You are being lied to about inflation. Latest CPI figures show nearly no inflation over the past year. Yet housing, tuition, and healthcare costs continue to soar.

- 3 Comment

Inflation. Few people think about inflation but simply accept the reality that prices will go up. However prices going up has a deeper economic reason than simply momentum. Inflation is notorious at destroying your standard of living. Our current financial system is now setup in a way to punish savers. Most banks are offering near 0 percent on standard savings accounts. However, they are able to borrow from the Federal Reserve near 0 percent and lend out mortgages at 4 percent or credit cards at 15 percent. Money out of nothing. If everything goes down in flames, the Fed will bailout the too big to fail. It is really the perfect system if you were a bank. However most people are not banks. And policy is dictated on the inflation rate as measured by the CPI. The CPI on a year-over-year basis is coming in at a neutral level. But look at housing values, college tuition, and healthcare.  None of these are even remotely close to coming in at neutral for the year. Prices are going up and wages are not. So why is there a motivation to hide the truth regarding inflation?

Cost of living and inflation

Most people feel poorer today because they actually are. The Fed continues on a path of easy money so those with access to financial markets are leveraging large into real estate and speculating into the stock market. The current structure heavily discourages people from saving. If you put money into a savings account you are losing money after inflation is factored in. It becomes a challenge for families because most don’t follow inflation rates or even policy actions by the Fed. Most don’t even own stocks. They simply try to pay their bills and do what is best for their immediate situation.

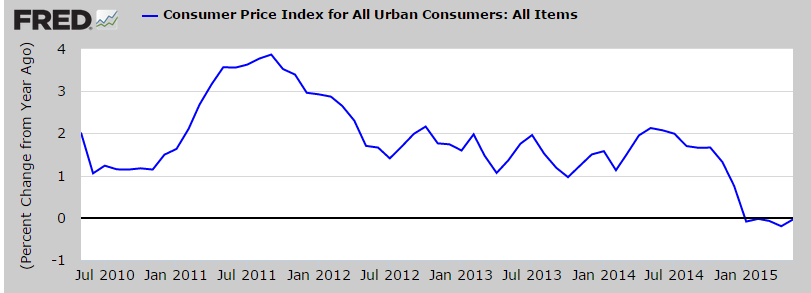

Take the widely used CPI measure:

The CPI looks to be neutral on a year-over-year basis which bucks the trend since the recovery started in 2009. But is that true? Let us look at the biggest expense most Americans face, housing:

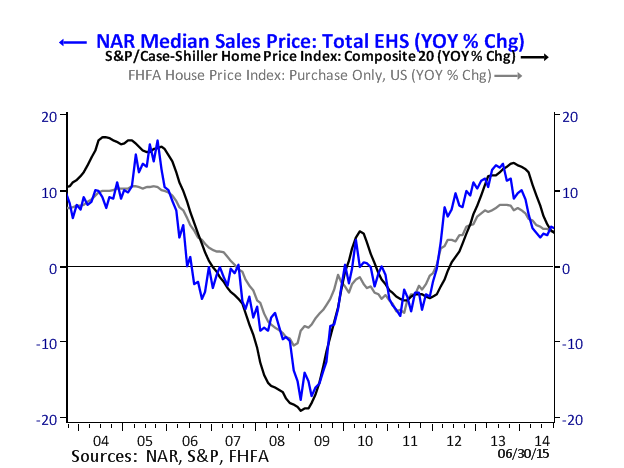

Year-over-year, the Case Shiller Index is up 5 percent. That is a big deal especially coming off double-digit housing price gains. Americans spend nearly 40 percent of their income on housing. So how is it then that the CPI is neutral for last year? Because the CPI measure the owners’ equivalent of rent (OER), not the actual price of a home or your outgoing housing payment (the majority of Americans still own their home). Of course this is one of the prime reasons the last housing bubble was allowed to grow too large before any policy changes happened because the OER was missing all of the big price gains in home values.

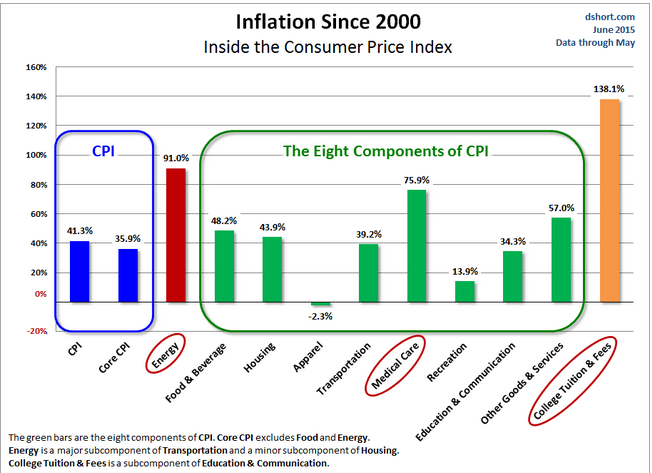

And what about college tuition and healthcare?

Since 2000, the CPI for housing is up 43.9 percent (but this is based on the OER, the Case Shiller Index is up nearly 80 percent), college tuition and fees are up 138 percent (a big burden on younger Americans), and medical care is up 75.9 percent (a big hit to our rapidly aging population). It is very difficult to see how inflation is simply not happening. But of course, if the CPI was more accurate the Fed would have to ramp back and much of the hot money would pullback from the market. The vast majority of Americans don’t have access to large debt pools to purchase real assets. Sure, you can get an auto loan to buy a car (bad at wealth building). Or you can go deep into student debt for a college degree (might be worth it but the $1.3 trillion in student debt outstanding is getting to be a very large burden).

The big reason why inflation is understated is to keep the debt based economy going and to essentially keep Americans in an endless spending cycle. But spending all your money and going into debt is not going to give you financial independence or even the ability to save for retirement. The wealthy in our country did not get rich buying cars with massive loans and going into back breaking debt for college. In many cases, they are the people underwriting the loans with generous rates from the Fed.

One perfect example of this is in the last half decade, big banks and investors have flooded the single family home market. This is the main net worth grower for regular Americans. Since banks and investors are hungry for yield, they crowded out the market and have pushed home values up. It is no surprise now that rents are rising. With millions more Americans renting, the largest expense of housing just got more expensive. Yet instead of building equity, this money is going to investors. These investors got generous loans thanks to our low rate environment. Why are rates low? Because the Fed points to the CPI figure and says “see, no inflation here!â€Â But now, the OER is going to go up but the gig is up and the money has already been made. See how this works?

So inflation is absolutely happening and there is too much money for the banking sector to pullback now. The Fed is the bank of all banks. Don’t think they are looking out for the working and middle class in this country.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Dan said:

I have been in the construction cost estimating business for 20 years and every year construction costs go up 10% – it is automatic. I wonder if the cost of asphalt or concrete in their basket of goods. Higher construction costs equals fewer projects, very destructive.

July 8th, 2015 at 7:41 am -

Roddy6667 said:

The government uses your monthly payment as a measure of how much you pay for healthcare. When your deductible goes to $8000 and less and less is covered by your non co-pay, your healthcare expenses have gone up. It doesn’t register on the CPI, however.

July 9th, 2015 at 9:43 pm -

Teri Pittman said:

We’ve been cleaning out some things and there are a few newspapers from the 70s on a chair outside. I was looking at grocery prices, especially for meats. All of it was less than a dollar a pound. Now I know that wages were lower. I think I was making $2 an hour in high school at my first job. Wages are not keeping up with the cost of living. I can’t see how anyone could say that inflation is low.

July 14th, 2015 at 5:20 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â