Little Known Ways the Federal Reserve Punishes American Savers and Supports Conspicuous Consumption.

- 0 Comments

The Federal Reserve is one of the most mysterious organizations in the world. What they don’t hold back on however is their intentions for the American saver. They are one of the biggest key players in the financial bailouts yet very little is ever discussed about this organization on national or even cable television. The actions taken by the Fed during the grand financial bailout are subtly punishing American savers. Policy will dictate market action. The Fed is trying to corner American savers so they are left with two options, both risky and problematic in the long-term. The American middle class is slowly sliding into oblivion thanks to the Federal Reserve and their favorable banking bailouts. Our economy is largely driven by massive consumption. Saving money especially in more traditional savings accounts is good for you, but not necessarily the economy. This is the paradox of thrift and the Federal Reserve is determined to punish savers and pave the road to conspicuous and financially dangerous consumption. The Fed agenda is clear and this is what American savers can expect for years to come.

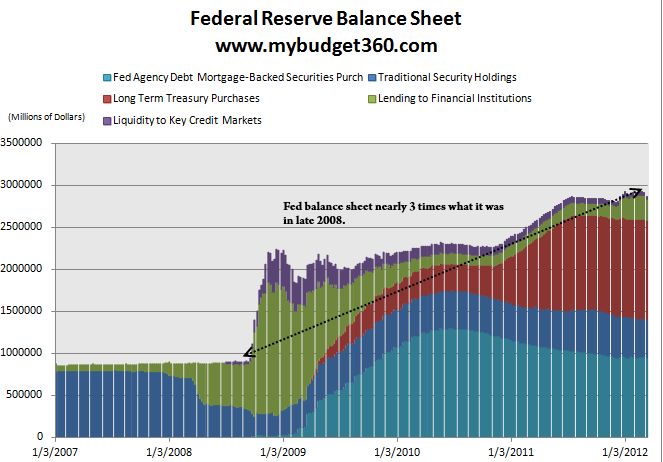

Contrary to what is being poured out over the airwaves the Federal Reserve wants you to spend every single penny you have. The Fed has grown its balance sheet by a factor of three since late 2008 thanks to major financial bailouts:

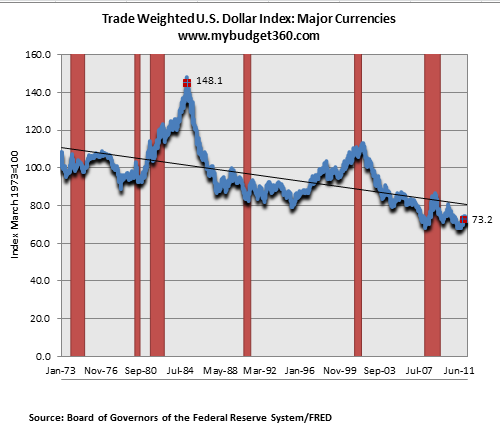

If the crisis is now over, why is the Fed balance sheet still near peak levels? That is because the Fed is still holding onto trillions of dollars of toxic loans likely backed by residential and commercial real estate. We say likely since we do not have a full accurate view of what is on their books. So why does this mean the Fed wants you to spend every green dollar in your wallet? First, since we now live in a debt based money system, access to debt has become a new form of pseudo-wealth. As the Fed takes on more debt it slowly debases the value of the currency thus making your dollars worth less and less as each day goes by. Don’t believe this? Just look at the US dollar chart for the last few decades:

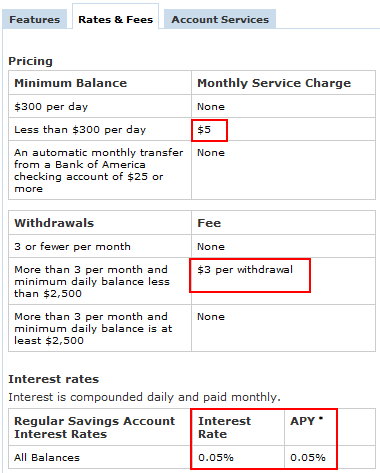

The dollar has lost over 50 percent of its purchasing power since the 1980s thanks to actions taken by the Fed. You might say, well I’ll simply put my money away in a savings account to avoid the evils that come from inflation. That is unlikely to help as well:

The typical savings account in the US is paying slightly above zero percent and is basically a brick and mortar mattress. By simply keeping your money in a savings account you are losing value as the dollar debases and inflation rears its ugly head. This is not accidental but a purposeful strategy set up by the Fed. They want you to spend or stuff your money into the extremely volatile stock market. Good luck competing with connected banks with purchased politicians or battling it out with high frequency trading boxes.

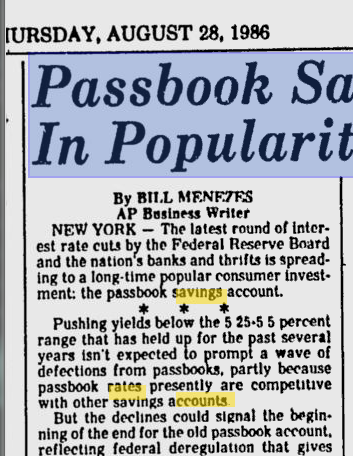

Even going back to the 1980s we see that savings accounts paid a much higher rate (of course anything is higher than zero percent):

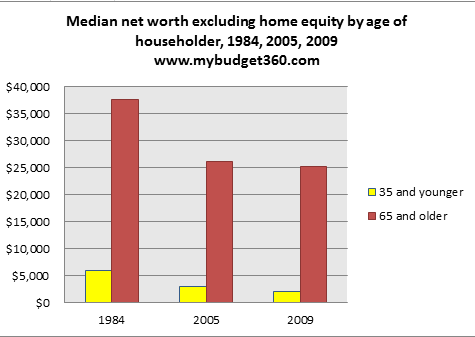

The problem also is that most Americans are now poorer than they were a few decades ago. The average per capita income is $25,000 and the overall net worth picture has gotten particularly bad for younger Americans:

Both younger and older Americans are poorer than they were in 1984 when excluding home equity. If we add home equity, the figures improve only a bit for those 65 and older. These actions create a form of shadow inflation through higher grocery prices, a more expensive college system, higher medical costs, and stagnant wages. At the same time banks are still charging high rates on credit card debt while borrowing from the Fed at levels that are practically free:

Given the massive risk in the market the overall baseline interest rate should be much higher. Yet the Fed by conducting these actions favors the following:

Fed Favors:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Financial market speculation, spending, going into debt (at artificially low rates)

Fed discourages: Â Â Â Â Â Â Â Â Â Â Â Â Savings (via low rates), being prudent when it comes to spending (go shopping)

So if you are wondering why it is so much harder for you to save just understand that our central bank is favoring policies that discourage savings. This is a debt addicted system and households are deleveraging not because they want to but because they have maxed out on what they can purchase. One thing the Fed cannot change is overall wages for the typical worker but they seem satisfied spiking wages for those in the financial sector that have access to the largest digital money machine known to humankind. The rest of the American public? Enjoy those 0 percent savings rates because they are likely to stay.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!