Is College Worth It? The $1.4 trillion question gets harder to answer as a record number of Americans attend universities.

- 1 Comment

One of the most perplexing questions on the minds of young Americans today is whether college is worth the associated tuition cost. It is rather humbling to see that $1.4 trillion in student debt is outstanding today. That is more than auto debt and credit card debt. College tuition has outpaced virtually every category that is tracked in our inflation measures. It has out run housing prices. It has left healthcare in the dust. It has crushed wages which are stagnant for nearly a generation. The last item is probably the most important measure to examine. If college is worth it, why have wages gone stagnant all the while tuition prices continue to go up? Is it because of federal loans? Is it because of mega complexes being built? Or is there something else going on?

The $1.4 trillion question

College tuition wasn’t always so out of control. There seems to be a “price growth through debt†phenomenon going on here. We’ve seen it with housing and also automobile costs. The financing of the system via Wall Street and big banks has caused a runaway inflation in base prices. As wild as housing and auto prices have gone, they simply pale in comparison to college tuition.

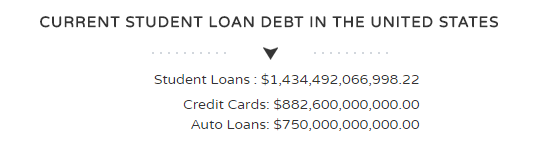

First take a look at the total student debt in the United States:

Source:Â Collegedebt.com

$1.4 trillion in student debt is outstanding. And this figure continues to grow at a breathtaking speed. It might be useful to lay out some facts on both sides of the equation.

Pro 1: College graduates do make more than high school graduates. That is simply the reality.

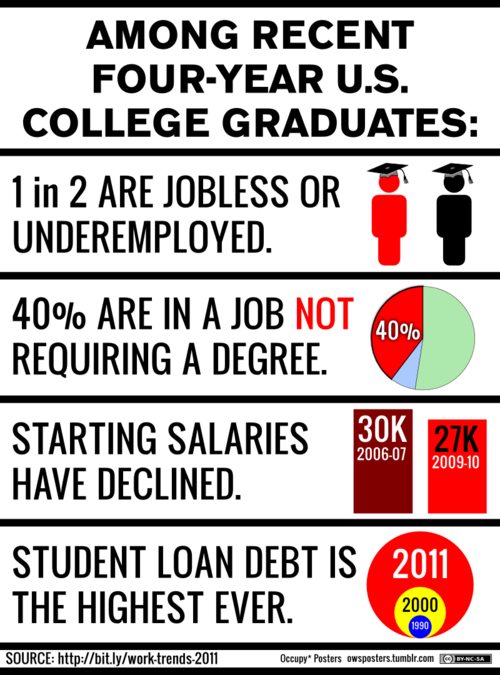

Con 1: Student debt outstanding is ridiculous. The average graduate in 2011 came out with $26,600 in debt and that number has only gone up since then.

Pro 2: Many jobs do require college degrees. So many may have to go to school to work in certain fields.

Con 2:Â Student debt has forced many to live with parents and put off buying a home or even getting married.

Pro 3: There are more opportunities for college graduates. In this tough employment market, that may make the difference between working and being part of the large non-working labor force.

Con 3: Many college graduates are working in fields that don’t require their degree. In fact, the estimate by the Department of Labor is that 17 million Americans with college degrees are working in fields where their degrees are not needed.

Hera are a few more stats on recent college graduates:

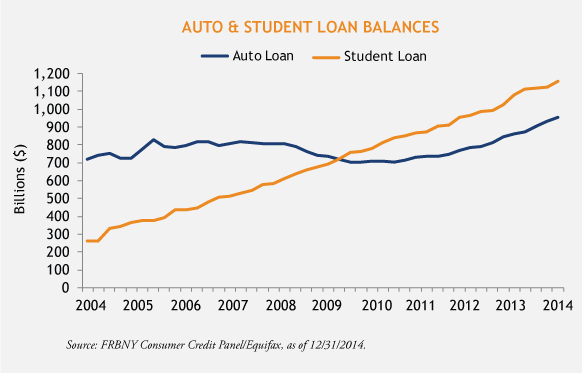

There is a big problem in the higher education market. There is little doubt about that. Student loan debt is moving at an unsustainable pace. For example, student debt has grown by more than $1 trillion in the last decade alone and has surpassed auto debt by a wide margin:

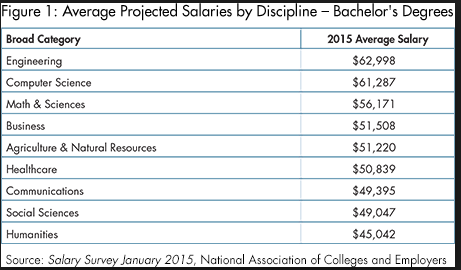

It should be noted that there are over 5,000 colleges and universities in the United States. Not all of the schools are created equal. It should also be noted that not all majors are created equal:

Science and Math pays. Another major factor is how well you do and your ability to network. How good is the career center in the school you are at? Is the market healthy? These are hard questions for most let alone an 18 year old that now has the capability to borrow $50,000 a year for a degree that may not be worth it. What is even more frightening is that college debt cannot be discharged through bankruptcy. This is one loophole that needs to be closed.

In the end, there are clear pros and cons on both sides. The unsustainable trajectory of the $1.4 trillion in debt and lower outcomes is going to see a revolution in higher education over the next decade.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

roddy6667 said:

I made more money driving a forklift in a non-union facility than the Humanities graduates.

August 14th, 2016 at 6:45 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â