Middle Class Americans Losing Financial Ground on Retirement – As Stock Market Rebounds more Middle Class Americans Have Less Money and Fewer Jobs. How is Health Care Spending Boosting GDP a Good Thing?

- 2 Comment

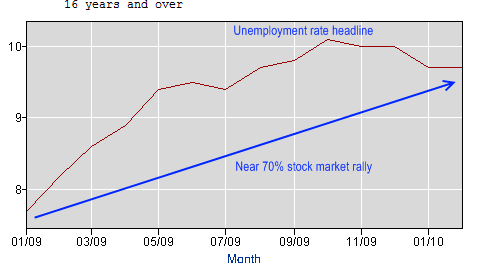

As more and more data is released on this Great Recession it is becoming abundantly clear that we have two tracks people are following. On one track where most travel, we have middle class Americans dealing with the highest unemployment in a generation while seeing their net worth dissolve. On the other side of the road, the one lane highway for the tiny percent of the extremely wealthy, we see an extraordinary jump in wealth since the depth of the crisis in March of 2009 when the S&P 500 touched that unholy number of 666. It must seem like a cruel joke that with the stock market being up nearly 70 percent since that low point in 2009, the vast majority of Americans are wondering why they don’t feel much of that rally when they open their wallets. The reality is that most Americans are not invited to this resurgence and in fact, the destruction of the middle class is partly a reason for this stock market rally.

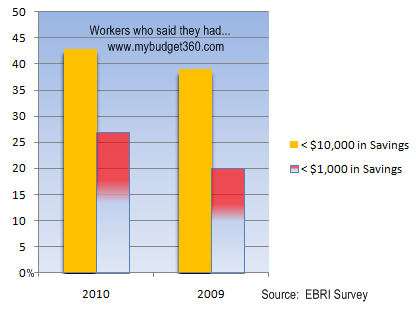

Take for example what Americans are saving. A recent survey from the Employee Benefit Research Institute’s annual Retirement Confidence Survey found some startling data:

43% of workers in the survey stated they had less than $10,000 in savings while an amazing 27% of workers said they had $1,000 saved. Many of these Americans are one illness or a job loss away from being broke (many are called the working poor). It is no surprise that the survey found that only 16% of those who responded felt comfortable about retiring, the lowest rate in a generation. What this survey highlights is that more and more middle class Americans are going to struggle in their retirement. Thanks to the Federal Reserve artificially slamming interest rates lower, many Americans on fixed incomes or Social Security will see no cost of living adjustments even though their daily cost of living items will increase in price. This is targeted destruction of the middle class.

And keep in mind this survey is comparing 2009 and 2010. What happened to the rally here? Workers clearly did not participate in the stock market rally. Why? Because a large part of the rally also hinged on “productivity gains†which is a nice euphemism for laying off people and making current workers juice out more production. So this translates to great profits for the Wall Street elite while unemployment in the last year has done this:

Source:Â BLS

It might be hard to save for retirement if you are getting fired. And that is what millions of Americans experienced in 2009 as the stock market went on a massive rampage as Wall Street was fueled by taxpayer bailout money and decided to load into stocks. Keep in mind that many of the large multinational companies are making a boatload of their profits internationally. This is great for those companies but as most Americans know, small business is the juice of the American economy and most small businesses sell to domestic clientele. A clientele that is increasingly poorer and unemployed. We used to call this group the middle class. This isn’t lost on some:

“(RR) Companies in the Standard&Poor 500 stock index had sales of $2.18 trillion in the fourth quarter, up from $2.02 trillion last year, and their earnings tripled. Why? Mainly because they’re global, and selling into fast-growing markets in places like India, China, and Brazil.

America’s biggest companies are also showing fat profits and productivity gains because they continue to slash payrolls and cut expenditures. Alcoa, for example, had $1.5 billion in cash at the end of last year, double what it had on hand at the end of 2008. Sounds terrific until you realize how it did it. By cutting 28,000 jobs – 32 percent of workforce – and slashed capital expenditures 43 percent.

The picture on Main Street is quite the opposite. Small businesses aren’t selling much because they have to rely on American – rather than foreign – consumers, and Americans still aren’t buying much.â€

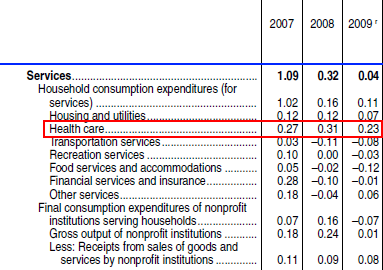

One of the disturbing trends especially when it comes to retirement is the massive increase in health care costs. It is absurd to use health care costs (i.e., premiums, etc) to inflate GDP but that is exactly what is happening:

Source:Â BEA

It is absurd that in 2008, as the economy was flying off a cliff and other service industries were contracting health care still managed to pull in 0.31 of the 0.32 gain in the entire year for this sector. Take a look at 2009. What service sector did the best in another troubled year? Health care. So to say that gouging Americans like the 39% hike in premiums in California is good for GDP is nonsense:

“(ABC) Reports that Anthem Blue Cross is raising premiums on some customers by 39 percent on March 1, have prompted the Secretary of the Department of Health and Human Services, Kathleen Sebelius, to write a letter to the company, Golden State’s largest private insurer, asking the company to “provide a detailed justification for these rate increases to the public.”

“Additionally, you should make public information on the percent of your individual market premiums that is used for medical care versus the percent that is used for administrative costs,” Sebelius wrote, noting that the profits of Anthem Blue Cross’s parent company, WellPoint Incorporated, have soared.â€

Ask any middle class American about their health care costs and the likely story is that prices have gone up consistently over the last decade as incomes have gone stagnant. How is this good especially when many baby boomers are now reaching retirement age with little savings as we have seen and are now going to shift a larger portion of their income to health care?

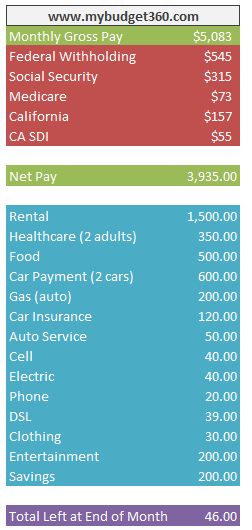

In many ways the health care industry is much in line with how Wall Street banks have operated for the last forty years. They’ll gouge and exploit the middle class until every dollar you earn is either yanked by bank bailouts, health care costs, or taxes. Let us run the numbers on a hypothetical family in California to see how this plays out. We’ll use a family making $61,000 a year (Census 2008 data):

Now the above is merely a hypothetical budget. I welcome people to comment on different items one way or another. The above is a two adult household with no children with two cars. This is very typical for California but I’m sure for other states as well. But as you can see from the above, given that this household is at the median there isn’t much room for large amounts of flat screen TVs, expensive nights out on the town, or leased BMWs. Yet many across the country lived like this and clearly that was on borrowed time and was all a ruse usually magnified by credit cards. Now as many near retirement they are realizing that the only game in town is Wall Street and that has now become a large casino.

I know many people scream personal responsibility. I’m the first to agree. But there is this massive amount of cognitive dissonance when people blame the middle class and working class for this mess when Wall Street who created the financial instruments of destruction, not only got away with the biggest transfer of wealth in history, they are actually getting richer because of bailouts. This is like putting a bank robber in prison for stealing $100 to feed his family while letting that same banker go to Wall Street and rob millions of Americans for billions of dollars and not only letting him go, but putting structures in place to make him richer! Is it any wonder why there is so much anger festering in America?

Retirement is getting harder and harder for many middle class Americans. What use is $1,000 a month in Social Security when your out of pocket costs for medicine is going to cost you $300 to $500 per month? How did we do it before? Stable banking that allowed people to pay off their mortgages and allowed people to live securely in their homes once they retired even with a small Social Security check. But now, many have tapped out their equity and mortgaged their future. Unlike Wall Street Americans don’t have access to the Federal Reserve. Massive part-time employment, weak worker protection, a corporatocracy raiding the workers, and a disappearing middle class. Get ready to work longer America because Wall Street needs that money to fund their bailouts and billion dollar bonuses for wrecking the economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Ali Oops said:

Your hypothetical family is not self-employed as there is no way two adults get health insurance for $350. To avoid turning the $46 left over into a three digit negative number, they do without the insurance and hope.

Also, note that in 2008 “financial services and insurances” took another .28 of expenditures. Even when times were good, the insurance industry was taking a big chunk of what would have been profits. The two categories together give a better picture of the general tax on the economy finance and insurance represent.

March 14th, 2010 at 10:03 am -

Penny Stocks said:

This is such an important topic, thank you so much for sharing.

March 23rd, 2010 at 3:02 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!