Do not be lulled by the siren call of inflation – The slow decline in living standards. Gas is up 100 percent over last 8 years while income has fallen.

- 6 Comment

Inflation has a slow methodical way of eroding the purchasing power of what sits in your bank account. The Federal Reserve is doing all it can to create asset inflation to allow banks to offload inflated assets onto the market so they can repent for the financial sins created during the credit bubble. Unfortunately there are unintended consequences for this. The first consequence is the fact that most Americans have seen their income drop in the last decade. So even if prices stayed the same, their purchasing power has fallen. Yet prices in many key items have actually gone up. By going into full debt mode, the Fed is trying to weaken the US dollar and because of this, the price of goods sold on global markets has gone up. The end result is that many working and middle class Americans find that they are purchasing less for more.

The cost of filling up the car

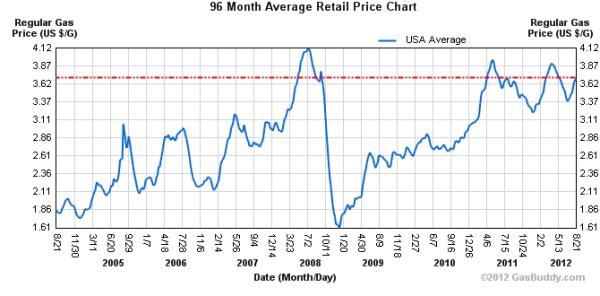

Some seem to think that the oil bubble somehow popped and has moved on. That is not the case.  Demand for fossil fuels remains strong and thanks to a weak US dollar, the price of gas is still high:

The cost of one gallon of gas is up over 100 percent from only eight years ago. Has the typical household income gone up by 100 percent in this time? Of course not. In fact, household incomes have fallen. Since the recession hit, the typical American has seen their net worth crushed by nearly 40 percent. With our commuting and auto based culture, having gas go up by 100 percent is definitely going to leave a dent in your wallet. Yet some still want to deny that there is no purchasing power loss in the US.

Do you eat?

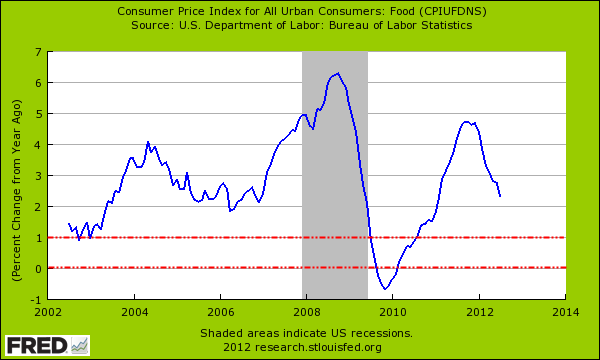

The price of food has also gone up:

Over the last decade the price of food has far outpaced the growth in income (which actually fell). At the height of the recession the cost of food was rising at a 6 percent annual rate. That is completely unsustainable. Even earlier this year the cost of food was rising at a 5 percent annual rate. This would be fine if household incomes were keeping in line but they have not. So two very key items in food and energy are certainly seeing the impact of inflationary pressures.

Tuition bubble

We’ve talked about the higher education bubble and how it is primed to burst given the $1 trillion in outstanding student loan debt. It is hard to believe but the cost to go to college has even outpaced the rate of housing values going up during the bubble. Yet this is a multi-decade trend here:

College tuition has run up nearly 500 percent since the early 1980s. During this time the overall CPI has only gone slightly above 100 percent. It has become more prominent in the last decade because of falling household income. The end result? We are on a path where many working and middle class Americans are seeing for the first time in a generation, a substantial decline in living standards. Still think that inflation is a good thing? The only way people will benefit is if wage inflation outpaces the overall CPI and that is clearly not the case.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

nike said:

real estate prices dropped 90 percent for the insider front runners buying distressed and selling now distressed at 300 percent higher inflated prices but still 60 percent below the highs of the pre fractional reserve bank system collapse of lending and bailout of printing up of on average 38 debt dollars for every dollar borrowed that compete and bid in buying houses equally with a dollar of ruined savings….

August 21st, 2012 at 7:09 pm -

fresno dan said:

It is amazing that economists believe that inflation will “solve” anything. We had the 1970’s that proved that the hypothesis that there was an inflation employment link was bunk.

We have also had 40 years of economic guru’s such as the FED chair being lionized, when they demonstratibly wrong time and time again…

http://research.stlouisfed.org/fred2/graph/?g=2Xa

wages divided by GDP

http://www.federalreserve.gov/boarddocs/testimony/2002/20020417/default.htm

no housing bubble!!!

and of course, “subprime is contained” BernankeAugust 22nd, 2012 at 3:05 am -

Roland James said:

Supply and demand doesn’t work the same for a vital finite resource that is nearing its global peak or plateau for the easy to get oil. Oil is truly unique re energy density, convenience, and flexibility. The oil being brought on now, however, is harder to get and much more costly. It is also being used by hundreds of million of people that didn’t use it much at all until a decade ago–primarily the Chinese. The world population had remained fairly flat until oil. Coincident with the age of oil, population has increased from ~1 billion to 7 billion. Metaphorically, oil is the platform of modern industrial society, or the sine qua non of modern industrial society, or the “blood” of modern industrial society. But now its use–together with the other fossil fuels, coal and natural gas– is making the “skin†(the global atmospheric commons) so that makes life itself is threatened. Carbon dioxide is party of the cycle of life, but too much of it is like too much clean water–a flood or a disaster.

So there is much more to be concerned about than the price is going up.August 22nd, 2012 at 6:29 am -

major said:

I am sure our so-called leaders are fully aware of the consequences of their actions to the working middle class. That makes them evil and corrupt. To their elitest mentality, the masses are there to serve their whims and self interest. The fact that they allow us 3 squares a day and a hovel to live in is more than we deserve in their estimation. But there is always Marie Antoinette and her price paid for elitism. I am sure she had second thoughts about the time the guillotine was to drop on her neck.

August 23rd, 2012 at 8:42 pm -

KENNY G said:

We are headed for some perilous times in the U.S………all the free stuff will soon be cut back drastically and then go away, thats when all hell will break loose…….think austerity.

August 24th, 2012 at 8:09 am -

therooster of Christ said:

Modern inflation is a by-product of free floating debt currency, but there is a flip side to this issue, one of little to no recognition. If we continue to see the dollar as a currency, only, then we are apt to miss the new function of the dollar in a real-time gold-as-money paradigm. The dollar is only a currency within the fiat currency paradigm. Within the real-time gold-as-money paradigm, the dollar is a vital real-time measuring tool that bridges the debt based paradigm to the asset based paradigm. The dollar’s role as a currency is but a stop-gap measure in time until the market wakes up to this fact. Gold had to be set free from the FIXED peg with the USD in order to be set free, which is what took place in 1971. The real-time genie was needed and set free but the debt genie also managed to escape at the same time.

August 24th, 2012 at 10:07 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!