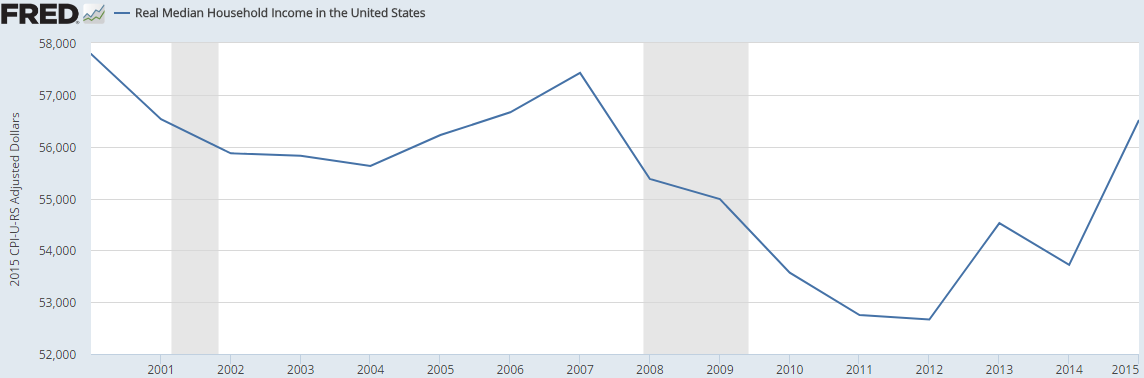

Since 2000 household income is actually down adjusting for inflation:

Since 2000 nominal wages are up around 30%. So just look at the first chart again. This is why inflation is a nightmare. It just creeps up on you slowly.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

IMissLiberty said:

You forgot to mention the income tax which progressively moves us into higher brackets as we get inflation raises. The income tax is “only supposed to tax the top 1 percent” according to testimony in 1913 when it was established. Now all of us are tax-slaves.

The Fed and Congress, and their disrespect for our money, causes all the other problems you mention. The government subsidizes (makes go up) health care costs and tuition. It raises the cost of housing by the same means. It also prohibits people from getting paid to learn new job skills (“minimum wage”) and instead pushes them to go into debt for their education. Congress taxes savings and employment, and subsidizes unemployment — causing it to be more expensive for employers to employ and more profitable for workers not to work. In short, as usual, the use of political power has backfired on us. When will the majority figure out that they are better off without bringing politics and force into their lives? Freedom is the answer.June 18th, 2017 at 10:26 am -

blame massive gov't said:

all have one thing in common ,Gov’t. Anything gov’t controls turn completely to chit,gov’t backed loans,gov’t subsidies,gov’t handouts,gov’t contracts,gov’t vouchers etc.Gov’t has swallowed up the private sector, now literally everything revolves around Washington the imperial city,stalin,tojo,hitler,mussolini combined could never imagine havin a gov’t of this staggering size

June 20th, 2017 at 1:27 am -

Manny said:

Taxes — not just income taxes either.

Sales taxes, gas taxes, and tolls (really a tax) as well as various taxes that are hidden as fees (or named as fees).September 19th, 2017 at 11:16 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â