The low wage employment tsunami: Low wage jobs now make up 25 percent of all employment in the United States.

- 2 Comment

The employment report continues to provide deceptive bread and circus fodder for the mainstream press. Never is any thorough analysis given to the 93+ million Americans that are now part of the “not in the labor force†category. In large part, we have a low unemployment rate because this massive army of Americans is simply not counted in the employment report. Then, if you dig deeper into the report you realize that a wide spectrum of Americans are now part of the low wage economy.  The “recovery†in terms of jobs can be summed up as follows: tons of low paying work, a shrinking of middle class jobs, and few jobs at the top. It is a crony salad bowl of financial incentives to the banking sector while turning a large portion of the country into modern day debt serfs. You need debt to keep up. Good debt (i.e., mortgages) is now tougher to get since banks have crowded out regular families in buying homes. Junk debt (i.e., auto loans) is easy to get and you can simply drive down to your local car dealer and drive away with a new car. With that said, the US has a massive number of workers employed in what are known as low wage jobs. The number is surprising when compared to other nations.

The low wage revolution

There is more to your pay than your hourly rate. Many people have faced the multi-faceted attack on their living standards via:

-stagnant wages

-rising healthcare costs shifted to workers

-the destruction of pensions

In other words, most financial decisions have been shifted onto an already poorer nation. In many cases profits have been on the rise in Wall Street because of stagnant wages and the deep cutting of benefits. The US now has a large portion of its labor force in low wage jobs. This is problematic when the cost of housing, healthcare, cars, energy, and college all seem to be rising at breathtaking speed.

Take a look at this chart showing the percentage of workers employed in low wage jobs across various countries:

Why is this problematic? Part of the bigger problem at hand is that many are unable to save and plan for retirement. Take a look at the current retirement crisis with baby boomers. Most would be in abject poverty if it were not for Social Security. And this is a generation that grew up in a robust stock market with nearly every advantage at hand. And with that, most are facing retirement with little in their nest egg. How about the upcoming generation of low wage workers? Take a look at this chart:

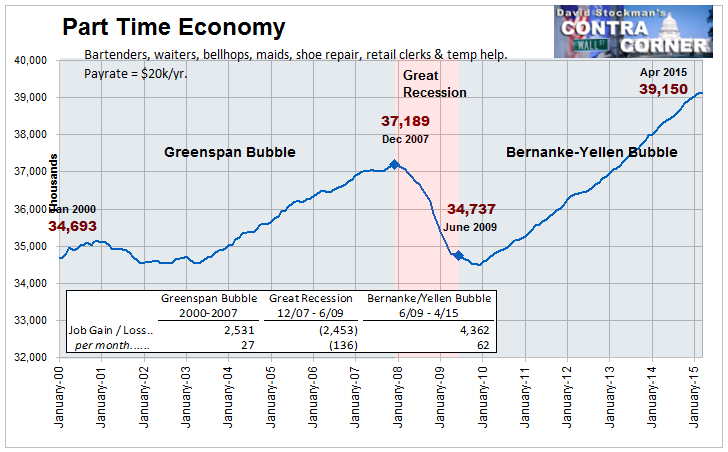

In terms of “growth†we have done a fantastic job of Chipotle-ization of our economy. Close to 40 million Americans now work in the low wage part-time economy where wages fluctuate and benefits are virtually non-existent. How many bartenders, waiters, bellhops, maids, shoe repair workers, and retail clerks are putting money away for retirement? No big deal you might say. But what happens as the passage of time throws these folks into retirement? An inverted pyramid can only hold so much weight at the top with a tiny bottom.

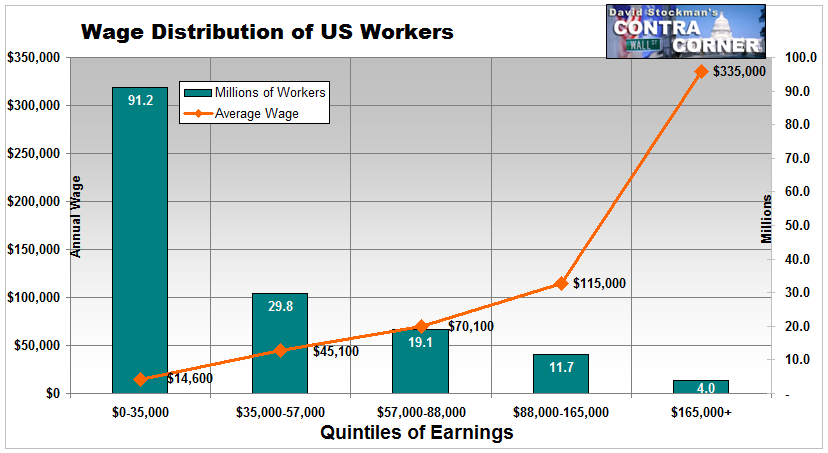

That bottom is having a tougher time supporting the top because the bulk of our population doesn’t make all that much money:

91.2 million workers in the US make $35,000 a year or less (this represents 58.5 percent of our entire workforce). And then you wonder why people have a tough time paying for a home costing $200,000, a car at $35,000, and a college education that can cost you $20,000 to $25,000 per year even at state schools when housing is factored in. If you look at the above chart, there doesn’t seem to be any counter-trend stopping this low wage tsunami.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

James Hammers said:

And why is the private sector or corporate America paying low wages instead of helping solve the financial crisis? Because they view wages primarily as an expense and to maximize profits, expenses must be kept to a minimum. But this view neglects an even more important fact. Wage earners are also the customers of the goods and services corporate America produces and are thus more of an asset than an expense. Wages that are less than a living wage produce customers that cannot even support those industries that produce the basic goods and services that constitute a basic standard of living such as food, shelter, clothing, health care and education. Thus if corporate America wants to have a customer base that can buy the goods and services it produces, it must pay its employees enough to be able to buy them. As wages increase, the customer base also increases its ability to buy goods and services beyond the basics. Wages are thus an asset which determine the abilities of wage earners to be customers. Imagine how the economy would rally if those making $7.50 per hour, a wage that severely limits the ability of the wage earner to buy even the basics for life, would be $15 an hour, a wage commonly seen as one that would enable the wage earner at least the ability to buy the basics for living, The good, clothing, housing, health, education industries and services would suddenly experience a doubling of sales and the accompanying profits. The resulting rise in demand would also increase the need for more jobs to meet the demand which would also further increase the number of wage earners that can at least buy the basics. We would thus see an economic system where supply and demand work in tandems for the betterment of both the customer and business.

May 19th, 2015 at 6:53 am -

Liz said:

I agree with James Hammers, but they are also forgetting that corporate America also benefits from consumers having no option but to maintain balances on credit cards and barely make minimum payments on loans. This way Americans are also paying more for the item than it’s worth. Only an illogical person would choose to go hungry when they can charge it to their almost maxed out visa instead. Corporations take advantage of this and high wage earners own stock in these companies. Thus they are making money off of not spending money.

August 9th, 2019 at 8:34 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â