Middle class in shambles – more debt, more job losses, more deceit. Banks attempt final push to break up the middle class. Housing values down by 30 percent but total household debt only down by 2 percent.

- 4 Comment

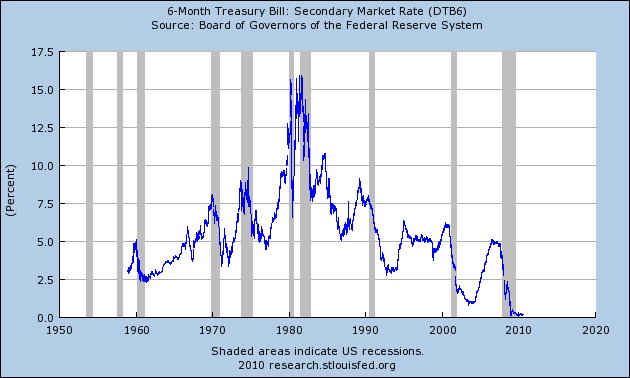

On Friday the grim reality of more job losses for Americans was plastered across headlines. What makes this even more distressing is this is occurring during what is supposed to be a recovery. Yet most Americans realize that there is no recovery outside of Wall Street. If anything, things have gotten progressively worse as foreclosures are still near their peak, bankruptcies are rising, and wages are stuck or reversing backwards. The government in conjunction with banking lobbyist and the Fed has decided to punish Americans who actually want to save their money. How? By allowing interest rates to be artificially low thus pushing savings account interest rates to all time lows. Current rates are low not because of a healthy economy, but because most people realize that the economy is still on a shaky foundation.

Take a look at the 6 month Treasury bill interest rate:

The above is occurring because people are running for cover and are happy to take a 0.20 interest rate instead of stuffing their money into a stock market that is more reminiscent of a casino. The skepticism is rooted in the fact that many are feeling in their gut the systematic dismantling of the once mighty middle class in America. Banks would love nothing more than for this to happen since a large portion of their income now comes from gambling on Wall Street. So massive foreclosures and defaults are fine as long as they can invest and speculate and make money that way.

“After all, many companies they support have moved jobs overseas so we now operate in a world where the interest of the banks is not aligned with the interest of typical Americans. In fact as we have seen with short selling the market, some investors and banks make billions of dollars by betting against the American economy.”

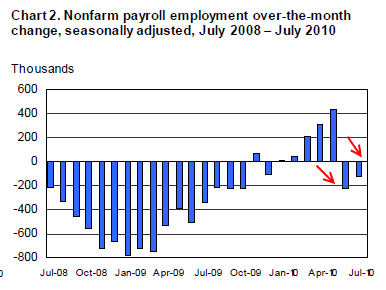

The only people talking about a recovery are those in the banking sector because for most there is no hint of a recovery:

Keep in mind the last two jump ups have to do more with Census hiring and the last two months of losses include those jobs pulling away. So basically any gains or losses are at the hands of artificial intervention. The overall economy is stuck because so much money is being sucked into the banking sector. Why would banks want to lend to a shrinking middle class when they can make more money speculating on Wall Street? It isn’t like the bailout money pushed into their lap had any strings attached, lobbyists made sure of that. So here we are nearly 3 years into this crisis and trillions of dollars poorer yet the middle class has gotten smaller. We now have 40 million Americans on food stamps. Even the U.S. Treasury head noticed this but this is thanks to the banks siphoning off money from the actual productive sectors of the economy.

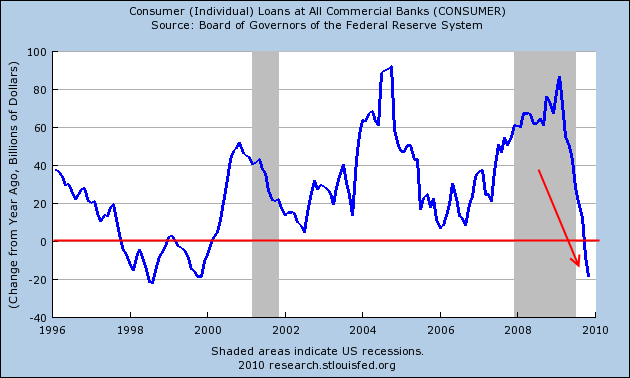

Banks have pulled back on their lending:

Clearly the middle class is not getting any net benefit from all the bailout money. So where is this money going? The bailout funds have gone to repair the broken and battered balance sheet of banks. Yet this was not the pretense that was put on the table years ago. What was sold to the American people was that the bailout funding was to keep lending going and shore up the housing market. Does the above look like that?

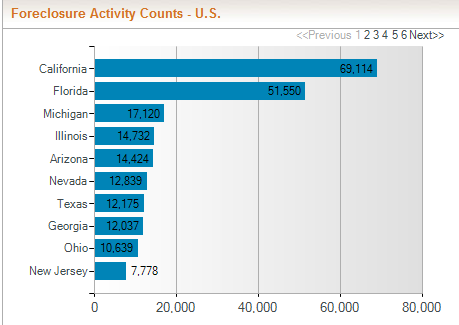

From January to June, over 1.7 million American homeowners received a foreclosure filing. If we look at overall foreclosure activity it remains elevated:

Source:Â RealtyTrac

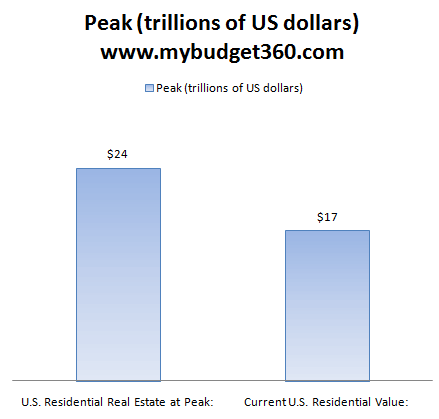

The reason foreclosures are still at peak levels is because Americans are largely unable to shoulder the massive amount of debt they are under. The housing market is still trillions of dollars away from the peak we reached:

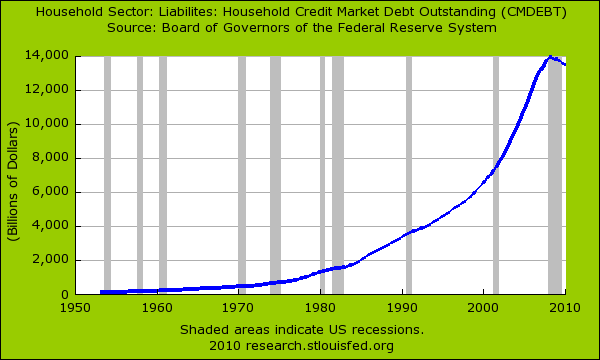

In total, roughly $7 trillion in U.S. residential real estate values have been lost in the last few years if we use the current Case Shiller data and the Fed flow of Funds report. However, the amount of debt working and middle class Americans has not adjusted accordingly:

While actual real estate values have fallen by close to 30 percent household debt has only moved lower by 2 percent! And you wonder why so many Americans are underwater and defaulting in mass on their loan obligations. The middle class is slowly being taken apart and this is no accident. Banks would want nothing more than to cement their power further and this was seen when the too big to fail got even bigger in this crisis. Time to break up the banks and restore power to working and middle class Americans before it is too late.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

ixlnxs said:

Bank runs for the win.

Take all of your money out of the too big to fail banks and put it in smaller local banks that have invested interest in the towns you live in.

When banks started taking a portion of a bank check I am owed as legal tender drafted on that bank, illegal, we should have known it was time to step away from the thieves.

August 6th, 2010 at 12:44 pm -

Nick said:

The Origins of the Overclass

By Steve Kangas

The wealthy have always used many methods to accumulate wealth, but it was not until the mid-1970s that these methods coalesced into a superbly organized, cohesive and efficient machine. After 1975, it became greater than the sum of its parts, a smooth flowing organization of advocacy groups, lobbyists, think tanks, conservative foundations, and PR firms that hurtled the richest 1 percent into the stratosphere.

The origins of this machine, interestingly enough, can be traced back to the CIA. This is not to say the machine is a formal CIA operation, complete with code name and signed documents. (Although such evidence may yet surface — and previously unthinkable domestic operations such as MK-ULTRA, CHAOS and MOCKINGBIRD show this to be a distinct possibility.) But what we do know already indicts the CIA strongly enough. Its principle creators were Irving Kristol, Paul Weyrich, William Simon, Richard Mellon Scaife, Frank Shakespeare, William F. Buckley, Jr., the Rockefeller family, and more. Almost all the machine’s creators had CIA backgrounds.

During the 1970s, these men would take the propaganda and operational techniques they had learned in the Cold War and apply them to the Class War. Therefore it is no surprise that the American version of the machine bears an uncanny resemblance to the foreign versions designed to fight communism. The CIA’s expert and comprehensive organization of the business class would succeed beyond their wildest dreams. In 1975, the richest 1 percent owned 22 percent of America’s wealth. By 1992, they would nearly double that, to 42 percent — the highest level of inequality in the 20th century.

How did this alliance start? The CIA has always recruited the nation’s elite: millionaire businessmen, Wall Street brokers, members of the national news media, and Ivy League scholars. During World War II, General “Wild Bill” Donovan became chief of the Office of Strategic Services (OSS), the forerunner of the CIA. Donovan recruited so exclusively from the nation’s rich and powerful that members eventually came to joke that “OSS” stood for “Oh, so social!”ex-military intelligence Steve Kangas… google him for the rest

and this is just the tip of the iceberg about these “elites”

August 8th, 2010 at 11:39 am -

theyenguy said:

I have three comments:

First comment, Yes indeed, On Friday August 6, 2010, the grim reality of more job losses for Americans was plastered across headlines.

That has not gone unnoticed by currency traders, who in early morning trading, today August 10, 2010, sold the euro yen carry trade and others The Euro fell 1.1% and the Yen fell 0.1%, causing disinvestment from stocks and commodities before the Federal Reserve’s policy meeting and after reports that showed economic growth slowing in the U.S. and China.

Emerging currencies, CEW, and major currencies, DBV, have both fallen, while the US Dollar Bull ETF, UUP, has broken out, with the US Dollar, $USD, trading higher. The USD/JPY is rising now for the second day in a row.

The currency traders have turned of their spigot of investment liquidity: World stocks, VT, and commodities, DBC, have fallen lower.

Even aggregate bonds, AGG, and total bonds, BND, have turned down a small percentage, with the recently top performing 10 Year Note, IEF, emerging market bonds, EMB, and corporate bonds, LQD, falling a small amount.

A look at The chart of debt, that is the US Ten Year Note, IEF, Corporate Bonds, LQD, Emerging Market Bonds, EMB, Build America Bonds, BAB, Municipal Bonds, MUB, and Junk Bonds, JNK suggests that peak debt, that is peak debt, was achieved yesterday August 9, 2010.

Thus so far, early in the day, we have total debt deflation underway, that is currency deflation, stock deflation, commodity deflation and bond deflation commencing all at once. Gold, GLD, has fallen less than stocks, VT, or commodities, DBC.

At the end of the day, will the US Federal Reserve come through and turn on some spigot of investment liquidity? Or have they too exhausted all its means of investment expansion capability with the QE Facilities such as TARP and others that ended March 31, 2010?

Second comment: Economic growth has been built upon growth in credit and yen carry trade investing.

Annaly Salvos in SeekingAlpha Tepid Top Line Growth article writes: “Economic growth, we would suggest, was largely built on the growth in credit (as we wrote in our June 8, 2010 blog post, “Debt Growth Drives GDP Growthâ€). So without debt growth, what is going to get the revenue trajectory on track again? Maybe, just maybe, the thing to do is let the deleveraging, saving, expense cutting process take place. Just as forest fires are a part of the natural life cycle of forests, so is the cleansing and seeding process of an economic downturn.â€

Yes, economic growth did come by credit growth, which came by the neoliberal economic policies of the czar of credit liquidity Alan Greenspan. The economic growth was also driven by yen carry trade investing with currency traders borrowing at 0.5% from the Bank of Japan and investing in many markets.

Perhaps a deleveraging process is taking place today; if not today, it will take place very soon.

The stimulus of deficit spending and intervention of the Federal Reserve with TARP and other facilities, probably prevented a catastrophic deleveraging. But their measures have only postponed the deleveraging that is a natural process of debt deflation.

Also the tragedy of the Federal Reserve’s facilities was that Bernanke effected a bloodless coup where he nationalized banking and integrated the banking system into the government establishing state corporate rule, that is corporatism.

As I look at the chart of debt, that is the US Ten Year Note, IEF, Corporate Bonds, LQD, Emerging Market Bonds, EMB, Build America Bonds, BAB, Municipal Bonds, MUB, and Junk Bonds, JNK, perhaps we are at Peak Debt, that is Peak Credit.

When the deleveraging of debt gets underway, those ETFs, especially EMB, and JNK, will see a rapid loss of value.

I believe that currencies, bonds, and stocks, will all be falling lower together and that only gold will preserve the investors wealth.

The deleveraging process will see stocks going off to the pit of abandon and bonds going off to the debt cemetery, there is such a great load of debt, it cannot be repaid. Business will shutter, and governments will cut way, way back on spending.

Third comment: Out of chaos, national leaders and finance ministers will waive national sovereignty and announce framework agreements which establish regional economic governance where â€credit bossesâ€, act as seigniors in public private partnerships, that is combines of business and government, to provide credit, which will be issued for the security needs of the homeland regions.

In Europe, I see a new role for the President of the ECB. I envision that in response to severe credit contraction and banking ill-liquidity, that he will be Credit Seignior, as he accepts sovereign and other debt and issues credit to Eurozone member banks thereby keeping some degree of money liquidity flowing.

Government leaders will become seignior, they will exercise seigniorage and become the first, last and only provider of credit. Then only food stamps and strategic needs will be financed.

August 10th, 2010 at 8:49 am -

Kenny G said:

Even if you still are able to generate a decent living you will soon be taxed out of it……there is no escaping the black hole of the ever growing Fed Government……all you can do is wait for the slow methodical destruction of your wealth……..they don’t want you to have anything…….good luck and i’ll see you in the soup line.

August 19th, 2010 at 11:56 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!