Inflation in the most important things: Inflation hitting housing, tuition, and medical services. Is the Fed reinventing another debt based bubble?

- 1 Comment

Household income is a vital measure of the overall well-being for most Americans. This is why it is important to try to understand why overall household incomes are back to levels last seen in 1995. This is a critical barometer that measures the health of the US middle class. Yet we continually see the argument that inflation is a good thing and since the CPI is registering such a low level of inflation, that the Fed should have a free-ride when it comes to digitally printing our way out of the recession. Yet even a tiny level of inflation is going to hurt when wages are stagnant. That is our current predicament. The one area where Americans spend their most money, housing is becoming more expensive courtesy of the Fed. Inflation is around you if you actually pay attention.

The cost of easy money

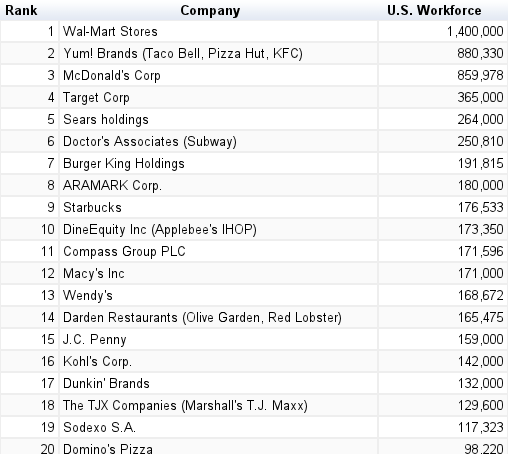

It is interesting to note that the big rise in home values has come because of the Fed artificially pushing rates to record low levels. Because of this, home values are trending higher:

While this might on the surface appear to be good, a large push has come from big financial institutions fighting over what little inventory is out in the market crowding out regular home buyers. Income strapped Americans are having to now deal with higher home prices but also, higher rents. This is fine if incomes were rising as well but they are not. So while the overall inflation rate might appear to be low in relative terms, the current wage growth is simply not there for average families.

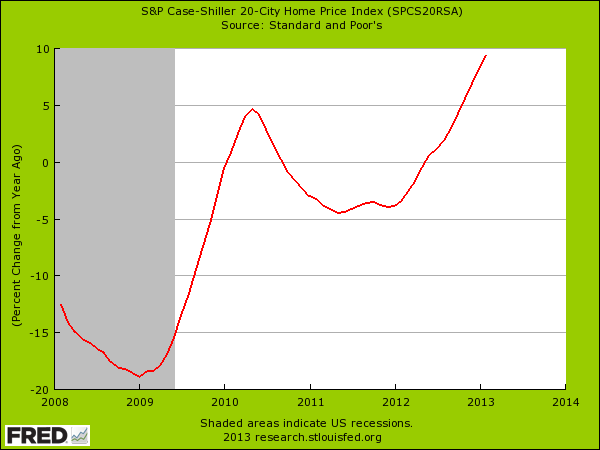

Take a look at actual income growth:

It is hard to really look at the above chart and mistake this for a solid recovery. If you have less money and more access to debt, all you are doing is repeating the debt bubble that led us into this crisis in the first place. The Fed seems to think it is smart to re-inflate the housing market even though wage growth is nowhere to be found on the radar.

Low wage America

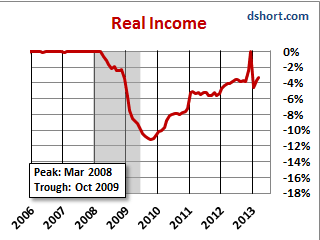

A large part of our country works in the low wage service sector. Some of the biggest employers in the United States are part of this lower wage economy:

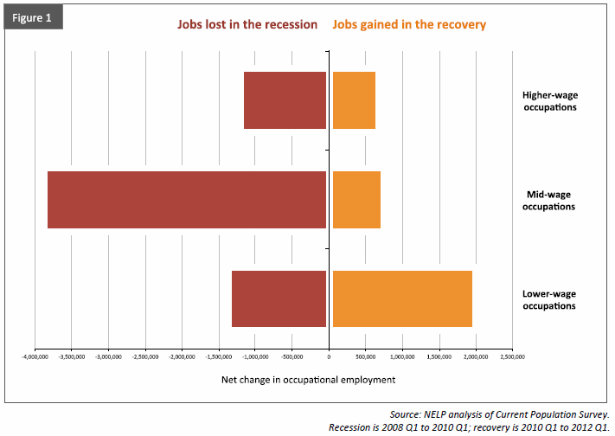

This is a very high number of Americans working in very low paid industries. In fact one of the interesting parts of the current economic recovery is that most of the new jobs have come in the low wage sector. A bulk of the good paying jobs lost during the recession never returned. They simply fell off the map.

We see this with the figures of where jobs were lost:

For example, in the last jobs report we find the following for added jobs:

+31,000 for temporary help services

+38,000 for food services and places of drink

+7,000 for social assistance

While adding jobs is certainly a positive, nearly half of the added jobs were low wage positions. So you think that having inflation moving up is a positive thing when incomes are constrained? The Fed continues to blow debt based bubbles here since the public is too broke to purchase anything with actual income. Finance a car. Get a mortgage for a home with almost nothing down. Go into deep debt with student loans. Yet we should not worry about inflation while more of America is employed in the low wage sector and to make up for a lack of income growth, Americans are encouraged to go into debt.

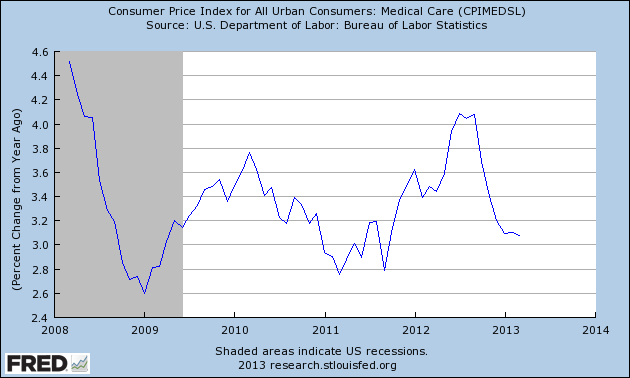

Medical care inflation is holding steady and this is one sector where more Americans are going to utilize these services as we become an older nation:

No need to worry about the lack of wage growth. Just go into maximum debt and let inflation eat away any of your current obligations. No wonder why the Fed is the only player when it comes to buying up mortgage backed securities.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Sarah said:

I carefully monitor my family’s grocery expenditures. Last month it appears that in my region (Maryland), we began to experience inflation in the general costs for prepared foods like cookies and crackers (I have five kids and pack school lunches so this are a bit of a necessity and essentially our only purchased processed foods). For us, buying the usual supplies I saw a 7% increase over the past two months over normal costs. Of course, my tracking is not scientific, but I’m playing close attention with buying mostly staples because my household runs on a very tight margin. When I reflect on that health insurance over the past five years in my household has increased on average 8% per year (we don’t have many choices in this rural area), I see where a jump in those fluctuating expenses like groceries, combined with the inflation in healthcare costs, can deplete a budget of any extra cash.

May 7th, 2013 at 4:38 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!