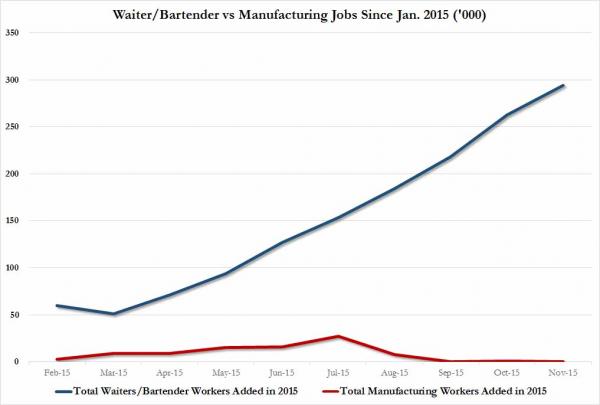

We have traded building cars for mixing drinks: This year the US added nearly 300,000 waiters and bartenders, and zero manufacturing workers. Manufacturing was once 33 percent of all jobs and now it is below 10 percent.

- 0 Comments

While the Federal Reserve now looks to have the green light on raising interest rates after many head fakes, the employment report isn’t so clear. Sure, we are adding jobs but we are adding a large number of jobs in the low wage segment of our economy. Case and point? Since the start of the year we have added nearly 300,000 waiters and bartenders and have added zero net manufacturing jobs. These service sector jobs provide little in the way of benefits and job security and many young Americans are trapped in these low wage jobs with incredibly high levels of debt. The media is tone deaf on why Americans are so frustrated this year and one reason for this is their lack of basic economic knowledge or empathy for the regular working family. For example, half the country is living paycheck to paycheck. For most Americans, their retirement plan is work until you die. This all makes perfect sense when a large portion of Americans work in low paying jobs. We have traded building cars for mixing drinks.

Outsourcing American manufacturing

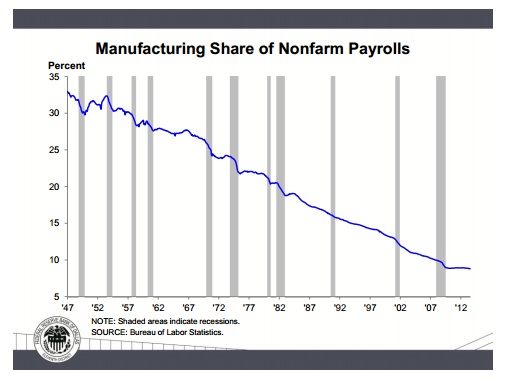

Before we look at the employment numbers for this year it may be worth it to put this into historical context. The US was a giant manufacturing machine for many decades. It probably comes as no surprise that the peak of our middle class coincided with the vast numbers of people working in good paying manufacturing jobs.

“(Dallas News) But U.S. manufacturing jobs have been declining since the 1930s. That decline — and the gap between manufacturing jobs and output — has accelerated in recent years by technological advancements, the increased productivity of workers and increased competition for factory locations from Asia and Latin America.

Manufacturing jobs make up less than 10 percent of the total U.S. payroll today, compared with 33 percent at the end of World War II.â€

The decline has been steady since the end of World War II. These were jobs that paid well and provided Americans with a package of benefits. This lasted for an entire generation. In the early 1980s many Americans had access to pensions (over half). Today, it is roughly the same amount as the percentage of people that work in manufacturing, roughly 10 percent.

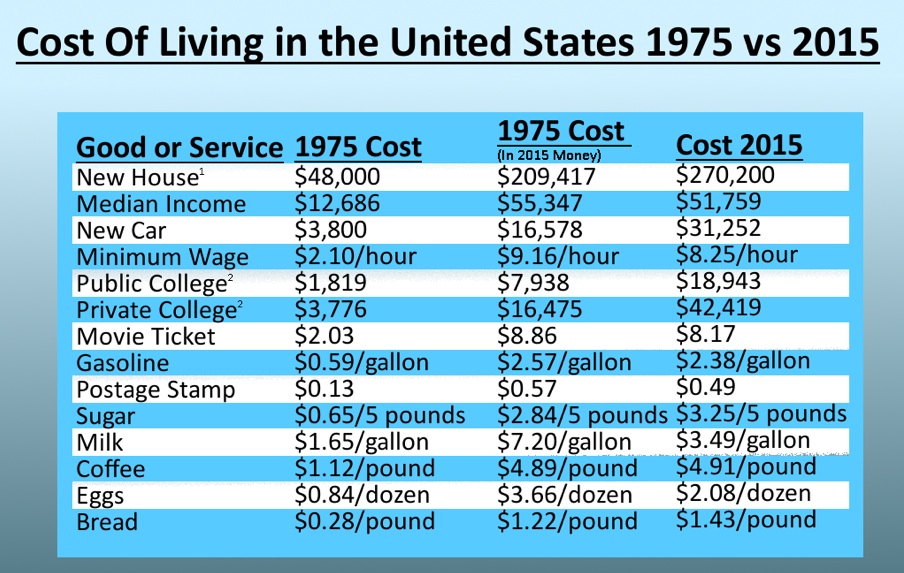

It is hard to plan for the future when all you can think about is paying the bills for the month. American families are seeing higher costs while being told that inflation is low. The case is actually very different. Inflation is happening very clearly in debt financed assets including:

-Housing

-Cars

-Healthcare

-Tuition

Just look at this chart comparing the cost of living in 1975 and 2015:

“This is a very telling chart. First, let us look at the biggest line item with housing. A new home today costs $270,200. That 1975 home adjusting for inflation would cost $209,417. This is a “real†increase of 29 percent. A new car costs $31,252 while that 1975 car adjusting for inflation would cost $16,578. This is a true doubling of cost here. Public college costs are up over 150% while private college costs are up over 160%. And you wonder why we have over $1.3 trillion in student debt outstanding.â€

And the problem at the core is that Americans have seen stagnant wages for over two decades. You can see this reflected in the decline of manufacturing jobs. Take a look at the below chart measuring added jobs in bartending and waiters versus manufacturing jobs:

This year we’ve added 294,000 bartenders and waitresses while adding zero manufacturing jobs. And yet the media keeps scratching their head as to why Americans are economically frustrated. Given all this news, it actually makes sense why Americans need a stiff drink.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â