Middle class acquiesces through the looking glass of financial mediocrity: The financial system continues to pillage the wealth of working and middle class Americans.

- 2 Comment

2013 can be remembered as a year where the markets fully disconnected from Main Street. The trickle down promises are all empty and hollow words. For example, we had one of the best stock market rallies ever yet most Americans are not seeing any wage growth. The housing market boomed but more than 30 percent of sales are going to big banks and investors using the Fed’s QE system to crowd out regular people. Why are higher home prices positive if incomes are not going up? The market no longer reflects the pains of the working and middle class. In fact, the stock market must appear like a looking glass for many Americans who look at their paychecks and net worth and must wonder how they can get a piece of the action. The con is strong since most of non-housing debt taken on this year came via auto and student loan debt. In other words, spending what you don’t have. The financial system continues to pillage what little wealth working and middle class Americans have.

Nearly half of country struggling

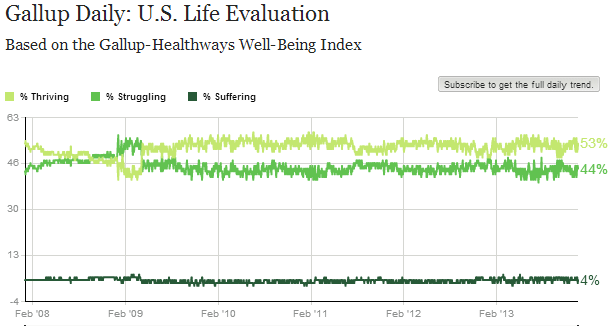

A recent Gallup poll found that 44 percent of Americans are struggling and 4 percent are flat out suffering:

What is interesting is that even in the height of the recession, the figures were very similar. Today we still have over 47 million Americans depending on food stamps to get by. With a record in the stock market, it is hard to reconcile how nearly 1 out of 6 Americans has just enough to buy food. We are still at record levels here suggesting that we have some profound structural problems in our system.

Many of the good paying jobs that left during the recession have been replaced by low wage and low benefit jobs. While the public is dealt the heavy hand of austerity the soft hand of corporate welfare is alive and well on Wall Street.

Household income is not moving up

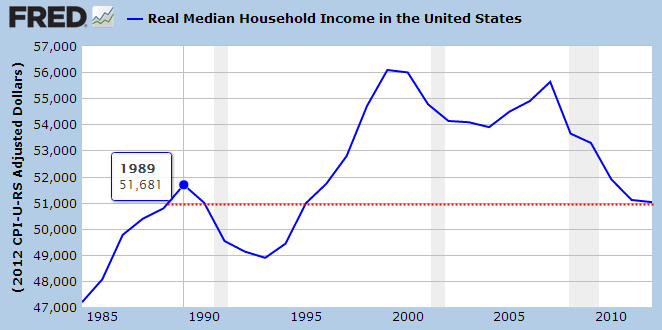

Adjusting for inflation, median household income is at levels last seen in the late 1980s:

What this suggests is that the tech boom of the 1990s and the real estate of the bubble of the 2000s did help to get some people wealthier but it certainly was not the middle class. In fact, there is a multi-decade trend going on where the middle class is slowly being pulled apart. Keep in mind that a large part of the financial sector does absolutely nothing in creating real wealth. They merely serve as a rentier-seeking profit machine that extracts wealth from the real economy. This is why QE has now pushed large banks into crowding out regular households in the market. The result? Higher home prices and higher rents with no real increase in incomes.

Spending up on auto and student loan debt

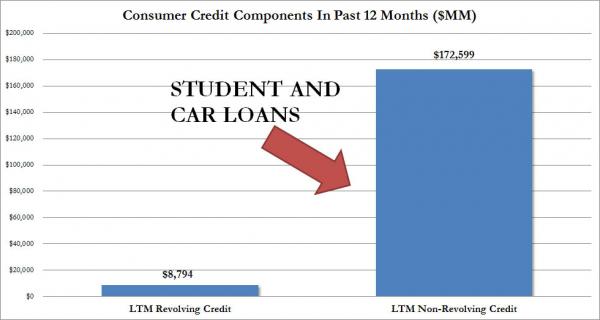

Roughly 95 percent of the increase in non-revolving debt this year has come from student and car loans:

Source:Â Â Federal Reserve, ZH

This should not be seen as a positive for the fact that real household incomes are not up. People are simply going into debt for spending on items today. Did this work out well last time? It did not. Yet the middle class is buying into the myth of a booming economy even though their incomes are not up! This is why they need to go into mega debt to buy cars and go to college.

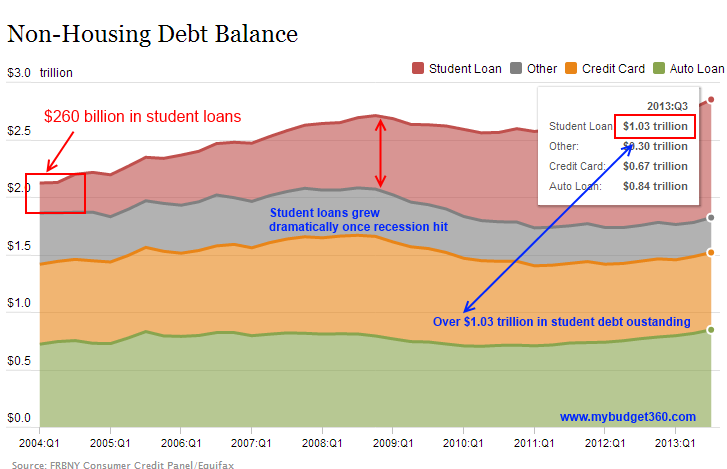

Student debt is already at $1.2 trillion (the Fed’s chart below is lagging behind the actual real figures:

For college graduates in many disciplines the debt taken on is simply not worth it. Yet the lack of good paying jobs has created fierce competition for work in certain fields. Younger Americans are starting out with incredible levels of debt and very low wage jobs. Many don’t even know what a pension is as these are being pushed out (although golden parachutes for executives are completely okay in this predatory system). The cognitive dissonance is powerful in the current market. Wasn’t it the financial industry that led this country into the worst recession since the Great Depression and is now partying on the Fed’s easy money stream?

Inequality at record levels

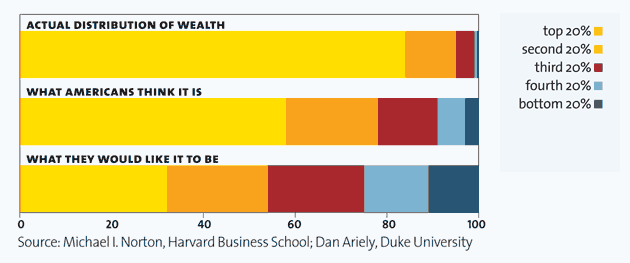

Of course all of this has led to record levels of inequality:

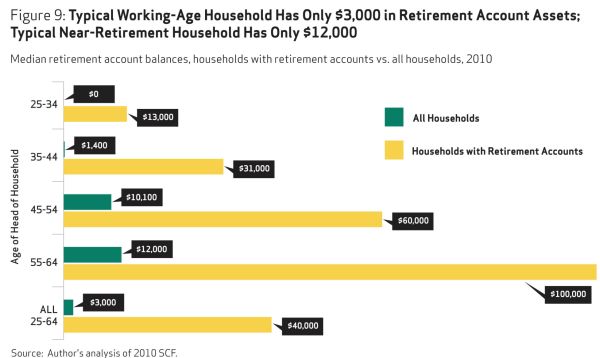

The top 10 percent control 75 percent of all the wealth in the nation. The bottom 60 percent of this country controls absolutely nothing (it barely shows up on the chart). This is reflected more dramatically when we look at retirement savings:

The typical working-age household has $3,000 saved for retirement in the wealthiest nation on the planet. Is it any surprise that 48 percent of the country is struggling or downright suffering? Yet here we are with a record in the stock market. Makes you wonder what that $4 trillion in the Fed’s balance sheet is really doing.

Many Americans are simply getting by and have accepted the status quo or are purposely bombarded with confusing messages from the mainstream press.

“Save carefully but look at that hot financial stock!â€

“Don’t miss out on the next housing boom!â€Â

Then we wonder why the middle class is slowly fading away deep into the looking glass.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Gringo Bush Pilot said:

The United States is not a nation of capitalists. It is a nation of wage earners with a tiny minority of capitalists. The only genuine capitalists — individuals who can live entirely from their investments — are a minuscule minority in the U.S. and all other so-called capitalist countries. Having a modest amount of retirement money in a mutual fund does not make anyone a capitalist except in the Wall Street Journal’s Op-Ed pages. For the foreseeable future, few Americans will derive any significant income from capital gains during their working lives, just as few will derive more than a small portion of their retirement income from sources other than Social Security including 401K’s. Right-wing propaganda about an emerging “capitalist majority†to the contrary, America is and will remain a nation of wage earners dependent on paychecks and public social insurance like Social Security and unemployment insurance.

December 20th, 2013 at 5:12 am -

Gary Reber said:

This is a MUST READ article on the impact of our soaring non-asset money-based national debt and its impact on inflation.

Influential economists and business leaders, as well as political leaders, should read Harold Moulton’s The Formation Of Capital, in which he argues that it makes no sense to finance new productive capital out of past savings. Instead, economic growth should be financed out of future earnings (savings), and provide that every citizen become an owner. The Federal Reserve, which has been largely responsible for the powerlessness of most American citizens, should set an example for all the central banks in the world. Chairman Benjamin Bernanke and other members of the Federal Reserve need to wake-up and implement Section 13 paragraph 2, which directs the Federal Reserve to create credit for local banks to make loans where there isn’t enough savings in the system to finance economic growth. We should not destroy the Federal Reserve or make it a political extension of the Treasury Department, but instead reform it so that the American citizens in each of the 12 Federal Reserve Regions become the owners. The result will be that money power will flow from the bottom up, not from the top down––not for consumer credit, not for credit that doesn’t pay for itself or non-productive uses of credit, but for credit for productive uses to expand the economy’s rate of growth.

The following is based on a presentation by Norman Kurland, President of the Center for Economic and Social Justice (www.cesj.org)

We need policies that will expand the rate of private sector growth through Employee Stock Ownership Plans (ESOPs) and other credit democratization vehicles. The Federal Reserve discount mechanism under section 13 of the Federal Reserve Act needs to be refined. The aim should be to radically reduce the cost of capital credit to enable workers and citizens generally to gain equity shares and dividend incomes from the process of financing growth capital, without the use of tax subsidies. It should also reduce the reliance on tax incentives and subsidies for financing expanded ownership, as part of a more comprehensive national economic empowerment strategy of “capital homesteading.”

The discount mechanism of the Federal Reserve (section 13 of the Federal Reserve Act of 1913) should be reactivated, with appropriate modifications and safeguards, to allow qualified banks and financial institutions to discount “eligible” industrial, commercial, and agricultural paper, representing production-oriented loans to leveraged ESOPs, IRAs, community investment corporations, and similar mechanisms for securing access to low-cost capital credit for broadening capital ownership among workers, area residents, and other non-affluent citizens.

When the Federal Reserve Act was passed, Congress intended the purchase of “eligible paper” to be the main way that the Federal Reserve System would create bank reserves. When this practice was followed, the banks in a particular area could obtain loanable funds in direct proportion to the community’s needs for money. But in recent years, the Federal Reserve has purchased almost no eligible paper.

When the Federal Reserve System was set up in 1914 the money supply was expected to grow with the needs of the economy. It was hoped that by monetizing “eligible” short-term commercial paper, by providing liquidity to sound banks in periods of stress, and by restraining excessive credit expansion, the banking system could be guided automatically toward the provision of an adequate and stable money supply to meet the needs of industry and commerce. To safeguard their liquidity and provide a base for expansion, the member banks could obtain credit from the nearest Federal Reserve bank, usually by rediscounting their “eligible paper” at the bank-i.e. selling to the Reserve Bank certain loan paper representing loans which the member bank had made to its own customers (the requirements for eligibility being defined by law). If necessary, the member banks might also obtain reserves by getting “advances” from the Federal Reserve bank.

In other words, under a standard central banking system, businesses or other productive enterprises would obtain loans at their local commercial bank. The commercial bank, in a process known as “discounting,” would then sell the qualified loan paper of the business enterprises to the central bank. In the case of the United States, the commercial bank would sell its paper to one of the twelve regional Federal Reserve Banks. To be able to purchase the “qualified paper,” the Federal Reserve would either print new currency or simply create new demand deposits.

As originally intended when the Federal Reserve System was established, this process would create an asset-backed currency that increased as the need for money increased, preventing deflation. As the loans were repaid, the currency would be taken out of circulation, or the demand deposits “erased” from the books. This would remove money from the economy that was not linked directly to hard assets, and would thus prevent inflation.

Although no actual teller’s window exists where commercial banks stand in line to sell loan paper to the Federal Reserve, the transaction is described as taking place at “the discount window.” When the “discount window” is “open,” commercial banks can sell their “qualified industrial, commercial and agricultural paper” to the central bank. When the “discount window” is “closed,” commercial banks must go elsewhere to obtain excess reserves to lend, or cease making loans.

How Has The Discount Mechanism Been Used?

Despite the fact that the discounting mechanism was intended under the Federal Reserve Act of 1913 to be the main means for controlling the American money supply, it has long been abandoned as an integral part of the United States financial system. The discount window has been used to help bail out a few companies or countries considered “too big” or too important to fail. Overall, however, the money creation powers of the Federal Reserve have been used to monetize government debt. Since this is not how the system was designed to operate, a number of problems have resulted.

Our economic problems are usually blamed on decisions by Congress or the President, particularly those decisions that result in nonproductive or counterproductive spending and tax policies. Little is said about decisions by the Federal Reserve, many of which, as binary economist Louis Kelso and others have pointed out for over 40 years, have been equally counterproductive. Fed policies have added to the problem of government deficits, fueling the growth of the national debt to today’s level of double-digit trillions (making the United States the highest government debtor in the world). This has artificially and unnecessarily slowed the growth rate of the private sector.

As a result, what Kelso and other ESOP pioneers predicted is becoming increasingly evident:

• Continuing economic disenfranchisement of the American people.

• Low rates of peacetime economic growth.

• Rates of private sector investment far below U.S. potential.

• Excessive use of nonproductive credit in the public and private sectors.

• Downsizing of U.S. companies in competition with foreign companies with lower labor costs.

• Mounting trade deficits in the global marketplace.

• A growing gap in consumption incomes between the wealthiest Americans and ordinary workers and the poor.

• Under-use of human talent and new technologies that could be employed to improve America’s competitiveness in the global marketplace.The reforms of the Federal Reserve Act proposed would be fully consistent with its original purposes––to provide an adequate and stable currency and foster private sector growth. These reforms would allow our country to take full advantage of the immense potential of a properly designed central banking system. They would restore a more healthy balance between Main Street and Wall Street, and between the non-rich and the already rich. The proposed reforms would shift the focus of the Federal Reserve from support of public sector growth and indifference to non-productive uses of credit, to support of more vigorous private sector growth, the favoring of productive uses of credit, and broadened citizen access to capital credit.

Most important, the proposed new boost to expanded capital ownership for private sector workers and other citizens would not be constrained by Federal Reserve balanced budget restrictions. It would involve no new “tax expenditures” or subsidies. Nor would it rely on existing pools of domestic or foreign wealth accumulations. It would be “A Proposal to Free Economic Growth From the Slavery of [Past] Savings”––a shift to what Kelso called “pure credit.”

For the complete article see The Federal Reserve Discount Window at http://foreconomicjustice.org/?p=1508.

December 30th, 2013 at 11:27 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!