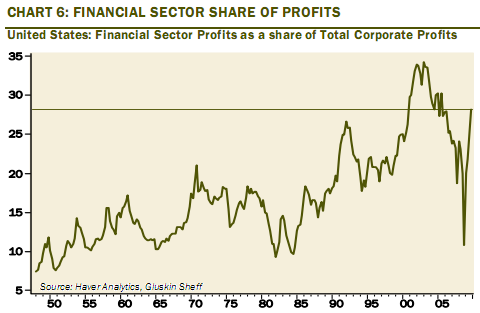

How investment banks turned housing and student loans into a toxic and financial disaster – Middle class largest asset coopted by banking sector to raid and speculate on. Financial sector nearly 30 percent of all corporate profits in U.S. In the 1950s it was under 10 percent.

- 7 Comment

Most Americans pull their net worth from their investment in good old housing. It is the biggest purchase most will ever make. And because of this, after the Great Depression, housing was a boring yet stable investment class. It had to be. This is the cornerstone of wealth for most Americans. Banks used to do their due diligence by verifying income and typically having a say in their local communities. All that changed starting in the 1980s. The first foray into banking corruption in housing came with the S&L Crisis. Thrifts largely gave out money with unsustainable interest rate schemes and when the market imploded, the taxpayers had to step in to bail out the banks. Yet during the process, many Wall Street financial firms made out like bandits on junk bonds and other “financial innovation†which was nothing more than sugarcoated robbery. Then in the late 1990s the depression era Glass-Steagall act was repealed and all bets were off. In a debt based system, housing was the largest debt class for Americans and investment banks decided to turn it into one giant casino. This financialization of our country is at the core of the disappearing middle class. Financial firms are largely wards of the state and operate to suck out rents from the productive economy.

The burden of housing and investment banks speculation

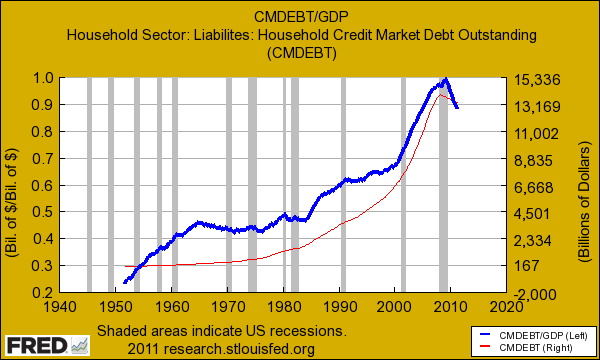

By far, the largest debt American households carry is with mortgage debt:

This is one of the most troubling charts since it shows how household debt since the 1950s has become a larger and larger part of our economy. In fact, at the peak in this crisis household debt nearly equaled our annual GDP. It isn’t too far from this point either today. The biggest part of this debt is made up by mortgages. Over 76 percent of household debt, some $13+ trillion, is made up of mortgages. And with homes sinking in value we now have 25 percent of households with mortgages holding onto underwater mortgages. The biggest factor here is that banks that serve with a fiduciary responsibility largely ignored all parts of their mission to rip off the public. This came at a taxpayer cost of trillions of dollars that have been paid out by the Federal Reserve and U.S. Treasury. The middle class is still paying for it today in a multitude of ways.

Inequality rises because of broken financial system

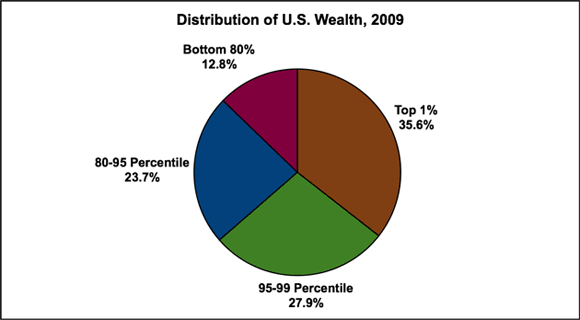

Wealth inequality in the U.S. is now at the levels last experienced during the 1920s:

The top 5 percent in the U.S. control 63 percent of all wealth. Keep in mind that the vast majority of Americans, those with an actual positive net worth, derive their wealth from housing. Most of those in the financial sector derive their wealth and income from financial speculation. They even pay 15 percent on their investment income which is what they live off of. When was the last time your tax rate was 15 percent? Just think about the hedge fund managers that made billions of dollars betting on Americans losing their homes and winning on this bet. How in the world does this add any value to the system? This is nothing more than socialized gambling and a vampire sucking the life out of the real economy.

The big problem in our current system is that a large part of corporate profits now come from the unproductive financial sector:

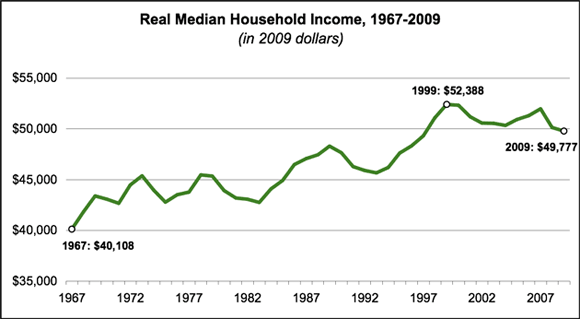

Think of the last decade where household incomes have fallen for the middle class, the financial sector has done fantastically well as the chart above highlights. In the meantime household income across the country did this:

It stalled out. This is the issue at hand and why so many people are starting to wake up to the oligarchy of the current banking system. The banking system’s purpose is to lubricate and keep the real economy growing. But when profits can be had on speculating on homeowners defaulting or student loan debt rising, why leave the office when you can push a few keys on a Bloomberg terminal and make more in one day than a manufacturing worker will make in one year?

You also have the absurd amount of student loan debt in our country and the cost of education:

Source:Â BusinessWeek

Take an open look at the above chart and align it with these stats:

Since 2000, in real terms college costs are now up by 23%

Since 2000, in real terms real pay for college graduates is down by 11%

Education costs have gone up over the last decade by 23 percent yet college graduate pay has fallen by 11 percent. How does that work? More debt. And of course banks have their hand in every aspect of this shell game.

It is no surprise then that you have the CEO of JP Morgan Chase making over 800 times the average annual workers wage. JP Morgan Chase owns trillions of dollars in “assets†largely in mortgage debt.

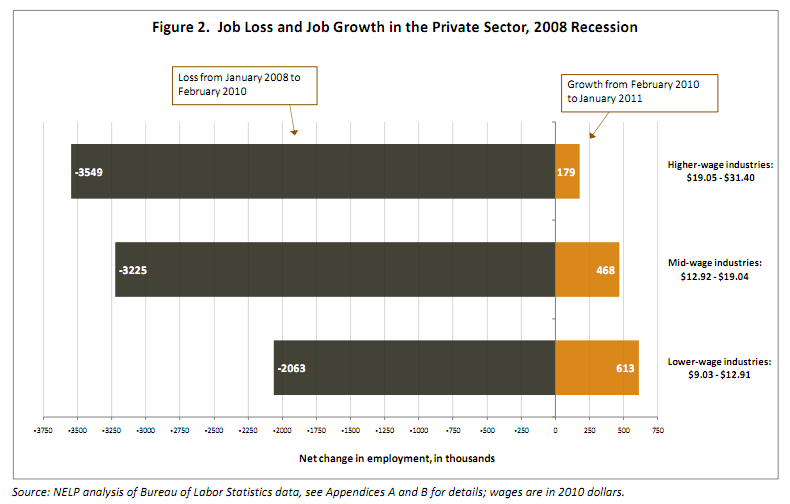

Low wage nation

One of the more disturbing trends emerging from this is that while those at the top of the financial sector continue to expand by greed and corruption, the few jobs added in the last few years have come from low wage sectors:

In other words, the middle class is being crushed at the expense of the financial sector. And this is a zero sum game since the taxpayer bailouts went directly to the banking sector. This wasn’t an “earned†victory for the delusional investment banks. This came at a heavy cost. How much longer will we allow commercial and investment banking to be intertwined in a system that clearly doesn’t work? Do we need more proof that the current setup is absolutely flawed? We are living in the midst of the worst economy since the Great Depression. Yet with so much money flowing into D.C. from Wall Street, we might as well look at Manhattan as the power hub of this country. Some have argued that people should protest D.C. because they make the laws. I disagree. Wall Street signs their paychecks and funds their campaigns so the real power is in New York in particular with the investment banks. Most other companies have to work to produce something while these banks simply need to look at what other industry they can pilfer and make bets on. If those bets go bad, they’ll just dip into the taxpayer wallets again. Housing, education, healthcare, and what else?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

MarkH said:

Tax receipts are way down at the same time that the financial sector is taking a bigger and bigger slice of the country’s GDP. Thus, more and more the money/compensation/income/profits of the country are being taxed as capital gains @ 15% instead of 35%.

Thus, to remedy part of the gov’t revenue problems and to restore some fairness (meaning equal taxation for all the businesses and people) we could increase the tax rate to be the same for everyone and eliminate many deductions to reduce that rate to something like 20-25%.

The effect? Calculate 35% of the $15 Trillion economy taxed at 20% higher rate produces $1.05 Trillion more in gov’t revenues. There’s your deficit remedy. No need to savage Medicare, Medicaid and Social Security.

October 6th, 2011 at 6:00 pm -

mad_dragon said:

>KEY FOR ALL THESE CHANGES IS “GLOBALIZATION” SINCE 1990S;

>LOW-END MANUFACTURING JOBS STARTED BEING RELOCATED TO OVERSEAS;

>NEW YORK IS “NY OF THE WORLD”, NOT JUST “NY OF THE U.S.A.”, THAT MEANS SOME FIGURES NEED TO BE COMPILED TAKING THE GLOBAL BIG PICTURE;October 6th, 2011 at 7:12 pm -

Phil said:

For the past 20 years + of work I have repeated sat in meetings and have had the interests of the “investor” be met with total disregard for any other approach. the dominance of the owner/investor has dominated all business’s decisions. while they have an interest other parties -workers, townships,society- are not met or considered. Until all parties are represented nothing will change.

October 7th, 2011 at 1:00 pm -

torabora said:

Do not be so quick to condem capital gain rates @ 15%. That investment money was what was left over after it was taxed at ordinary income tax rates that combined state and federal can reach 50%. So instead of just spending the left over income on stuff the after tax money is chosen to be invested….and for their risk pay a lower 15% rate. Jobs are thusly created. Taxes are created. Also the capital gains mostly are dividends which had to be taxed at the corporate rate.

If they would have bought stuff with left over income it would only be taxed at sales tax rates.

The boogie man isn’t ‘low taxes’….it’s irresponsible spending.

October 8th, 2011 at 5:46 pm -

Dumbfounded said:

The middle class is dead.

October 8th, 2011 at 6:37 pm -

The Cash Flow Is King said:

History has shown that economic systems collapse when economies move from production hubs to a system reliant on skimming off the top and exploited other countries is the main source of income. The chart that shows that the real growth in profits has been derived from the corrupt financial system is a warning to those who are not hedging the portfolio against losses, if not total implosion.

Also, in regards to student debt. The unemployment rate for those who have a BA degree is 4%. Those who have a high school degree is 11%, and those who do not have a high school degree is 14-15%. What these numbers suggest is that you should go to college to get a degree as it will help you get a job. However, going to a college that puts in an circumstance of unsustainable debt levels, at a time when having a college degree means less and less is a no win scenario. Not to mention those who are currently graduating, realizing that there is no place for them to be employed, and going back to graduate school (taking on massive debt), only to in 3-4 years to find out that the economy has no miraculously recovered.

October 11th, 2011 at 1:49 pm -

compass rose said:

King, the problem with your reasoning is that going to college just to get a degree, any degree, with the goal of leapfrogging into a more successfully wealth/income-skimming class, only extends the imperial-till-we-crash model of economics. (Not to mention that your numbers whiff of poor construction, and maybe I’ll have time next week to find out where they came from, since I see them widely quoted, especially by the Ed Biz.)

Economic strength comes from having a populace that has the skills to do productive work. The Ed Biz has become as financialized as the rest of the economy since the 1970s. I can say this with confidence, since I worked there for three decades. The McFranchise model of schooling was already coming in in the Seventies, and throughout the looting of Reaganomics and Greenspanismo, in many communities, The Ed Biz was the only net creator of jobs.

The fact that college grads may have higher employment rates in some construction of the numbers may simply reflect that the Global Crash hasn’t hit there yet; a lot of middle class jobs are created out of and still running on the late 20th century bubble economy. And that is the core of why we all worry about the Destruction of the Middle Class. All those Ed Biz jobs of dubious productivity, but assured value in a consumerist economy.

In fact I would argue that education servicing is one of the major factors crushing the middle class at this time. The answer isn’t more schooling. The answer is more productivity, and more jobs doing something tangible.

October 21st, 2011 at 9:18 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!