Is College Even Worth It? Americans Owe $1.84 Trillion in Student Debt and the Number Continues to Grow. US household income at $60,000 with some private schools charging $60,000 a year.

- 2 Comment

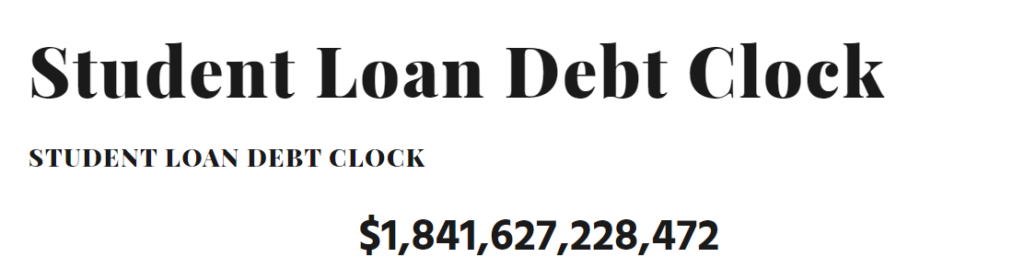

Is college worth it? That is a question more American families are asking as our total outstanding student debt now passes the $1.84 trillion mark and inches closer to $2 trillion. This is money that needs to be paid back and is diverted from other items like buying a home or investing for retirement. Millennials carry the brunt of this debt and so do younger generations and this has clearly impacted their ability to buy homes with millions of Americans living at home with parents well into their 30s and 40s, ages where in previous generations people were venturing out to purchase a home. In this article we are going to explore total student debt, household incomes with the new Census data, and college tuition in the CPI as inflation is growing at record levels.

Total student debt

The total student debt burden is growing at a steady pace despite the economic crisis brought on by the pandemic. If you think about it, college is the only place where income really does not matter for a loan unless you are trying to buy your way into an elite school as we saw with the Varsity Blues case. But there is over 4,000+ colleges and universities in the US and students now carry $1.84 trillion in debt for attending:

This number is only growing and at this pace, total student debt will cross $2 trillion some time in 2022. One of the most frustrating talking points comes from older generations saying “just get a job” and pay your way through school. Yes, these are people that went to college at a time where working in the summer would afford you a spot at a university.

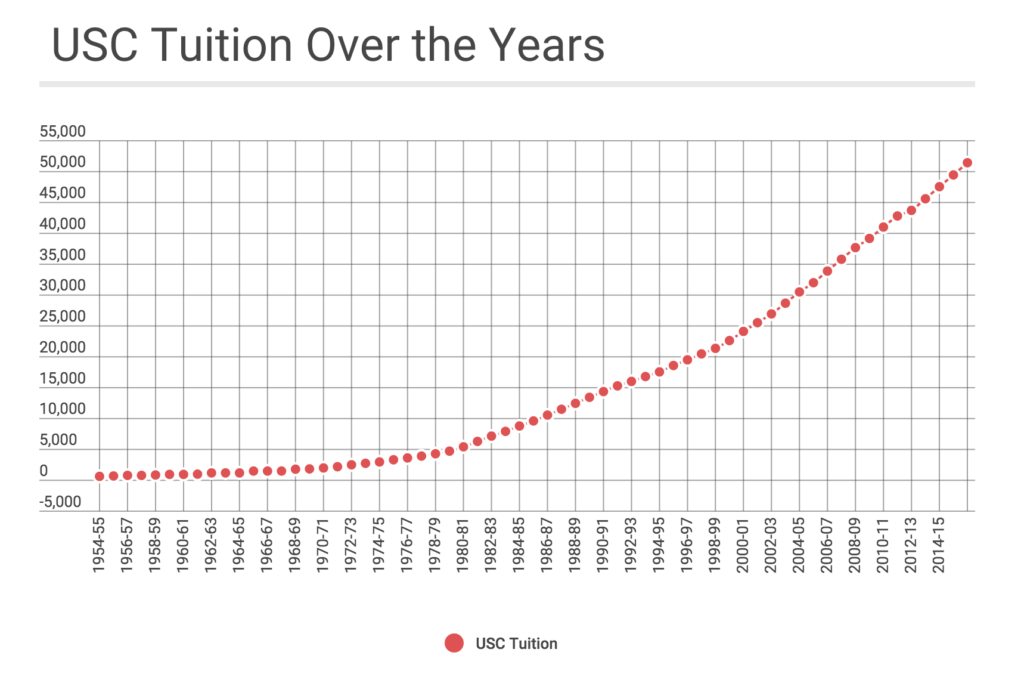

Case and point, take a look at USC tuition in California:

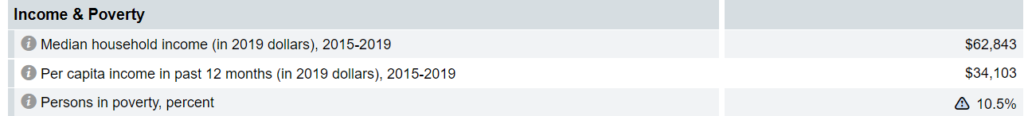

In 1980 it cost $5,000 a year to go to USC. Household income in the US in 1980 was $21,020. Meaning a typical household had 4 times the income of one year of college tuition. What is it today? First let us look at income today:

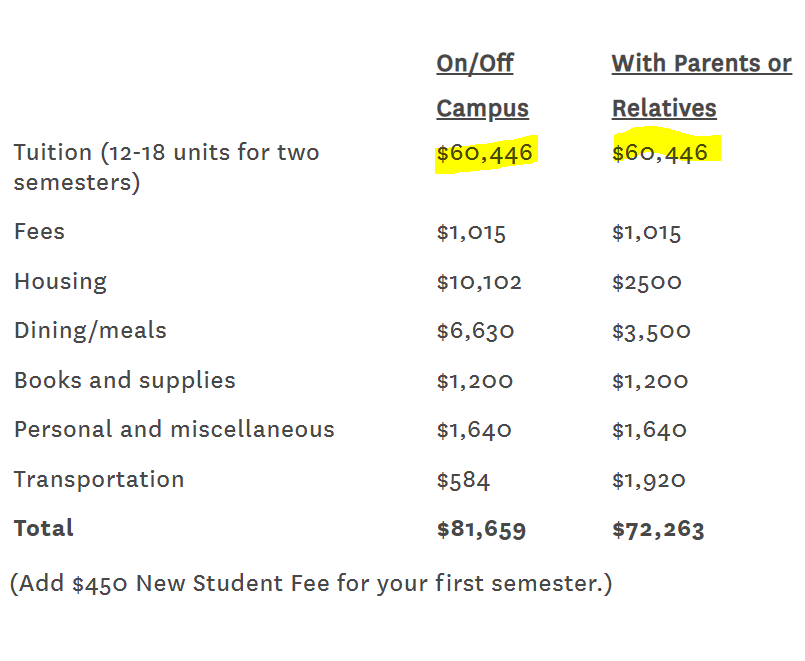

Median household income is now $62,843 and tuition at USC is:

Tuition at USC is now $60,446 per year so basically a 1:1 ratio between US household income and the cost of 1-year of college here. Think about that and you can fully understand why student debt is where it is at. No amount of summer jobs is going to cover $60,446 a year since that is close to the median household income of American family with two working adults!

Now you might be asking, how can tuition keep rising if incomes are not keeping pace because of inflation? Great question and the reason is college debt and loans are one industry where income does not seem to matter and people are given money based on really no metrics at all. In fact, you are qualified for more loans the lower your family income. Instead of asking maybe we should think about making education more affordable the banks simply give more money. For a decade or so predatory “universities” popped up in the for-profit arena that essentially served as a vampire squid to suck money out of federal loans and provide students (many from disadvantaged backgrounds) a worthless degree for a hefty cost – essentially a sub-prime education. They would recruit in poor areas and “financial aid” counselors basically used them in a parasitic form to extract every cent they could so they could enroll. Many of these institutions spent one-third or more of revenues on marketing. There has been a crackdown on this side of the market but now you have elite chasing OPMs (online program managers) that latch onto marquee schools and essentially operate in the same way. Charging six-figures for elite graduate degrees from good schools but are operating in the same way many of these for-profits did, especially when it comes to marketing and in many cases have executives that worked in the for-profit market.

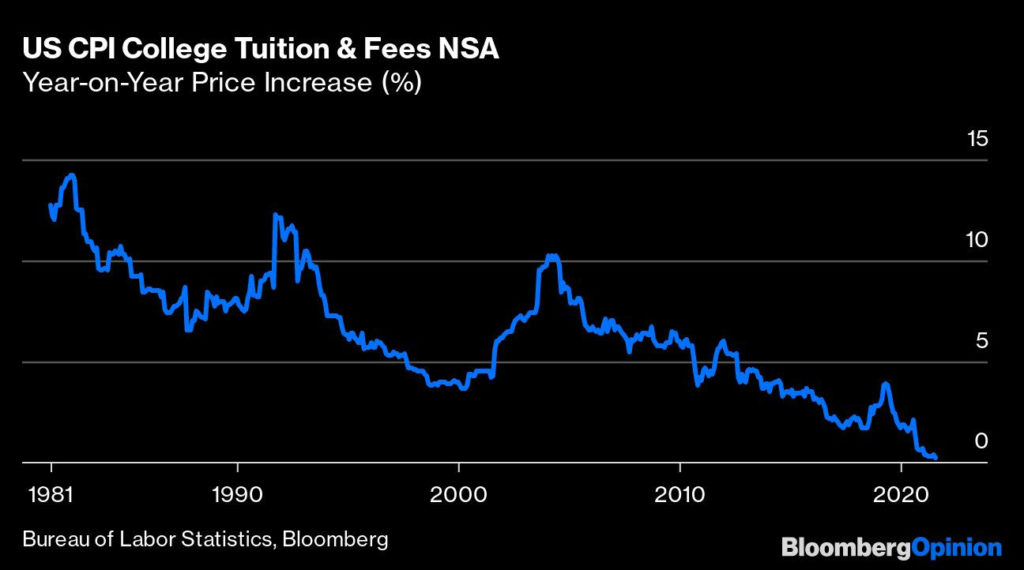

But there may be a limit to this game:

The rate in which college tuition is going up is hitting a wall. This trend was already happening but when people were paying $60,000 a year for an undergraduate degree at USC through Zoom, many started to ask “is college worth it?” At some point lower priced state schools and other more affordable online options popped up to expose what was already there – some elite schools are merely vanity projects for parents to get their kids in so they can say “my kid is going to X school” to make up for their perceived deficits. But in terms of education and value there are some serious issues here. Is college worth it? All of that depends on what you are paying.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

BenefitJack said:

Thanks for the post. Assuming $5,000 is USC tuition in 1980, that is an average annual rate of increase is 6.5% over that 40 year period. However, isn’t USC a private school.

For comparison, at University of California, in-state tuition is now ~$15,000 a year. Over at Ohio State, in state tuition went from $1,100 in 1980 to ~$12,000 – an average annual increase of 5.75%.

You tell me, is USC vs. University of California worth the difference?

The problem with student debt is not those who secure a much higher wage in their chosen profession. The problem with student debt comes from less than marketable skills from some degrees and, of course, the fact that many student debtors never complete their degrees.

As for those who do complete their undergraduate degree, the median debt payment (for the ~56% of the student population who do graduate with student debt) is between $200 – $299. For someone making $50,000+ a year (median annual wages for all college graduates), the tradeoff seems worth it.

September 14th, 2021 at 5:42 am -

Lance P said:

Those prices are ridiculous and sad. How did it come to this? I got a Masters in Computer Science from the University of Nevada, Reno from 1989 to 1992. It cost $50 per credit hour, so taking from 10 to 15 credit hours a term for three terms would only cost $1500 to $2,250 a year. I had a $7.25 an hour campus job where I worked between 20 and 30 hours a week. It was in a computer lab where I was the lab monitor so most of the time I could do homework. It was the perfect college job and it paid for tuition, apartment, health and car insurance, gas, and food. I graduated with no debt. It was a wonderful experience with no woke crap or liberal hounding professors.

BTW, the USC that you mentioned. I took a remote course from them around 1986 paid for by my company. They had a video camera pointed at the teacher with a book on his desk. All he did was read word for word from the book while highlighting what he wrote for 60 straight minutes. No lab, no questions, no blackboard, nothing. What a joke and the cost was $325 a credit hour. It was a disgrace. I can imagine what it’s like now. No thanks.

September 15th, 2021 at 5:15 am