A leveraged system – US debt jumps $100 billion on last day of year. Total US debt markets at $58 trillion.

- 2 Comment

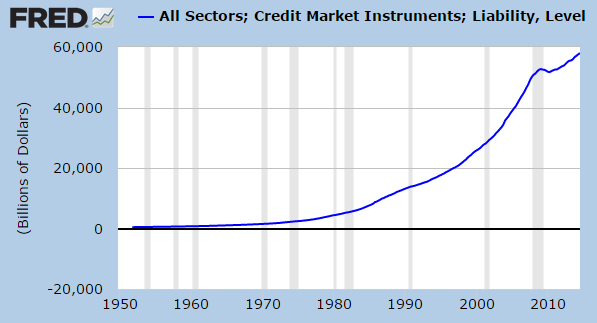

The New Year came and went and here we are fully into 2015. Most Americans didn’t realize this but on the last day of the year US debt jumped by $100 billion in one day driven largely by Social Security adjustments.  The current economy is dangerously addicted to debt. There was a time not too long ago where paying for college or even a car with cash was seen as a common occurrence. That is no longer the case and we are even seeing subprime auto debt since many Americans are cash strapped and a little low on the income side. Total credit market debt is nearing $58 trillion which seems a bit excessive given this is three times annual GDP. The current system is highly addicted to debt in any form. Those with the ability to access debt and leverage it can thrive in this system so long as debt is accessible. For many Americans with stagnant wages debt is available but for products that largely create negatives for wealth accumulation – cars, TVs, etc. Many on Wall Street can leverage cheap debt to purchase goods in the economy and crowd out regular workers.

A leveraged system

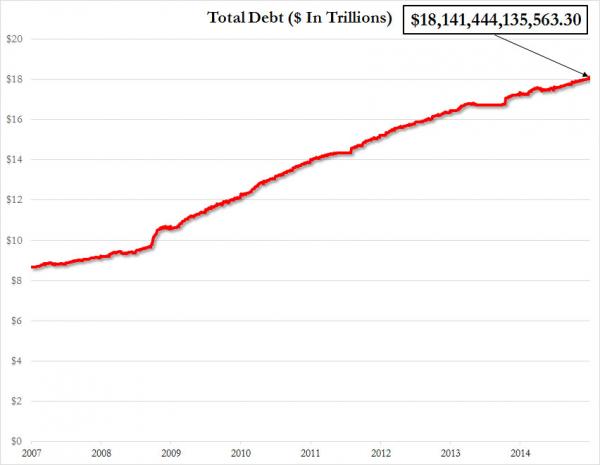

Total US debt is now at $18.1 trillion with $100 billion being added on the last day. In 2014 total US debt rose by a stunning $790 billion. This is an incredible rate of growth relative to the rise in GDP.

Let us take a look at the rise in debt:

In the last seven years alone we have gone from $8 trillion to the current level of $18.1 trillion. $10 trillion added to the debt ledger just like that. The cost to bailout the economy came at a hefty price and much of the funds went to big financial institutions as many Americans realize they are getting the bill and are left with a slew of low wage jobs as a thank you.

You can’t blame Americans for going deep into credit card debt, auto debt, college debt, and mortgage debt. This is the only way to access these items. The days of saving and buying things seems like a remote memory to many younger Americans struggling to pay the bills from their paychecks. So debt becomes this needed tool to live in the current economy. Yet the cost of many of these items becomes inflated thanks to the flood of credit in the system. Think of higher education. It is no surprise that tuition rises nearly in tandem to what the government (and member banks) will lend.

With all of that said it is no surprise that total US debt markets now stand at $58 trillion:

Does anyone think the US will payback that $18.1 trillion? Sure, we continue to pay the interest on this debt but this is because most of the world has systems with deeper problems. So basically, money is rushing into the US as a safety measure but lower rates do very little for the typical working family as inflation is now eroding the standard of living.

The system has an incredible amount of leverage floating about. As long as credit continues to flow, things will keep running. But keep in mind that debt needs to be paid back. College debt as millions are finding out will follow you for most of your life with many loans going to 20 or 25 years for repayment. Basically a mortgage before even buying a home. Some auto loans now go into seven years of payment.

Given budget projections we are likely to increase our debt once again in 2015 and this is assuming a continuation of what is going on. Throw in a minor hiccup and you can see from the first chart how quickly into the hole we can go. We’ve reached a point of full on debt addiction. Debt is now equivalent to wealth and those with more access to debt are leveraging the daylights out of it.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Ame said:

So what happened to the so-called “Global Currency Re-set”? I suppose things haven’t gotten bad enough in enough countries for this to be seriously considered? What do the leaders of the world’s countries think is going to happen if they don’t do a re-set? Do they think they will win some sort of currency race to the top of the heap? What good is it to gain the world but lose one’s soul?

If all countries the world over are to avoid WWIII, a re-set may be their only option. I don’t know if the power-hungry will allow it, though. It would be short-term pain (for everyone worldwide) for a long-term gain in global well-being. Truly humanitarian.

January 3rd, 2015 at 9:24 am -

laura m. said:

Obviously the economy and the country is trashed. Politicians are useless bums, getting paid for doing nothing beneficial for the country, but only what they are told to do by corporate bankers. Thus, voting is in vain. Patriot activities and groups in the last fifty plus years have been useless, producing nothing to incl web sites, magazines, conferences, talk shows, etc. There are not enough real men to stand up for free market capitalism and libertarian ideals. This country is down the abyss with a zero future.

January 3rd, 2015 at 11:53 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â